Dish: No Partner Needed for 5G Wireless Dance

Chairman Charlie Ergen says funding is in place, but questions remain in prepaid phone market

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Dish Network chairman Charlie Ergen said the satellite-TV operator expects to light up its first wireless market in Q3 and doesn’t need a strategic partner to help offset the cost of deploying what he called a state-of-the-art 5G network.

Ergen, speaking on a conference call with analysts about Dish’s fourth-quarter results, didn’t give specifics about that first wireless location other than it would be “an NFL city.” Ergen said he expects to meet the federally mandated deadline of providing service to 20% of the country by June 2022 and to 70% by June of 2023.

He also put the brakes on any speculation that Dish would need a deep-pocketed partner to fund construction of the wireless network. Now, fresh off a convertible notes offering in December that raised $2 billion, and with about $4 billion in cash on the balance sheet, Dish has the funding it needs.

Going It Alone

“I think we always thought we might need a strategic partner when we didn’t have any capital,” Ergen said on the conference call. But just like in the early days of satellite TV, once the company’s vision became clear and it began to hit execution milestones, a partner was no longer needed, he said.

“Ultimately, we got confident enough and good enough in what we were doing, that it just made sense to keep the equity,” Ergen said. “And it didn’t make sense to give up the equity. I think we’re probably in a similar situation today, in the sense that we do have enough capital on our balance sheet today to build our network.”

In the past, Ergen had estimated the wireless network would cost about $10 billion to build, although some analysts have said that figure may be dangerously low.

In a research note, Barclays Group media analyst Kannan Venkateshwar wrote that the lack of a need for a partner means that Dish’s balance-sheet health is going to be more important than ever, especially since the 5G network isn’t expected to reach meaningful scale for at least two or three years. He pointed out that Dish’s decision to raise $2 billion through a note offering that converts to equity could mean it couldn’t find any partners.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

“The fact that the company issued equity-linked paper recently is likely another indicator of the lack of willing strategic partners and its need to limit

carry costs to manage its cash flow,” Venkateshwar wrote.

While Dish has been accumulating spectrum for years, it got a big boost as part of the conditions surrounding T-Mobile’s $26 billion purchase of Sprint last year. As part of those conditions, Dish agreed to buy about $3.4 billion worth of 800-Megahertz wireless spectrum from T-Mobile and paid $1.4 billion for Sprint’s prepaid wireless business, Boost Mobile.

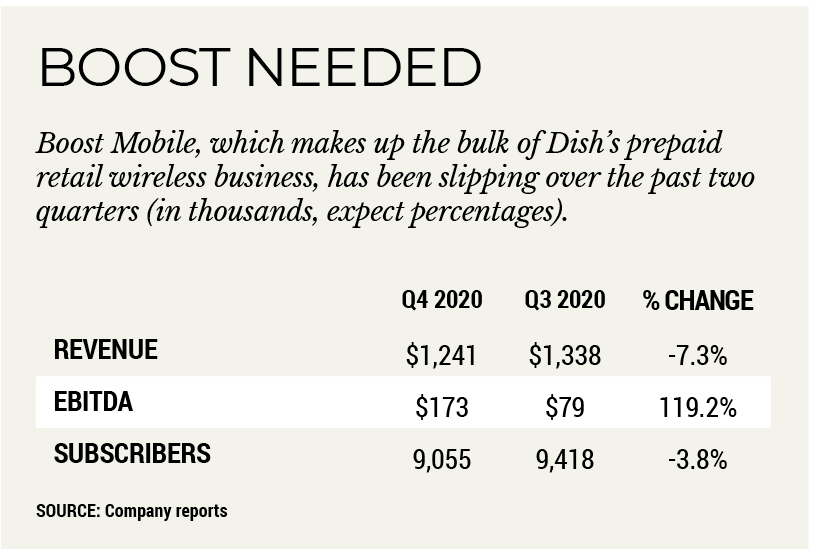

Boost, with about 9 million subscribers, has provided a steady stream of cash to Dish: Revenue was $1.4 billion in Q4. But Dish said in its 10-K annual report filing late last month that it might have to pony up a “material” amount of cash to keep the Boost business going.

Dish said in the 10-K filing that T-Mobile notified it in February that it will decommission its 3G CDMA (Code Division Multiple Access) network, on which the Boost Mobile service runs, on Jan. 1, 2022. That, Dish said, would would have a “material adverse effect” on its wireless business, forcing the satellite company to either migrate Boost customers more quickly to a network it hasn’t yet built, purchase an enormous amount of new handsets to allow Boost customers to access T-Mobile’s 4G network or brace itself for a torrent of wireless customer defections. Dish seems to be gearing up for the defections.

“It’s hard to upgrade, to go from a phone that works great and works in their territory, and then go to another phone that won’t even work on our network because we’re 5G,” Ergen said on the call. “Then we have to upgrade them again. So if you run the numbers on that, there would be significant fallout from that, in my opinion.”

Providing new handsets to Boost customers wouldn’t just be a logistical nightmare, it may be impossible to execute,” Ergen added.

“I don’t even think we could get the supply of the phones that we would need,” Ergen said.

While Boost has been a help as Dish continues to move forward with its wireless buildout plans, it’s real value may be in the pool of potential customers it presents for the 5G service when it becomes available.

Boost has been losing subscribers since Dish took over in July, shedding about 363,000 customers in Q4 and 212,000 in Q3, a worse pace than its peers. Its value as a springboard for Dish’s 5G service is now in question.

A Big Setback

In a research note, MoffettNathanson principal and senior analyst Craig Moffett wrote that Boost was expected to provide a retail brand, store locations and a customer base that could eventually be converted to Dish’s 5G network. That arrangement now appears to be in danger. The analyst said having to migrate Boost customers to 5G quicker means it could be a “very challenging year ahead, both for subscribership and for costs.”

Dish may be able to get some relief from the federal government, or at least more time to migrate customers. Asked on the call if he had contacted the Federal Communications Commission about T-Mobile’s CDMA shutdown, Ergen said he hadn’t spoken to the agency personally, but it is possible one of his staff may have. He said he believed T-Mobile’s decision to discontinue the CDMA service was anti-competitive. He noted that Boost customers are “economically challenged,” and that removing one of their options to access affordable wireless services, especially during a pandemic, seems to go against the motivation for allowing Dish to buy the service in the first place — to establish a fourth national wireless provider.

“We are one of four providers,” Ergen said. “Washington picks winners and losers, and they make policy that affects people one way or the other. And we’ve had some good luck, we’ve had some bad luck with that as have others.”

Mike Farrell is senior content producer, finance for Multichannel News/B+C, covering finance, operations and M&A at cable operators and networks across the industry. He joined Multichannel News in September 1998 and has written about major deals and top players in the business ever since. He also writes the On The Money blog, offering deeper dives into a wide variety of topics including, retransmission consent, regional sports networks,and streaming video. In 2015 he won the Jesse H. Neal Award for Best Profile, an in-depth look at the Syfy Network’s Sharknado franchise and its impact on the industry.