Has Cable Broadband Hit the Wall?

Some analysts fear cable high-speed data will never recover as ‘unfettered feast on DSL’ ends

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

The slowdown in cable broadband subscriber growth has been well-documented — spiking during the pandemic and dropping off as workers and students returned to offices and schools — but there has always been the hope that while increases won’t ever return to pre-pandemic levels, they might at least get close. Now, some analysts aren’t quite so sure.

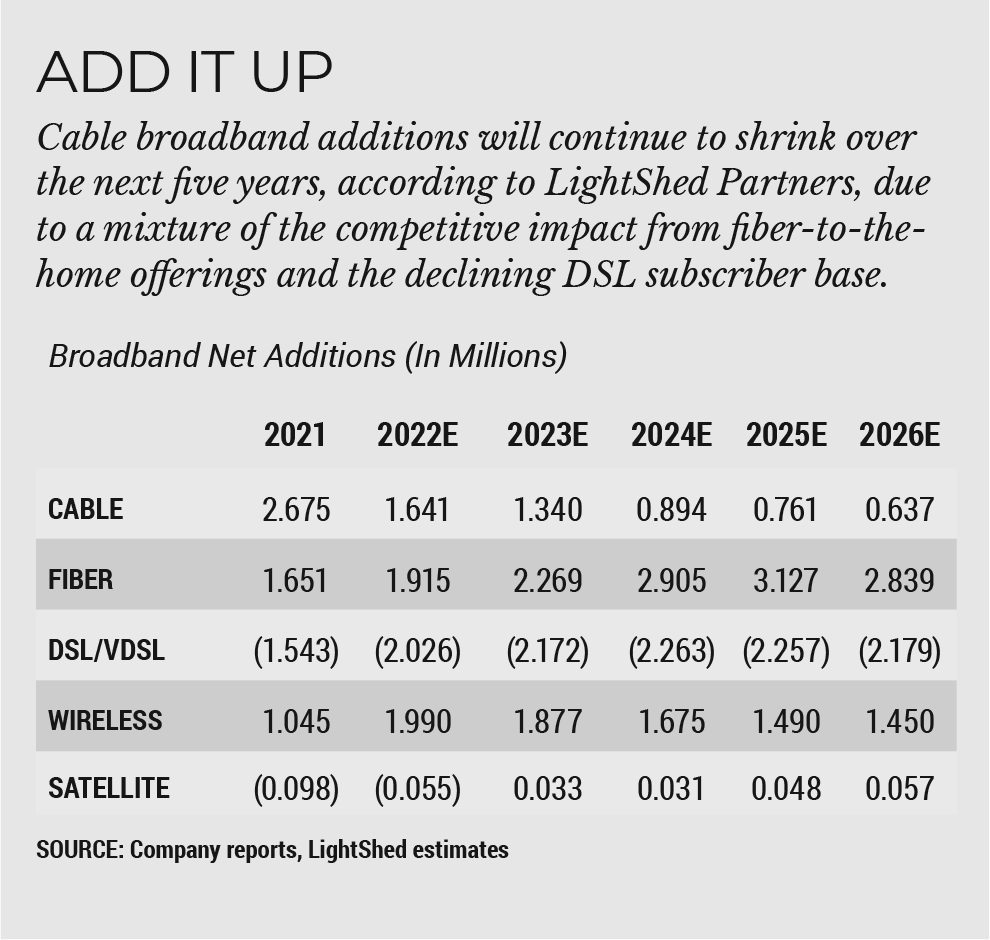

Cable operators added 3 million broadband subscribers in 2019 and 4.6 million in 2020, according to LightShed Partners analysts Walter Piecyk and Joe Galone. Those increases began to slow to 2.7 million additions in 2021, and are expected to dip even further in the next five years. While the pace of the decline varies by analyst — Piecyk and Galone predict cable broadband additions will fall to 1.6 million in 2022 and to 637,000 by 2026, while others predict the erosion will be less dramatic — most believe that a return to past growth rates is unlikely.

