Advertisers Expect to Spend 12% Less in 3Q

Latest Advertiser Perception study eyes 7.5% decline in 4Q

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Though advertisers are becoming more optimistic, they expect to spend 12% less in the third quarter and 7.5% less in the fourth quarter, according to the latest in a series of studies by Advertiser Perceptions.

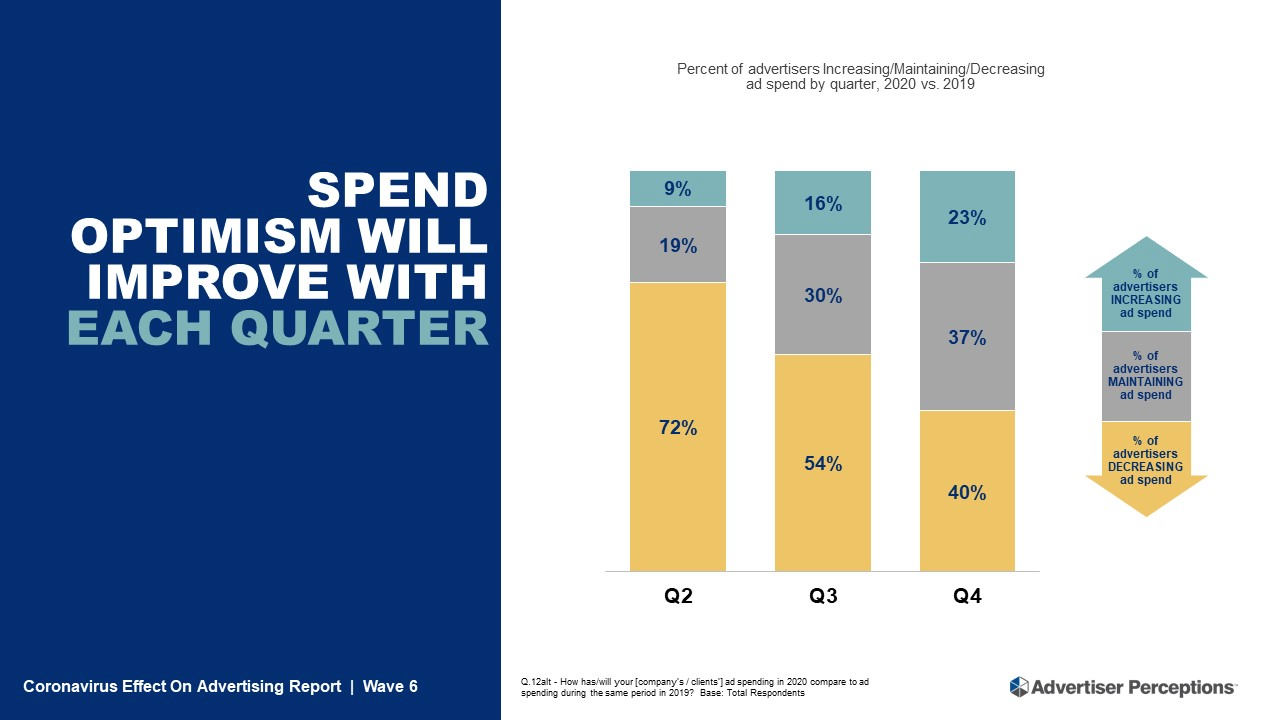

According to Advertiser Perceptions’ sixth bi-weekly survey, the share of advertisers saying they’re decreasing ad spending drops from 72% in the second quarter when the full impact of the COVID-19 pandemic was felt, to 52% in the third quarter and 40% in the fourth quarter.

At the same time, those increasing spending rises from 9% in the second quarter to 16% in the third quarter and 23% in the fourth quarter.

