Bad Audience Estimates Hurt Linear Television as Upfronts Approach

Make-good ads frustrate advertisers — but they don’t want cash back

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

As buyers and sellers make plans for another upfront, they face two issues that make it difficult for networks to increase revenue and for advertisers to reach as many companies as they expect.

Ratings erosion for the linear networks is problem enough for anyone dependent on TV advertising. That problem is intensified by the networks’ propensity to overestimate how many viewers they’ll reach in order to have more inventory to sell, and the historic willingness of sellers to largely accept those inflated numbers in order to keep pricing down on a cost-per-thousand viewers basis.

Last year’s unusual upfront and the unpredictable TV season that followed have put a spotlight on those issues, buyers and sellers said.

Simply put, after a long delay because of COVID-19, when networks and buyers got around to making deals, they didn’t anticipate a double-digit dip in ratings. That meant that as the season started, commercials underdelivered on promised audiences and make-good ads piled up, squeezing supply and pushing up prices for spots remaining on sale in the scatter market.

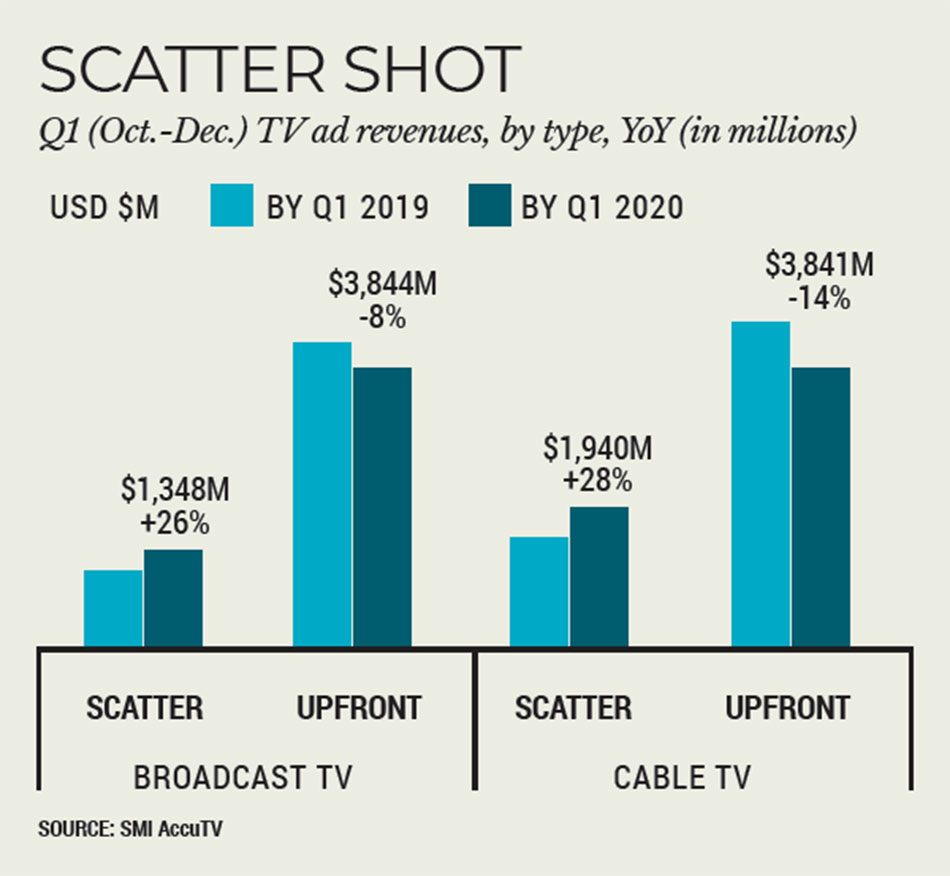

New data from Standard Media Index shows that spending in scatter rose during the first quarter of this broadcast year (see chart). Prices were up from 1% for entertainment programming to 45% for news on broadcast. On cable, entertainment prices were down 7% after diving even more in the upfront, and up double digits for news and sports.

During upfront negotiations, the networks gave clients more flexibility to cancel upfront buys and get money back — something media companies are loath to offer. Turns out, that’s not what the buyers and their clients wanted.

David Sederbaum, executive VP, video investment at Dentsu Amplifi, said the amount of cash back being offered to advertisers and even being accepted is higher than in past years. That’s a sign the market isn’t working the way it should.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“I don’t think that the sales community is doing as good a job as they need to with their ratings estimate projections,” Sederbaum said. “We as an industry need to push the sales community to be more accurate in their estimates, because the clients don’t necessarily want money back, even if cash back is an option.”

Instead of cash, advertisers want to reach their consumers. A big reason why ratings are down is because viewers are switching from linear and traditional pay TV to over-the-top options, including streaming services. Gradually, ad dollars are following.

Scramble for Digital Reach

Media companies are building and buying digital platforms and ad-supported streaming services to keep those ad dollars in the family.

“You can reduce your investment in linear television, as long as you’re getting that reach other places, specifically OTT and digital video,” said Sederbaum. “There are more opportunities than ever to spread that money out. But I think that the big media companies have certainly recognized that they need to diversify their offering as well.”

Tatari, an analytics and media buying company, has noticed the shift in the market and has been advising its mostly direct-to-consumer clients that instead of buying at the last minute, they’d better have a plan, because the inventory they want might not be available if they wait.

“In this marketplace, the future is not going to be like the past,” said Brad Geving, Tatari’s VP of media. “We’re urging clients to think ahead more than they normally would and think about what budgets they want to allocate to TV, so that we can secure that head of time.”

Geving noted that the period between Christmas and New Year’s — Q5, Tatari calls it — is usually a good time to buy because inventory is plentiful and prices are low. “This year, we didn’t see the normal discounts,” he said.

Primetime broadcast has been the first inventory to dry up and Tatari buys a lot of linear cable. But cable ratings have fallen faster than broadcast. “If there weren’t cable inventory available on linear, then we would be looking for CTV to fill that gap,” Geving said.

Another factor causing the squeeze on inventory is the practice of buying commercials based on young adult demos — adults 18-49 or 25-54. Those viewers are cutting the cord and streaming these days, leaving broadcast and cable with a high proportion of viewers 55-plus.

That’s one reason why A+E Networks wants to shift to using total audience, or adults 18 and older, as its primary currency during this year’s upfront.

(A+E will hold its virtual 2021 upfront March 3. WarnerMedia will present its kids and family programming on Feb. 17.)

Embracing Older Demos

“Traditional linear television should be seen as a total audience play, with frankly a skew towards the older audience,” A+E Networks president of ad sales Peter Olsen said.

A+E will make estimates for both total audience and the traditional demos. But Olsen admits “there’s very little incentive for the seller side to have realistic estimates.” He adds: “You get a lot of frustration now that people can’t be delivered in flight.”

Looking at the supply-and-demand math for the upcoming upfront, Olsen sees prices going up 15% to 20% for adults 18 to 49. And yet, buyers and clients will try to insist that they don’t want CPMs going up more than 5%. “That’s not sustainable,” he said.

By including loyal older viewers, the audience for linear TV will shrink more slowly, which would also slow price increases.

A+E and others are offering other advertising solutions, including audience targeting, addressable advertising, digital and over-the-top solutions. And that’s fine with buyers.

“The more choices that we have from the buying side for our clients, the more leverage we have,” Sederbaum said. “With the data and technology at our disposal, we can also right-size our investments and spend less if we’re doing it targeted through addressable media.”

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.