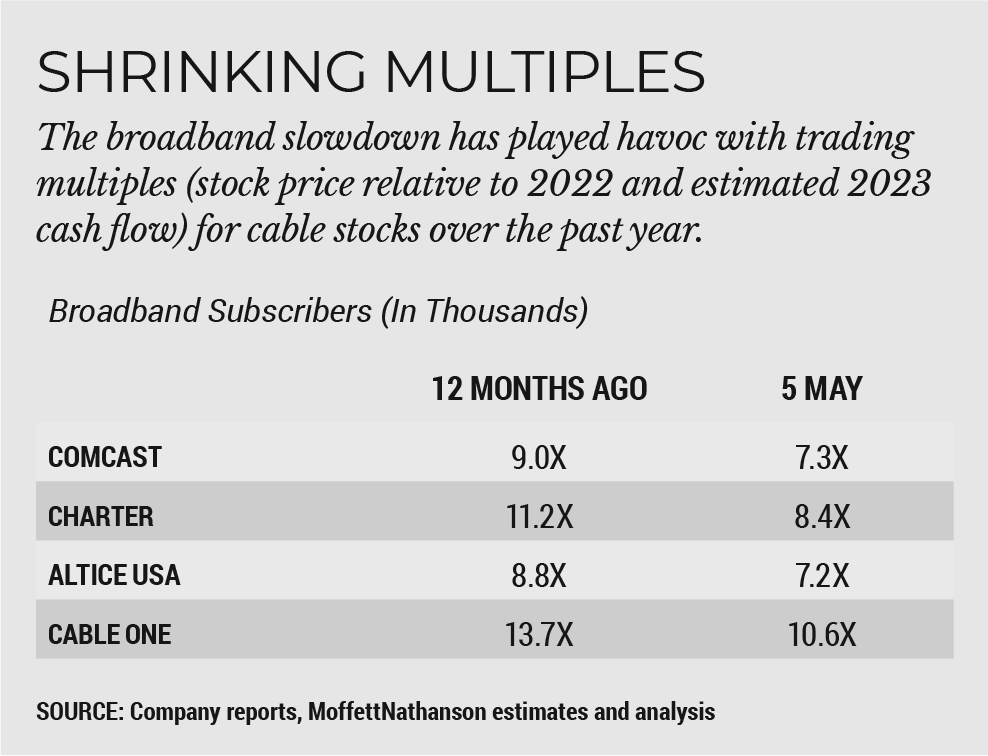

The result has been a precipitous drop in trading multiples for cable and telecom stocks alike. Cable has been hit hard: trading multiples on former high flyers like Comcast and Charter Communications have fallen from 9 times and 11.2 times cash flow 12 months ago to 7.3 times and 8.3 times, respectively. Cable One, which sported a trading multiple of nearly 14 times cash flow a year ago, now trades at around 10.6 times.

As a result, stock prices have fallen. As of May 5, Comcast shares are down 19% on the year, Charter has dipped 30%, Altice USA is down 37% and Cable One has fallen 38%.

“The concern, of course, is that slowing broadband net additions are a sign of a longer-term decline, and that a lower terminal growth assumption is therefore warranted,” MoffettNathanson senior analyst Craig Moffett wrote in a recent research note.