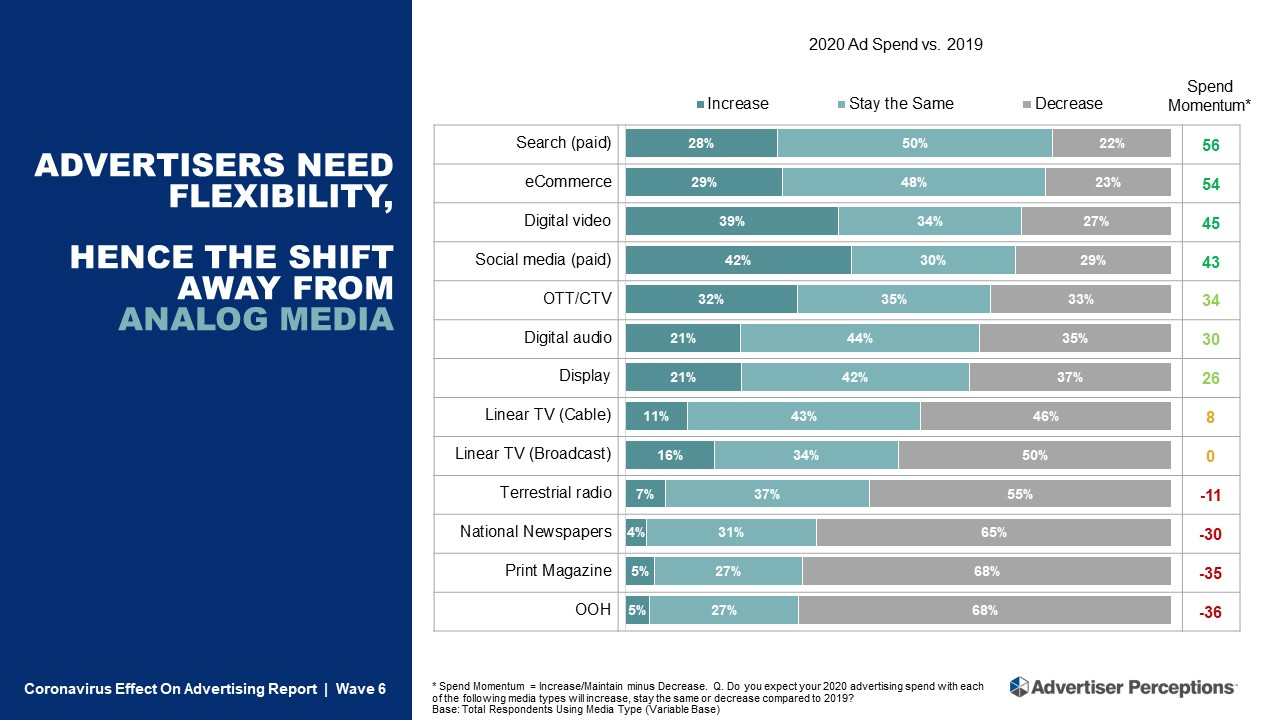

As they start to loosen their marketing wallets, 87% of advertisers said they are looking for greater flexibility in media contracts. That vast majority--70%--expect to keep their budget with the same media companies they worked with before the pandemic, but in such an uncertain business environment they want to move much faster in terms of activation, cancellation and allocation of commitments. The average media planning time has fallen to 2.3 months from 4.2 months, according to the report.

“Perhaps the greatest impact of COVID-19 on media is the way it will be bought and sold,” said Lauren Fisher, VP, business intelligence at Advertiser Perceptions. “Everyone now operates in a faster-moving marketplace, and that means two things. First, advertisers need more insights into changing consumer appetites and connection opportunities. Second, they need the ability to change plans and buys more often.

In addition to flexibility, advertisers are looking for insights from media vendors. In the survey, 61% of advertisers said the want insights into how COVID-19 is affecting the advertising landscapes. They are also seeking input from media companies on strategy and KPIs in addition to opportunities to connect with consumers.

Advertisers also said they will be emphasizing regional marketing because of the uneven way businesses and other activities are restarting state by state. As a result, they will be even more reliant on digital media, particularly social media, display, search and digital video.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“Moving forward, all signs point to increased spending on CTV/OTT and eCommerce, emphasizing more integrated, holistic programs,” said Fisher. “As the economy reopens and recloses at various speeds and to different extents across the country, the right message at the right time becomes even more important. Media that answer these critical questions will gain in engagement, spending and trust.”

For the survey, Advertiser Perceptions interviewed 150 advertisers from its AdPros proprietary community between June 10 and June 15. All of those participating are involved in media selection decisions, with 35% working at marketers and 65% at agencies.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.