Charter, Comcast Set New Growth Paths After 2020

After early pandemic gains, top operators focus on streaming, growing footprint

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

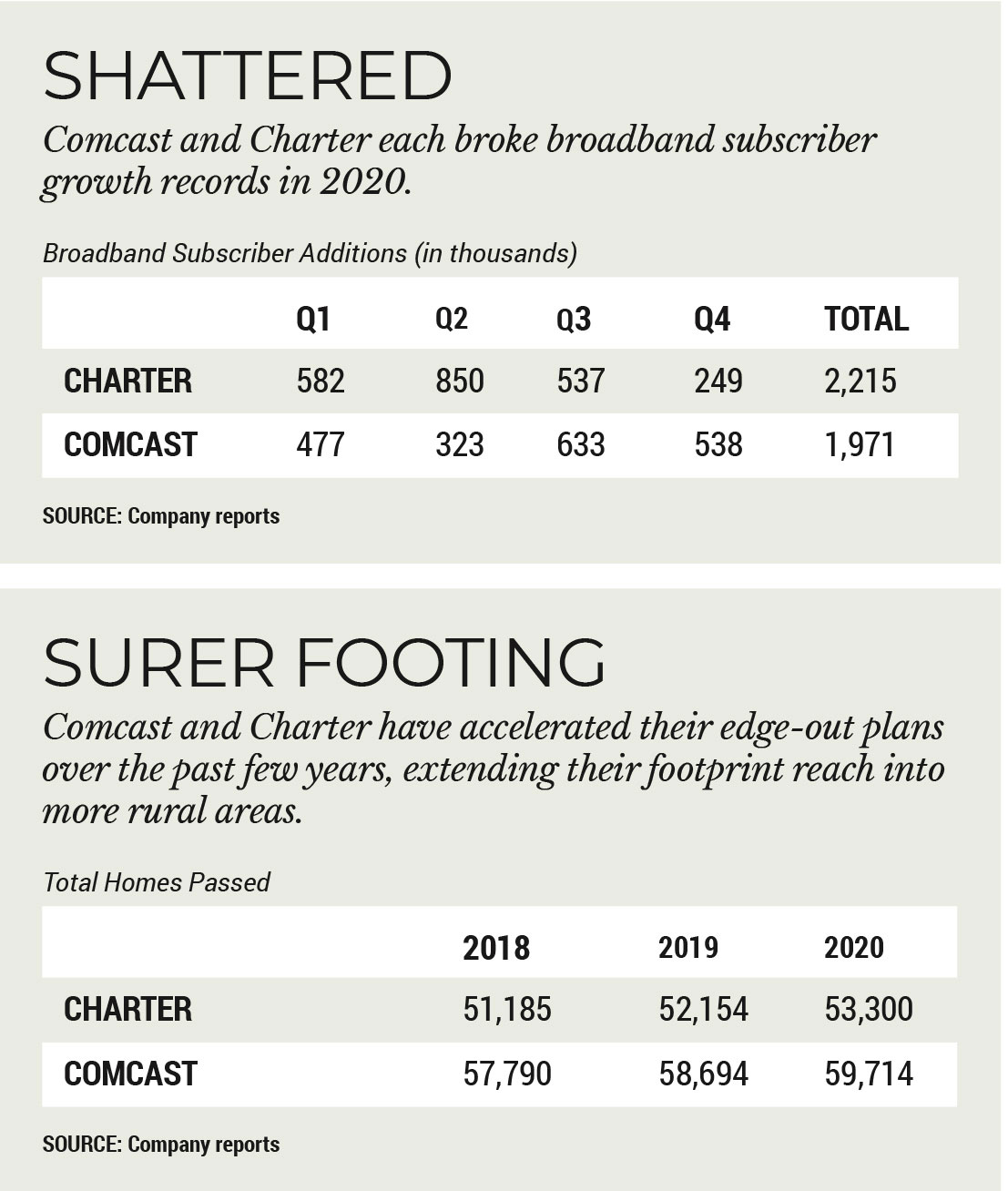

After an unprecedented 12-month run that saw broadband subscriber numbers reach record heights, the country’s top two cable operators urged investors to lower expectations for the current year as they focus on other avenues for growth.

Comcast was first out of the gate, reporting a fourth-quarter gain of 538,000 high-speed internet customers on Jan. 28. That was slightly below some analysts’ hopes for 550,000 additions, but it pushed the full-year gain to about 2 million, its highest total ever. Comcast warned investors that despite the strong growth — Comcast shattered subscriber addition records in the third and fourth quarters, driven mostly by pandemic-related stay-at-home orders — they shouldn’t expect more of the same in 2021.