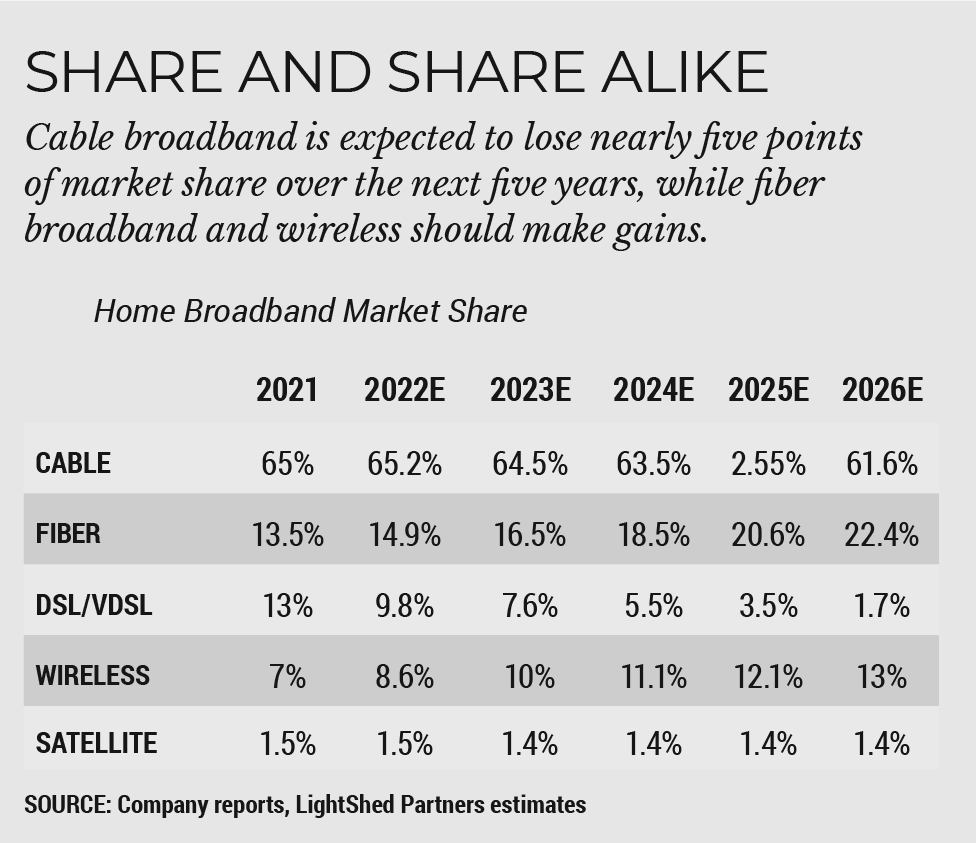

For Piecyk and Galone, the biggest factors in the continued slowing of cable broadband growth are fiber competition and the disappearance of digital subscriber line or very-high-speed DSL customers. For years, operators have feasted on DSL/VDSL customers who switched to faster, more reliable cable broadband service. But that success has depleted the DSL/VDSL ranks significantly. LightShed estimated that DSL/VDSL broadband market share, once 22.7% in 2017, fell to 13% in 2021 and will further decline to just 1.7% by 2026.

“DSL has been a share donor to its ISP competitors for more than a decade, losing 10 percentage points of market share over that period,” Piecyk and Galone wrote, adding that even at its current 13% penetration rate, there’s not much “low-hanging fruit on which cable operators can feast.”

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Adding to the pressure is the rise in fiber-network construction and fixed-wireless access (FWA) offerings from telcos and other ISPs.

In their report, Piecyk and Galone reminded investors that telcos have announced plans to build fiber to an additional 30 million homes over the next five years, and that smaller telcos and even cable operators have put forth their own fiber initiatives. How those ultimately play out is anyone’s guess, but it is safe to say that there will be significantly more homes passed by fiber in the next few years than the current 40 million.

That should worry some cable operators because fiber-to-the-home offerings generally attract a big chunk of the market, with an adoption rate of about 30% over the past three years, according to LightShed. Cable operators have claimed those gains will be hard to continue as cable deploys lower-cost, speed-boosting upgrades to their networks, but Piecyk and Galone said fiber builds should attract 15% of market share in the first year and 40% by year four.

“We believe consumer dissatisfaction with the cable company runs a bit deeper,” the analysts wrote. “Consumers are smarter than many acknowledge and might not be easily mollified by a boost to their upload speeds in the months preceding a new fiber offering by a competitor.”

Fixed Wireless Worries

Moffett predicted the broadband slowdown will continue, but he’s more optimistic cable operators will be able to successfully beat back the fixed wireless threat. The analyst sees fixed wireless as more of a rural play — and that wireless additions will offset high-speed data sluggishness.

