Land-based Competitive ISPs Note LEO Rivals

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

At a March 15 WISP America 2022 trade show session held in New Orleans, Louisiana, titled “Not Your Father’s WISP”, the transitional data supporting and describing hybrid fiber wireless providers was first unveiled to WISPA show-goers by the trade group behind the event, the Wireless Internet Service Providers Association (WISPA).

This comes six years following the first study in 2016-17. The second survey and report were completed in 2020-21. The delay meant the excitement was obvious; the attendance was strong. Post-show response has been receptive. Businesses want to learn how to use the data to improve their inner and outer workings.

The audience, who was mostly operators, with a sprinkling of vendors, analysts, and policymakers, was eager to hear, consider and implement information that – in the words of one of the presenters – can be business life-changing: contacts, trends, projections, predictions, estimates, mood analysis, survey-over-survey comparisons, and scores of other ways to keep molding a telecom-related entity toward perfection. Both operationally and via profits. The data points come from two surveys each involving hundreds of operators, and two each involving hundreds of vendors, each set answering over 70 questions, and various additional online and related research and analysis, plus thirty 90-minute interviews of relevant executives.

Key Datapoints

From the one-hour session, various random yet very helpful reports’ data highlighted:

- A 2016-17 vs. 2020-21 growth in systems of 100,001 subscribers and more is over 100%. Consolidation is coming, yet many more new operators are emerging, which is why, nationwide, the overall number of hybrid fiber wireless operators grew from 2,000 to 2,800 in those five years.