“High-speed internet customer additions remain healthy,” Comcast chief financial officer Michael Cavanagh said on a conference call to discuss Q4 results. “And we have all the pieces in place for 2021 to be a very strong year. We also have to remember that 2020 was exceptional on many accounts. And because of that, we view 2019, which was also very strong for us, as the more appropriate year against which to benchmark our performance.”

Not that 2019 was a bad year: Comcast added 1.4 million broadband customers in that year. At the same time, video customer losses doubled in 2020 for Comcast — a bit of a contrast to other operators that saw losses decline or, in the case of Charter Communications, become gains. Comcast lost a total of 1.4 million video subscribers in 2020, nearly double the 733,000 it shed in 2019. A return to those levels would be a welcome, although not quite feasible, outcome.

Video Gains at Charter

Charter ended the year with a net gain of about 19,000 residential video subscribers, rising to 56,000 if business customers are included. But it said it expects a return to video losses as the pandemic wanes.

On a conference call with analysts on Jan. 29, Charter chairman and CEO Tom Rutledge said the video additions were a result of the company’s broadband growth.

“We had good results in video for two reasons,” Rutledge said on the call. “We had growth in connectivity and as a result of that, having market share shift to us from other video providers and they bought our broadband, we grew our video against a macro trend of declining multichannel video growth. That macro trend hasn’t gone away.”

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Rutledge said he expects video subscribers to continue to decline across the industry in 2021, perhaps at a more moderate pace, while broadband growth won’t be the same this year as in 2020, which should pressure video growth.

“On the other hand, we’ve been able to grow with OTT products and smaller packages and we still have opportunities there,” Rutledge continued. “We’re forecasting our internal growth in those areas to continue to accelerate. So, the net of these two things is difficult to say, but I think we’ll do better than the industry in general, if you just look at multichannel video growth. Whether that will be positive or negative, I’m not sure.”

ALSO READ: Broadband Drives Q4 Again for Comcast Cable

After a year when cable operators saw broadband demand increase as most Americans were forced to stay home for work and school as the pandemic rages on, a falloff in demand was expected.

“The simple fact is that broadband results have been so good in 2020 that 2021 can’t possibly meet the same standard,” MoffettNathanson principal and senior analyst Craig Moffett wrote in a research note. “Comcast’s blowout fourth-quarter broadband growth put an exclamation point on what was already a year for the record books.”