“Like everyone else, we’ve been worried about broadband net adds, and we still are,” Moffett wrote in a recent report, adding that he doesn’t think overall growth will go negative and sees positive signs from wireless. “Wireless is neatly taking the baton from broadband as cable’s next growth driver, just as broadband did from video so many years ago.”

Moffett said he expects broadband growth to fall by nearly half in 2022 at Comcast (to 749,000 additions from 1.3 million in 2021); and by 43% at Charter (from 1.2 million in 2021 to 828,000 in 2022). At Altice USA, which lost 3,000 broadband customers in 2021, Moffett sees more of the same — he predicts it will lose about 8,000 residential broadband customers in 2022.

But for this analyst, 2022 is pretty much the growth bottom for the top three operators, as he anticipates a gradual uptick in broadband additions over the next four years. Moffett predicted Comcast will add 756,000 broadband subscribers in 2023, 772,000 in 2024, 789,000 in 2025 and 806,000 in 2026 for a compound annual growth rate of 1.8%. That’s about half its 3.7% CAGR in the pandemic years of 2019 and 2020, but not far off its 2.3% CAGR between 2016 and 2017.

Moffett is more encouraged by wireless subscriber growth, which reached record levels for Comcast in Q1 and near-record levels for Charter in the same period.

Comcast is expected to add about 1.3 million wireless customers in 2022, up about 14% from the prior year, and consistently add 1.25 million news per year for the following three years, according to Moffett. At Charter, wireless additions should reach 1.2 million in 2022, leveling off to 778,000 by 2026, the analyst wrote.

As for telcos like T-Mobile and Verizon, Piecyk and Galone estimate they will add about 9.3 million fixed wireless broadband customers by 2026 — impressive growth, but slower than the guidance the companies themselves have given. T-Mobile has predicted fixed wireless broadband growth of 5 million access lines, with Verizon’s guidance for 4 million to 5 million additional fixed wireless broadband customers by 2025.

“Our wireless home broadband estimates may be tamer than consensus or the guidance of the companies themselves, but they are still a contributing factor to our expectation that cable broadband growth will slow,” Piecyk and Galone wrote. “Cable’s unfettered feast on DSL subs is coming to an end, and wireless offers a legitimate alternative to a disgruntled subset of cable’s subscriber base. If wireless operators can deliver on their own guidance, cable operators might face a contraction in their sub base rather than simply a deceleration of growth as reflected in our models.”

Fixing to Grow the Pie

Many have feared fixed wireless access would take share from cable operators, but Moffett isn’t convinced it will have the impact some predict. For one, he noted that much of T-Mobile’s fixed wireless access (FWA) growth

has come in rural areas where there wasn’t an incumbent broadband provider. And much of Verizon’s FWA additions have come from B2B customers, and have been particularly strong in new segments like food trucks, construction trailers and mobile COVID-19 testing sites.

“For FWA in particular, it is obvious that some of the growth at T-Mobile and Verizon is coming from cable,” Moffett wrote. “But it is equally clear that much of it is not.”

The reality is that FWA’s impact is probably somewhere in the middle. Moffett estimated that total broadband subscriber growth was 2.3% in Q1 without considering T-Mobile and Verizon FWA, and up 3.2% when they were added.

“FWA is unquestionably having some competitive impact,” Moffett wrote. “But much of its growth is best viewed as expanding the market, either into new categories and/or new geographies.” ▪️

Mike Farrell is senior content producer, finance for Multichannel News/B+C, covering finance, operations and M&A at cable operators and networks across the industry. He joined Multichannel News in September 1998 and has written about major deals and top players in the business ever since. He also writes the On The Money blog, offering deeper dives into a wide variety of topics including, retransmission consent, regional sports networks,and streaming video. In 2015 he won the Jesse H. Neal Award for Best Profile, an in-depth look at the Syfy Network’s Sharknado franchise and its impact on the industry.