Advertisers Plan to Spend 33% Less in Upfront, Survey Finds

Advertiser Perceptions sees shorter-terms commitments and shifts to digital video

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Advertisers say they expect to spend 33% less on upfront television buys in 2020 compared to last year, according to a new study by Advertiser Perceptions.

Advertiser Perceptions has been conducting surveys of advertisers and media buyers every two weeks to gauge their ongoing reaction to the COVID-19 pandemic and the resulting economic uncertainty.

The advertisers polled said the networks should not expect them to commit to more than 90 days’ worth of TV inventory during this year’s upfront. Advertisers usually commit to a full-year’s worth of advertising during the upfront.

Concerns about the upfront comes after media companies reported a drop in ad revenues in March and forecasts of ad spending declines of 20% to 30% in the second quarter.

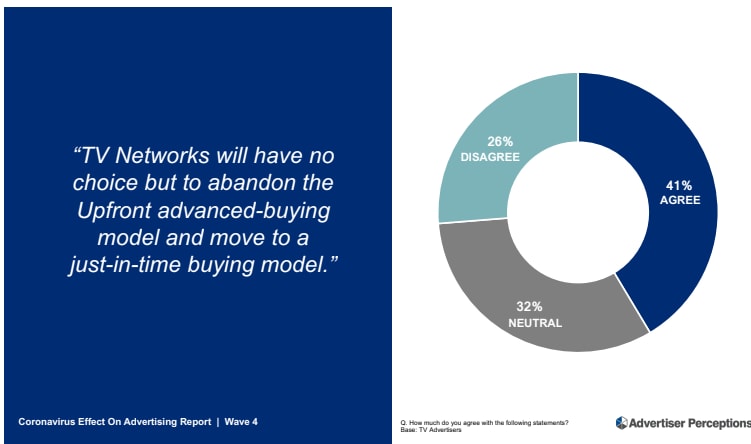

The upfront changes could be long-lasting, with 41% of respondents saying that networks will be forced to abandon the upfront model altogether in favor of a more just-in-time buying model.

According to the survey 50% of the buyers and advertisers said they can replace the reach of linear TV with over-the-top and connected TV and other digital video ads.

“The upfront strikes at the heart of the uncertainty advertisers are struggling with,” said Justin Fromm, executive VP for business intelligence at Advertiser Perceptions. “They can’t commit long-term but they can’t afford to get caught flat-footed in a tight scatter market, either.”

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Advertisers might not have adjusted their 2020-21 TV budgets yet, but they expect to spend more in scatter this season, despite the pricing risk, Fromm said. Many advertisers plan to negotiate their fourth quarter buys this summer, then continue conversations into the fall for Q1.

“This is not an economic downturn as usual. This is because we’re at the virus’ beck and call in terms of when this lets up. There’s not a road map for this,” he said.

One advertiser quoted in the survey said “we don’t want to be the advertiser left behind if we hedge our bets and don’t do a big upfront.” Should it turn out that business is normal in October, his company would have to buy in the scatter market and pay massive price increases, the advertiser said.

In the new survey, advertisers said they were concerned about whether TV viewing will shrink as businesses open and people leave their homes, how the availability of content will affect viewing in primetime and other dayparts and how to reallocate sports dollars if games aren’t played.

The advertisers are also looking for guarantees among the uncertainty, given that it will be harder to produce reliable audience estimates.

Flexibility is a watchword for advertisers. While typically, flexibility has meant the ability to take options and pull back spending commitments, Fromm said there is more to it than that.

“It's really about being creative in this new era, helping advertisers understand what the right creative messaging is, helping them find new ways to create new creative because production is shut down, helping advertisers who can't open find new ways to message,” Fromm said. “All of these things are things that the networks can bring to their partners to encourage spend.”

The Advertiser Perceptions Report is based on 151 interviews conducted between May 1 and May 5. The respondents were 34% marketers and 66% agency staffers. All of them are involved in media decisions. The study also included 18 in-depth interviews with agency and marketer executives.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.