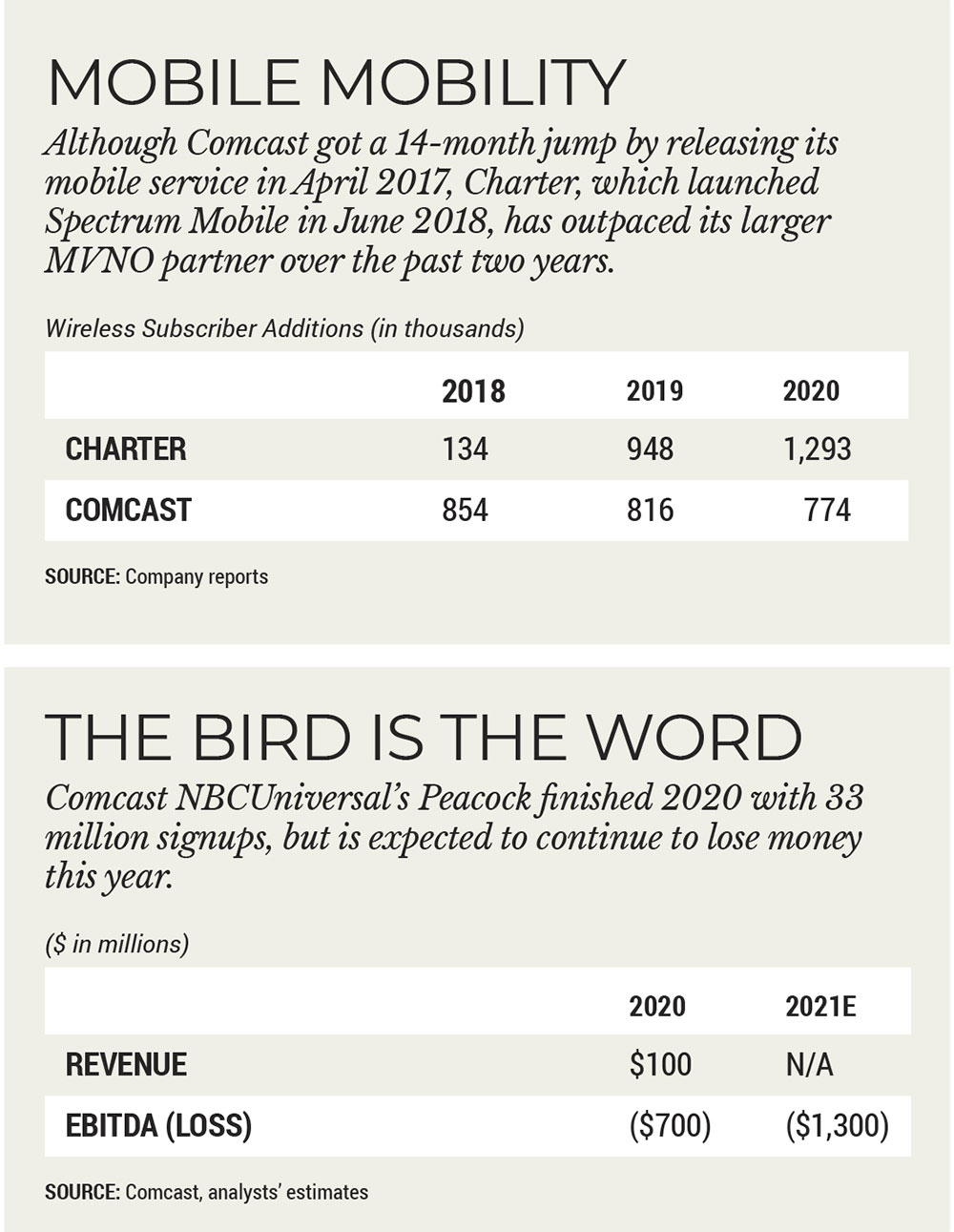

While no one expects cable operators to duplicate 2020’s growth this year, many analysts see last year’s milestones as laying the foundation for other potential growth areas. For Comcast, that could be Peacock, its video streaming service. For Charter, with ongoing footprint expansion and success in recent wireless spectrum auctions, it could be a combination of broadband and mobile gains.

Peacock, launched on May 27, already has 33 million signups as of the fourth quarter. Moves are being made to add more content to the service and bolster its paid subscriber ranks. The latest: NBCUniversal struck a deal with WWE to make Peacock the new home to the WWE Network SVOD service and its programming, including WrestleMania and pay-per-view events. NBCU’s USA Network and Fox would maintain their exclusive rights to WWE programming like Monday Night Raw and Friday Night SmackDown, respectively.

Peacock Feathers Comcast’s Nest

Wrestling isn’t the only exclusive programming for Peacock. In January, Peacock began streaming The Office episodes, after the former NBC stalwart ended a rights deal with Netflix.

On the conference call, NBCUniversal CEO Jeff Shell noted that since Peacock began offering The Office exclusively on Jan. 1, viewership is higher than it was when the show was on Netflix. Shell said the show has had a halo effect for other Peacock programming.

“What’s happening is we’re seeing that people who are watching The Office on Peacock are watching lots of our other comedies,” Shell said. “So it’s really driving Parks and Rec and really driving Brooklyn Nine-Nine, amongst others. So there’s kind of an ecosystem effect.”

NBCU has also been steering sports onto the streaming service. In addition to the WWE, Peacock began streaming some English Premier League soccer last year and will beef up the sports lineup at the end of this year when NBC’s cable sports network, NBCSN, shuts down.

“WWE is kind of a perfect property for us because it allows us to [put] thousands of hours of programming that were behind a paywall that we’ll now put on the free service of Peacock, which will not only enhance the brand of WWE, but we can monetize in advertising,” Shell continued. “We get the events that were behind a paywall that used to be pay-per-view can drive our $4.99 premium version of Peacock. … So I think the model that we’ve constructed here to really kind of leverage our existing linear businesses and drive advertising is working. And I think comedy, sports [are] two of the success stories certainly so far.”

In a research note, Bernstein media analyst Peter Supino wrote that while Peacock still lags behind other streamers like Netflix and Disney Plus in terms of scale, “its first year seems emphatically ahead of plan in terms of signups (33M) and engagement.”

The addition of programming like The Office, a deal with Disney to split carriage of Modern Family, and hopefully the Summer and Winter Olympics over the next 13 months, could pose an opportunity to attract significantly more viewers.

