Operators Brace for Spike in NFL Costs

Analysts expect big license-fee hikes to pay for 10-year, $95 billion pacts

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

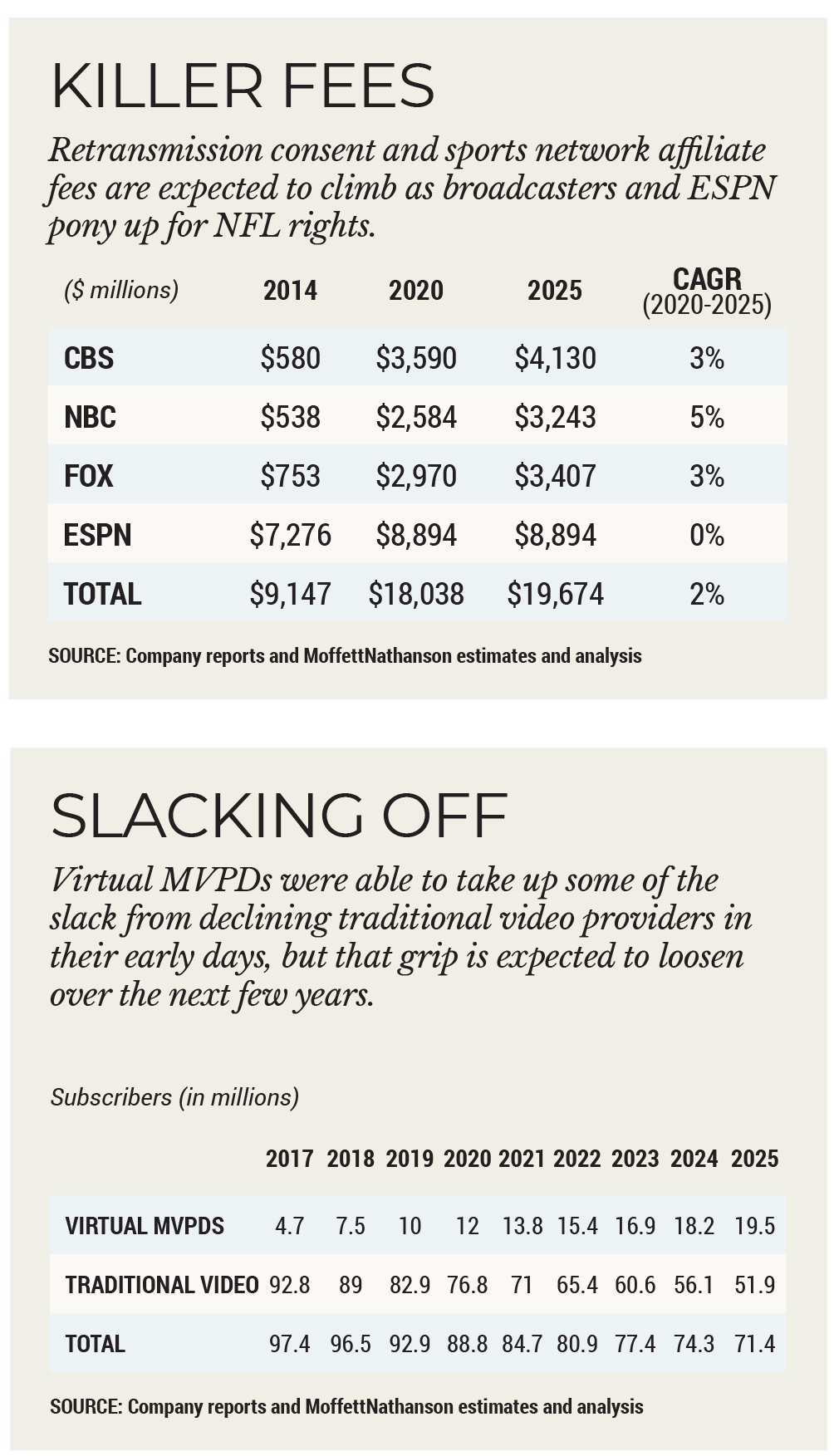

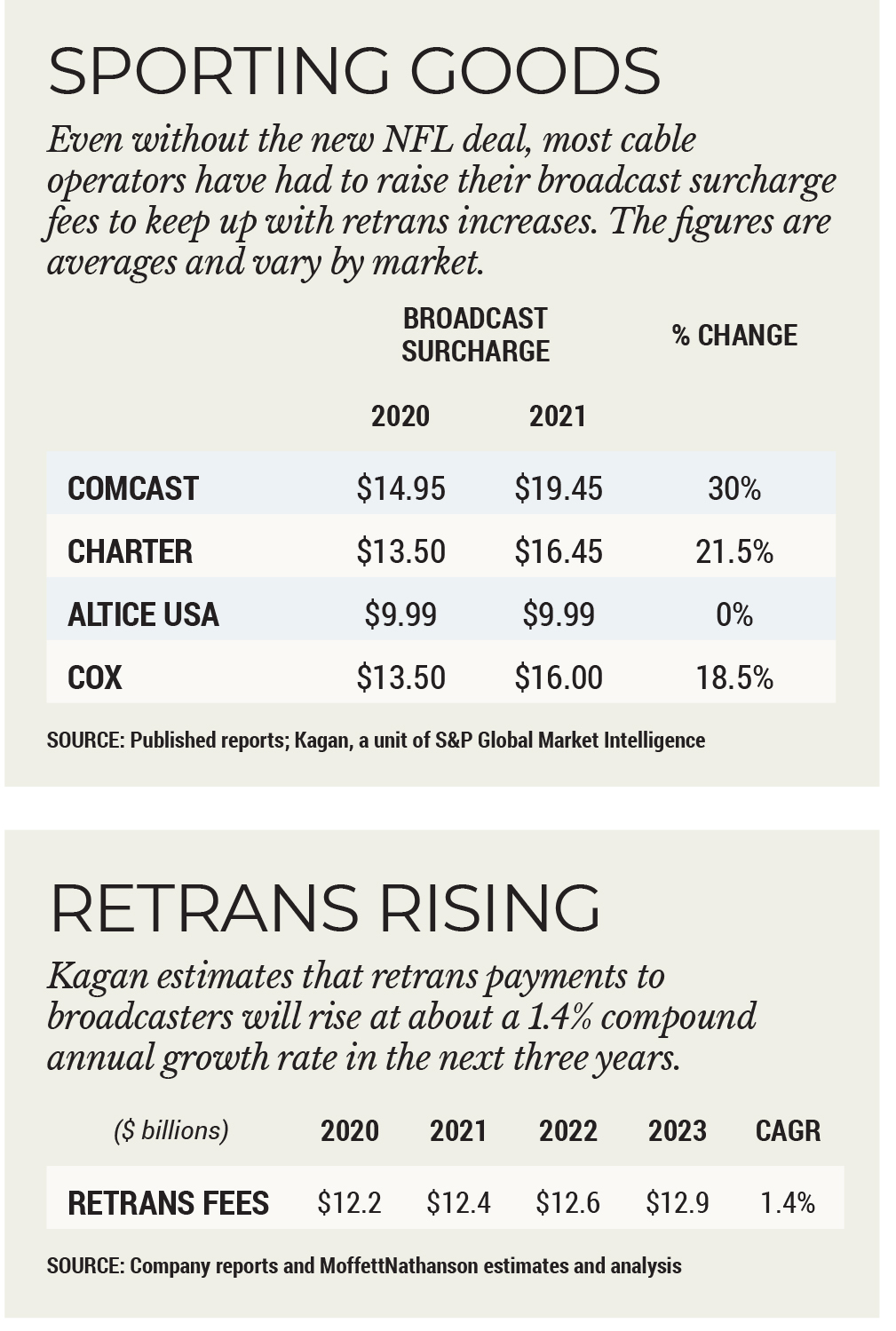

The jury is still out as to how broadcasters and cable sports programmers expect to pay for the landmark 10-year, $95 billion deal for National Football League rights, but many distributors are bracing for big increases in retransmission consent and affiliate fees to pay at least some of the freight.

The NFL deal spreads rights payments over 10 years for CBS, ABC, Fox and NBC Sunday regular-season and playoff games and ESPN for Monday Night Football. Amazon Prime Video stepped up for Thursday Night Football contests, agreeing to pony up about $1 billion annually for exclusive rights for the games, which shouldn’t have an impact on pay TV.

