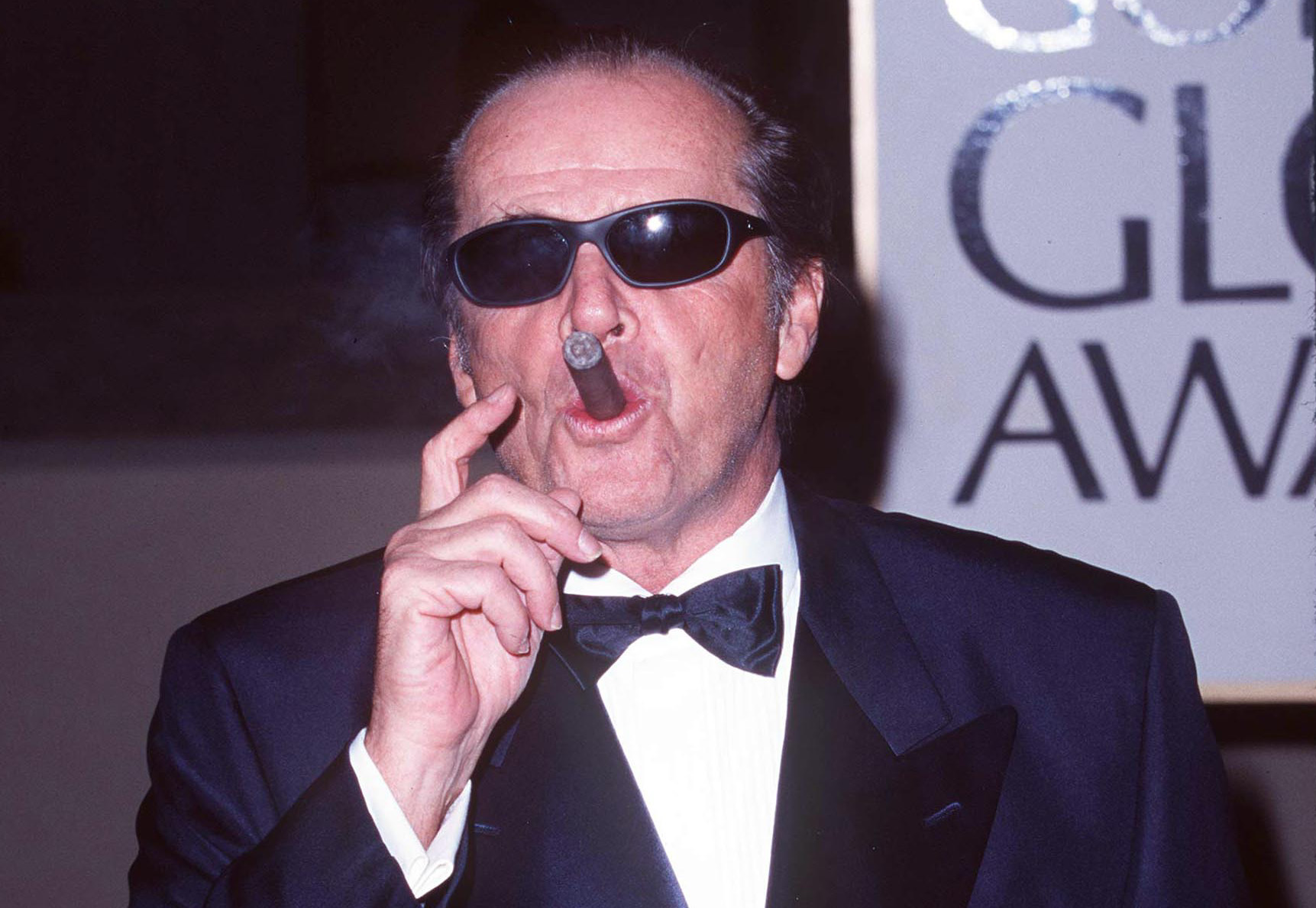

No Cigar

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

We were so close. So freaking close.

The 2019 retrans season looked like it was going to end on a high note, with only one minor service disruption (four Cox Media stations going dark to Verizon customers) and one deal -- Hearst TV and AT&T -- looking like it was heading for the finish line. But then, after raising hopes by issuing four extensions over a two-day period to AT&T -- what seemed like an indication that a deal would be imminent -- the wheels fell off. Hearst pulled its 34 broadcast stations in 26 markets like Boston, Baltimore, New Orleans and Milwaukee from AT&T’s DirecTV and AT&T TV Now customers on Jan. 3.

UPDATE: Cox Media and Verizon reached a retrans agreement on Jan. 4.

UPDATE: Hearst TV and AT&T reached a retrans agreement on Jan. 5.

The end of the year is usually feast or famine on the retrans front. Either there is a flurry of deals or darkness (never say blackout) as distributors and programmers either have something to prove (i.e. an axe to grind), an acquisition they want to protect from regulatory retaliation, or nothing at all.This year already was the worst ever as far as station disputes -- according to industry watchdog the American Television Alliance 276 stations went dark for at least some period by October, well above the 213 stations that touched the void in the prior full year. Now, the question will be whether the 34 Hearst stations -- whose retrans contract officially expired on Dec. 31 -- will be counted in 2019 or 2020. Either way, everybody loses.

