Redstone Moves Could Spark TV Consolidation

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

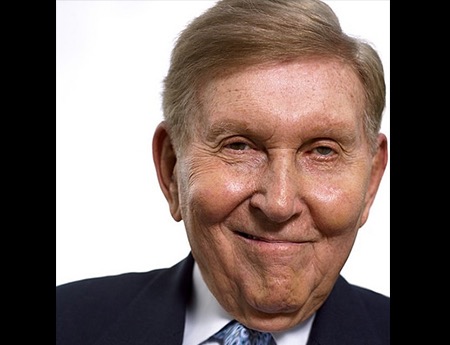

With 92-year-old media mogul Sumner Redstone apparently loosening his grip on some of his properties, a round of industry mergers and acquisition could be coming up next—including a sale of Viacom.

RELATED: Viacom, CBS Stock Up As Redstone Resigns

On Wednesday, CBS announced that Redstone has given up his post as executive chairman. On Thursday, Viacom’s board will meet and there are reports it will also name a new chairman.

“Thinking about what this change for CBS and Viacom could mean for the broader media landscape, we believe that changes for the Redstone controlled empires could be the trigger for media company consolidation as each company will be forced to figure out if they are a buyer or seller in the coming months,” said Michael Nathanson of MoffettNathanson Research in a report.

The TV business has been under pressure from low ratings, slow growing ad revenues and, more recently, declining pay-TV subscribers, which hurts distribution revenues.

“In most industries, the obvious confluence of negative data points would force those sub scale players to act,” Nathanson said. “But, here in media, given the family ownership of assets and the incredible executive comp, it seemed like no one was in any rush to change. However, after this evening’s announcement, we think that low valuations are forcing a call to action for Boards and shareholders of some media companies.”

Nathanson notes that Time Warner’s low stock price has been sparking pressure for it to sell assets and that there are reports of Lionsgate looking to acquire Starz. “As we can attest with Altice’s acquisition of Cablevision, anything is possible which is why being short Scripps Networks Interactive, Discovery and AMC Networks could be dangerous in 2016,” he said.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

As for Viacom, “after 10 years of being on its own and with the stock treading water, recent public comments made by Shari Redstone [Sumner Redstone’s daughter and vice chairman of Viacom and CBS] suggest that the she is looking to get more actively involved in the company. We are not sure what the outcome will be here, but the underlying cheapness of the equity value suggests that there is upside from here,” Nathanson said.

Viacom has been the media company hardest hit by the shift of young viewers away from traditional TV and its stock price fell by more than 40% last year.

“Given that Viacom remains one of the cheapest stocks in the S&P 500, there are many paths to unlocking value here – including disposal of the entire company, Paramount or their joint venture assets,” Nathanson said.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.