The new deal doesn’t take effect until 2023, meaning that operators will have at least a two-year reprieve until the next retrans cycle. While some analysts have said recent retrans negotiations likely took an increase in NFL rights costs into account, they probably didn’t anticipate a doubling of the fees programmers paid — and virtually were forced into paying.

“[A]s more premium content is shifted to DTC platforms, as ViacomCBS and NBCU have shown with their new NFL contracts, the industry runs

the risk of both higher cord-cutting and greater viewer erosion,” MoffettNathanson media analyst Michael Nathanson wrote in a note to clients. “In particular, those programmers — again ViacomCBS and NBCU — who appear to abandon their linear programming obligations by rapidly shifting premium content over to their DTC platforms run the risk of getting dropped by MVPDs and/or suffering lower annual price escalators, especially as it relates to growth in retrans.”

Also Read: Big Four Are Sports TV's Comeback Kids

For the most part, cable operators are anticipating a big jump in retrans costs in the next couple of years. Those that have finalized pacts in the past year shouldn’t feel the pain of any NFL-related increases immediately. But since retrans deals are usually three to five years in length (and the NFL rights deals go through 2033), they will feel the pain eventually.

Distributors that will probably have to face a retrans negotiation this year include Dish Network, Cox Communications, AT&T’s DirecTV and U-verse TV units and Altice USA, according to Kagan, a unit of S&P Global Market Intelligence. Dish deals for 113 Sinclair Broadcast Group stations in 83 markets and for 61 Tegna stations in 51 markets come up for renewal this year, according to Kagan, as do Cox’s agreements for 33 Nexstar Media Group stations in 23 markets and 17 Sinclair stations in 12 markets. AT&T will have to negotiate for 28 Fox stations in 18 markets and Altice USA will start talks regarding 13 Fox stations in eight markets before the end of the year. However those deals turn out, multichannel video programming distributors (MVPDs) are bracing for increases that they, in turn, would like to pass onto consumers. (See chart.)

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Most of the top operators have increased their monthly broadcast surcharges to cover retrans increases, including Comcast, which boosted its surcharge by $4.50 per month per subscriber in January to $19.45, and Charter, which hiked its monthly surcharge by $2.95, to $16.45 per month, earlier this year. The figures are averages, and actual surcharges vary by market.

“I think this leads to even more unsustainable price increases being demanded of pay TV providers and their customers,” Mediacom Communications senior VP of government and public relations Tom Larsen said. “That’s not a good scenario for the pay TV business long term.”

Some of those fee increases could be demanded by networks and stations that have been less active on the retrans front in the past. The new deal brings The Walt Disney Co.’s ABC back into the NFL fold for the first time since 2006, with rights to the Super Bowl in 2026 and in 2030, as well as three Monday Night Football games — in a doubleheader with ESPN — per year. In a research note, Barclays Group media analyst Kannan Venkateshwar noted that ABC has a significant retrans revenue gap of between $200 million and $600 million annually, compared to its broadcast peers, that should narrow with the NFL’s return.

“With Peacock, Paramount Plus, ESPN Plus and Amazon carrying NFL games, most football games will now be available on some streaming service, which is inevitably likely to result in the pace of cord-cutting accelerating significantly once the new deal fully kicks in and if Disney chooses to make football available on ESPN Plus,” Venkateshwar wrote.

Cable, satellite and telco TV operators will likely foot most of the $95 billion bill over the 10-year period of the deal through higher fees, ACA Connects CEO Matt Polka said in a statement.

“Broadcast networks and TV station owners like Sinclair, Nexstar, Tegna and Apollo Global Management will continue to leverage the broken retransmission-consent rules to demand excessive fees from smaller cable operators, driving up the cost to watch what broadcasters like to call ‘free TV,’ ” Polka said. “In order to make up for their massive NFL obligations, broadcasters will hike their prices even higher — and, ironically, use blackouts of NFL games themselves in order to do so.”

While operators are reluctant to predict what impact NFL rights will have on retrans negotiations going forward, they are resigned to the reality that fees during the next cycle will be substantially higher. Whether or not they agree to pay them is another thing.

Could Push MVPDs to Breaking Point

In a research note, Nathanson said making programming as valuable as NFL football available both on broadcast and direct-to-consumer streaming services could be the last straw for MVPDs that have complained in the past about having to pay for networks that were available elsewhere for free or at a lower price.