In a statement, AT&T said Hearst TV’s decision to pull its stations were the broadcaster’s alone. And Hearst had granted four (count ‘em, four) extensions to its retrans agreement in the past two days, usually a sign that things were moving forward.

But alas, they weren’t. And just in time for the NFL Playoffs.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Retrans deals are almost always about money and this time appears to be no exception. AT&T said in a statement that Hearst is demanding “far higher fees than we have ever agreed to with any other station owner including very recent deals with far larger broadcasters.”

Hearst countered by reminding everyone that it invests heavily in its programming and that AT&T was “seeking the right to carry our stations at below market rates, which is neither fair nor reasonable.”

They’re both right. Retrans fees have skyrocketed over the past several years and broadcasters, as the advertising market has declined, are becoming increasingly dependent upon them to survive. But customers don’t care about that. All they care about is that Saturday night there is a really good chance that they will turn on their set, ready to watch the Titans v. the Patriots and all they will see is a black screen. Most likely there will be some boilerplate message about how the broadcaster/distributor is sorry for the inconvenience but due to somebody’s greed or insensitivity or whatever, they will not be able to watch this station.

But the thing is, people don’t care who’s fault it is. They just know that they are getting fed up with it.

Case in point. I received a call on Friday night at about 7:20 p.m., minutes after the Hearst stations went dark, from a DirecTV subscriber in Orleans, Mass., who told me that if I didn’t do something about these blackouts that she was going to drop DirecTV.

I’ve been getting a lot of calls like that over the past year or so, even though there is absolutely nothing I can do about their dilemma. Even when I told this person that I did not work for DirecTV or Hearst, that I was just the messenger, she continued to complain, mainly, I think, out of the mounting frustration pay TV subscribers feel during these disputes. She told me that if she didn’t get her ABC station back by tomorrow, she was going to quit DirecTV. She told me she has gone through too many of these disruptions -- “every year,” she said -- and she was sick of it. She told me nobody was listening.

And that’s what gets lost in these retrans scuffles. Chances are that DirecTV and Hearst will reach a deal, probably before the NFL gets too deep into the playoffs. And when they do, they will apologize for the inconvenience and continue like nothing happened. Meanwhile, their customers stew.

I’m not blaming either side in this, by the way. Each has their valid points. But each also will have to deal with an increasingly frustrated viewer who is running out of people to blame. Cord cutting is at an all-time high and as more and more networks launch direct-to-consumer options, the chances for these disputes could lessen. But giving up lucrative affiliate fees will mean that either programmers will have to do with less or they will have to start charging consumers a lot more. What happens then?

It is pretty obvious that the current distribution model will have to evolve, but it’s not going to disappear overnight. In the meantime, distributors and broadcasters are going to have to find a way to play nicer.

Because we were so close to ending the year on a high note. Sure, 2019 was the worst year for retrans disputes on record. But during the last few months, when the potential for disaster seemed high, deals managed to get done.

Nexstar Media Group, which went dark to AT&T for two months in the summer, signed five retrans deals (representing 70% of its footprint) in the last week of the year -- Comcast, Frontier Communications, Charter Communications, Mediacom Communications and Verizon Communications’ Fios TV.

Fios TV wasn’t so lucky with four Cox Media stations (bought by Apollo Global Management in February), which went dark to its customers on Dec. 31.

The stations -- WXPI in Pittsburgh; WFXT in Boston; and WYST and WNYS in Syracuse, New York -- were still unavailable to Fios customers in those markets at press time.

Fios had complained that the stations were demanding price increases of more than 70%.

What caused the year-end almost detente is anyone’s guess. Maybe it was because the more aggressive largest station groups had their biggest fights earlier in the year (Nexstar), or had finished up big acquisitions (Sinclair Broadcast Group) and didn’t want to ruffle any regulatory feathers, or maybe it was just dumb luck.

On the regulatory side, the U.S. Senate let STELAR legislation sunset, but made one of its tenets (the requirement that distributors and broadcasters negotiate in good faith) part of a compromise bill.

In May, a group of 17 small stations in 14 markets -- many of them under shared services agreements with Sinclair -- went dark to AT&T customers in a retrans dispute. AT&T filed a complaint with the Federal Communications Commission in November, arguing that they weren’t negotiating in good faith. The FCC agreed, and within weeks every one of those stations had signed a retrans renewal.

Whatever the reasons, something has to give. Because in 2019, more than 300 television stations went dark to paying subscribers, people who have endured a decade of service disruptions and name-calling and finger-pointing and are reaching the end of their rope.

They say things have to get worse before they get better, and 2019 was definitely worse than any year before it on the retrans front. Let’s hope 2020 is better, and not just another year of “close, but no cigar.”