Later, Shell avoided saying NBCU’s linear cable networks would become part of Peacock, but hinted that streaming content could be as profitable as linear content.

“Cable networks obviously are a big part of the business, they are still the biggest EBITDA driver, and I don’t expect that to change anytime in the near future. But we’re looking at the two revenue streams of the business — subscription and advertising — as one business, broadcasting, cable and Peacock,” Shell said. “We’re programming it as such, we’re selling it to advertisers as one platform as such, and so over time it will be harder and harder to distinguish between the profitability of cable networks and the rest of our television business because we’re looking at it as one business.”

Peacock is still losing money. Comcast said the streaming service generated about $100 million in revenue but lost about $700 million in 2020. Comcast expects that deficit to increase to about $1.3 billion in 2021. But that doesn’t mean it will keep losing money for long.

Flex Could Have Muscles

The increasing importance of Peacock in Comcast’s overall strategy was not lost on MoffettNathanson principal and senior analyst Craig Moffett. In a research note, Moffett pointed to Comcast’s broadband-only product, Flex, and how that offering could become a key piece of the company’s overall strategic puzzle.

“In a perfect world, Flex could become a second Roku,” Moffett wrote. “They’ve already got the right content partnerships, and they’ve already got a distribution partnership agreement with Cox. If they could get one with Charter, Flex would have a national footprint, a prerequisite, it would seem, for both national advertising and national retail.”

Comcast chairman and CEO Brian Roberts said on the Jan. 28 earnings call that at least part of Peacock’s success could be attributed to Flex. And the hope is that influence will continue across the product line.

“We’re seeing [that] other programmers are approaching us with their content and seeing what both the X1 platform and the Peacock platform and this Flex platform can do for them,” Roberts said, and Comcast continues to look for ways to take advantage of the Flex platform and possible bundling opportunities. “I think we’ll have more to talk about throughout the year.”

Charter doesn’t have a Flex-type product, although Rutledge had hinted in 2019 that he would be open to licensing Flex at some point. For now, though, it seems that the second-largest cable operator in the country is focusing on expanding its footprint and the reach of its mobile services.

ALSO READ: Charter Q4 Broadband Adds Light at 246,000, But Video Losses Improve

Charter ended the year with 53.3 million homes passed, an increase of about 1.1 million from the prior year and a clear acceleration from 2019, when it added 969,000 homes. Comcast added about 1 million homes, ending the year with 59.7 million homes passed.

Moffett said in a research note that Charter’s edge-out plans will help keep the broadband business humming and also could beef up the wireless rolls.

Charter added about 315,000 wireless customers in Q4, below consensus estimates of 351,000 additions but well above the Q4 2019 total of 288,000. Charter ended the year with 2.4 million Spectrum Mobile subscribers, more than doubling its 2019 mark of 1.1 million wireless customers.

Charter Bulks Up Wireless

While Spectrum Mobile isn’t profitable yet, Charter has been acquiring spectrum to help boost broadband growth and cut overall costs in wireless. Charter was the top bidder in the recent RDOF auction and has amassed a large block of CBRS licenses. Moffett noted that both Comcast and Charter have amended their MVNO agreements with Verizon Wireless. The additional CBRS spectrum should help Charter offload some of its wireless traffic from the Verizon network to its own network, reducing expenses.

“To the extent that they can offload a meaningful amount of traffic from their MVNO agreement, they will be able to reduce their variable costs more dramatically,” Moffett said of Charter.

On Feb. 1, Charter said it would spend $5 billion ($1.2 billion from RDOF funds) over the next several years to build out broadband service to about 1 million homes in 24 states within its footprint, in addition to current edge-out programs.

Rutledge said that over the next four or five years, CBRS could potentially help Charter offload as much as two-thirds of its wireless traffic from the MVNO, depending on several factors.

CBRS can also enhance the quality of the service, Rutledge said which in turn would enhance the consumer experience.

“That’s an unstated opportunity going forward and hard to quantify, but it’s part of our strategy,” Rutledge said.

Mike Farrell is senior content producer, finance for Multichannel News/B+C, covering finance, operations and M&A at cable operators and networks across the industry. He joined Multichannel News in September 1998 and has written about major deals and top players in the business ever since. He also writes the On The Money blog, offering deeper dives into a wide variety of topics including, retransmission consent, regional sports networks,and streaming video. In 2015 he won the Jesse H. Neal Award for Best Profile, an in-depth look at the Syfy Network’s Sharknado franchise and its impact on the industry.