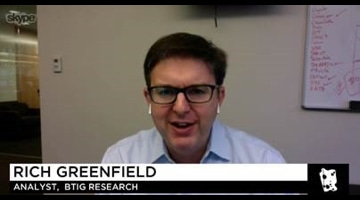

Analyst Rich Greenfield Reverses Course on Disney

‘We were wrong,’ he said, upgrading Disney’s stock

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Rich Greenfield, the analyst who is outspoken in his belief that streaming will demolish the traditional TV business, said he was wrong about his recommendation to sell stock in the Walt Disney Co.

Read Also: Disney Plus Now at 86.8 Million Subscribers

In a post entitled “Upgrading Disney to Neutral: We were Wrong,” Greenfield and his colleagues at Lightshed partners, said he under-appreciated how quickly business would return to “normal” despite the continuing COVID pandemic and underestimated how completely Disney management would throw itself into its pivot to streaming.

“While we cannot fix our mistake, we believe investors will find it valuable for us to analyze why our call went off the rails, particularly in the past couple of months,” he said.

Read Also: Rich Greenfield Urges Investors to Sell 'Money-Losing' FuboTV

In particular, Greenfield said they were surprised that new Disney CEO Bob Chapek has gone all-in on streaming. They were “blown away” that Disney plans to increase content spending to more than $8 billion by 2024.

“Honestly, we felt Disney had given the CEO job to the wrong person,” Greenfield said. Instead Chapek has "impressed us” by leaning hard into the streaming playbook.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Read Also: Analyst Rich Greenfield Launches LightShed Partners

Greenfield also said that Disney has been managing its business to get the most possible subscribers and not prioritizing average revenue per unit or other shorter-term financial metrics. The company is also moving toward unifying its streaming products, putting ESPN into Hulu and pushing the Disney Plus-ESPN Plus-Hulu bundle.

Finally, Greenfield and Co. were surprised that the market no longer cares about the performance of ESPN and Disney’s other traditional TV properties.

“We believed Disney was moving slowly in streaming to sustain the health of those legacy TV assets,” they said. “While virtually every investor we talk to would like to see Disney spin-off its legacy broadcast/cable network assets, especially ESPN as we have suggested, they believe any value from a direct-to-consumer sports streaming business is a net positive compared to the legacy business simply evaporating over the next five to six years.”

Disney stock was down 0.69% to $177.35 in mid-day trading Friday.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.