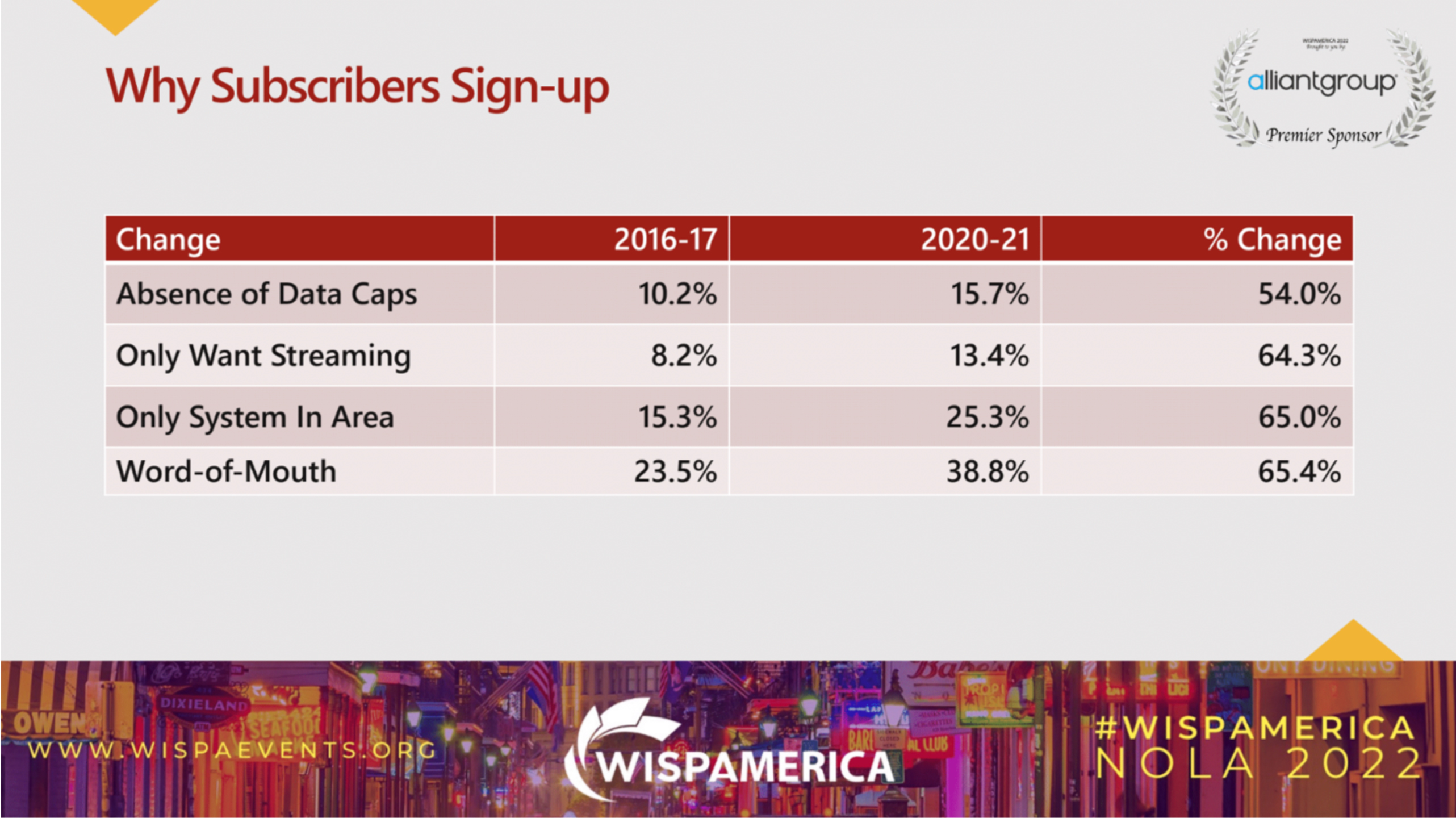

- The 2016-17 vs. 2020-21 reasons why customer sign-up rated the tried and true, age-old, “word-of-mouth” as the strongest reason and fastest growing, when the almost 800 most-recent survey recipients told us of their best new subscriber motivators (See, chart below, entitled “Why Subscribers Sign-up”).

- The five-year trend among perceived opportunities tops “Enhanced Spectrum Access.” This was the sole item that showed an increase during this timeframe.

- Margins approach 75% for the highest-rated ancillary profit-making service, which was “Home Information Technology Warranties.”

- Within the ever-more-popular Business/Commercial/Enterprise sector, 28.8% more in 2020-21 than in 2016-17 indicated “Health Services” as a new growth area.

LEOs Lurk

Yet, perhaps the “newsiest” new data was the focus by operators not just on future competition, but importantly on just one form thereof: satellites, but especially low Earth orbiting satellites (LEOs). More than a quarter of survey respondents specifically called out LEOs in 2020-21 versus 2016-17. Yet, as mentioned in the descriptive text, this trend also has a silver lining for land-based operators. Franchisees are going to be needed globally to help sell these new LEO systems. Why Not Hybrid Fiber Wireless Operators?, one speaker asked (See, e.g., Space Crowding in LEO is a Challenge, But Improvements in Design and Traffic Management Offer Hope, for a further look into the new pipe).

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Additional Datapoints

The Carmel Group’s co-panelists were Dale Curtis Communication’s CEO, Dale Curtis, and WISPA’s director of communications, Mike Wendy, who also served as moderator. Mr. Wendy also brought along a short video that made two focused points. One was that hybrid fiber wireless broadband pipes come in many forms, one of which is likely to be either pure fixed wireless or a hybrid fiber wireless combination. In essence, whatever the need, hybrid fiber operators have the tools needed to “get it done.” Mr. Wendy’s other point was that going forward, a lot more fiber will integrate into every hybrid fiber wireless system, and at least for denser ex-urban well-to-do areas. If an operator has not aggressively deployed those optical fibers, viability can be expected to be a true concern.

For Mr. Curtis, the core message was his current efforts on WISPA’s behalf to create 1) a new WISPA tagline, 2) a refined logo, and 3) “a new messaging framework that reflects the industry’s new realties and desired evolution.” Key mood-testing captured early-on recommends WISPA industry emphasis on a) the concept of “Connectivity,” b) also, as above, the “these operators get it done, no matter the tool” message, c) a local, consumer focus, d) and again, as above, less of a wireless and more of a fiber emphasis going forward, plus e) the industry needs to use the “small business” and “rural” traits, but do not let those limit its growth.

Additional Data

For that sometimes elusive answer to the frequently asked question, Where Do I Find More?, these links below begin a good primer:

Jimmy Schaeffler (AKA “Shamus Schaeffler”) is chairman and CSO of The Carmel Group, a west coast-based consultancy founded in 1995. He can be reached at jimmy@carmelgroup.com.