By making games available simultaneously on both linear and streaming platforms, Nathanson noted, programmers are risking “the possibility that distributors start to punish programmers who move their key content to their owned DTC platforms. As

such, distributors may choose to entirely drop network offerings or decide to rein in their intended annual pricing escalators. Thus, a combination of rising cord-cutting and falling pricing power would crush media earnings.”

According to a distributor that asked not to be named, the streaming aspect of the deal could make dropping a broadcaster a more thinkable option, despite the pushback by consumers.

“It’s something that all providers, if they aren’t already thinking about it, they need to be thinking about it,” the distributor said.

Most operators were reluctant to be specific as to what impact the NFL contract will have on retrans fees because the new rights deal won’t kick in for another two years. Still, they don’t appear overly optimistic about the future.

“We remain concerned about the rising costs of sports content and the impact it has on consumers’ access to affordable video services,” Cox executive director, media relations Todd Smith said.

Nathanson observed that the new NFL deal appears to be focused on the league getting a bigger share of the retransmission consent fees that stations are paid by MVPDs.

“If prior deals were about extracting maximum value for ESPN, these deals were about reclaiming the billions of dollars of retrans payments that the broadcast industry has collected from distributors,” Nathanson wrote. During the last NFL rights negotiation, ESPN affiliate fees were 10 times higher than the retrans revenue of the average broadcast network. Now the ratio is about 5 to 1.

“With the current rise of cord-cutting and the acceleration in broadcast retrans revenues, we estimate that this gap will narrow even further over the course of the next deal,” Nathanson wrote, putting what MVPDs pay to stations even closer to what they pay ESPN.

The streaming implications of the new NFL arrangements could be the real wild card. According to reports, CBS, Fox and NBC have the right to simultaneously stream the games with their respective broadcast network, a right CBS held in prior deals with its CBS All Access (now Paramount Plus) service.

Will Streaming Ties Bind to Pay TV?

Some of the broadcast streaming services are expected to require viewers to have either a higher-tier subscription or a pay TV package that can be authenticated by the streaming service in order to access games. Those dynamics aren’t abundantly clear at the moment, though. According to some reports, subscribers to Paramount Plus’s lowest tier — priced at $4.99 per month — will get access to NFL games.

Kagan senior research analyst Justin Nielson said if streaming customers are essentially getting the games as part of their regular or even free packages, that could diminish the value of the NFL rights in the eyes of distributors.

“The exclusivity of the Sunday broadcast games for stations is diminished if it is also available for streaming,” Nielson said. “It will be interesting to see if the major TV-

station owners push back on increases in reverse retrans payments to the networks as traditional multichannel subs decline as more viewers move to streaming.”

LightShed Partners partner and senior analyst Rich Greenfield, who has long predicted the end of the traditional cable bundle, said in a note to clients that the NFL deal could be the final nail in linear TV’s coffin. But it also could spell the ultimate demise of retrans, he added.

“With more and more NFL content available outside the bundle, the legacy multichannel bundle will evaporate even faster than expected (cord-

cutting) and the ultimate subscriber floor will be lower than anyone thought possible before,” Greenfield wrote.

While Fox doesn’t have a direct-to-consumer streaming service yet, Greenfield added that the new NFL deal could provide the catalyst to launch a subscription tier of its Tubi streaming service that includes the NFL games.

Loss of Leverage

As more and more viewers migrate to streaming, that should materially affect station leverage over distributors, Greenfield continued.

“In turn, retrans should stop growing and eventually start to decline, especially when you layer in that all the most compelling general entertainment TV programming is now flowing to direct-to-consumer streaming platforms vs. the legacy multichannel bundle,” he wrote.

Mike Farrell is senior content producer, finance for Multichannel News/B+C, covering finance, operations and M&A at cable operators and networks across the industry. He joined Multichannel News in September 1998 and has written about major deals and top players in the business ever since. He also writes the On The Money blog, offering deeper dives into a wide variety of topics including, retransmission consent, regional sports networks,and streaming video. In 2015 he won the Jesse H. Neal Award for Best Profile, an in-depth look at the Syfy Network’s Sharknado franchise and its impact on the industry.