Arris Puts Up $2.1B For Pace

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Almost two years after sealing up $2.35 billion acquisition of Motorola Home, Arris is diving deeply into the M&A pool again via a $2.1 billion deal for U.K.-based Pace plc, a deal that will give Arris a dominant share of the set-top box market.

Arris said the deal will accelerate its growth strategy and generate more scale, creating a behemoth with $8 billion in pro forma revenues (Pace had fiscal year 2014 revenues of $2.6 billion), 8,500 combined employees (Arris has about 6,500), and an enhanced international presence. Both Arris and Pace are positioned well at Comcast, as they both supply devices for the MSO’s next-gen X1 platform. The acquisition is expected to be accretive to Arris non-GAAP earnings per share in the first 12 months after the deal is wrapped.

With respect to set-tops, Arris will gain ground particularly in the area of satellite, as the combined company will tout a customer base there that includes DirecTV, Astor, Foxtel, Canal+, MultiChoice and Sky.

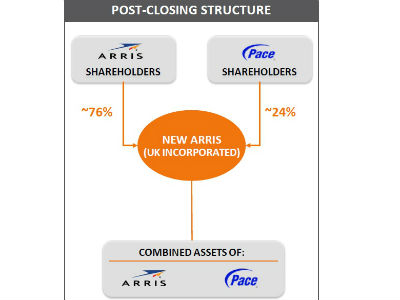

Arris said the deal, involving a mixture of cash and stock, will result in the formation of “New Arris,” a new holding company that will be incorporated in the U.K., and have its operational and worldwide headquarters based in Suwanee, Ga. New Arris will continue to trade on the NASDAQ under the “ARRS” ticker, they said. In connection with the formation of New Arris, each current share of Arris will be exchanged for one share in New Arris.

According to an 8-K filing with the SEC, Arris is subject to a break-up fee of up to $20 million.

Pace shareholders will receive approximately 48.2 million shares of New Arris in aggregate. On a pro forma basis, current Arris shareholders will hold about 76% of New Arris and Pace shareholders will hold roughly 24% of New Arris. The transaction is expected to be taxable, for U.S. federal income tax purposes, to the shareholders of Arris, they said.

Arris shares were soaring in after-hours trading Wednesday, up $7.56 (24.75%) to $38.10 each as of about 5:45 p.m. ET.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Arris chairman and CEO Bob Stanzione will serve under the same title at New Arris, and the then-current Arris board of directors will serve as the New Arris board of directors.

The companies said the proposed transaction has been approved by their respective boards and expect the deal to close in “late 2015."

"This transaction is another example of ARRIS's ongoing strategy of investing in the right opportunities to position our company for growth,” Stanzione said. “Adding Pace's talent, products and diverse customer base will provide ARRIS with a large scale entry into the satellite segment, broaden our portfolio and expand our global presence. We expect this merger will enable ARRIS to increase its speed of innovation.”

“While we believe that Pace is strongly positioned to continue to execute its strategy in the medium and long term, we believe that the combination of the complementary ARRIS and Pace businesses will create a platform for future growth above and beyond our standalone potential,” added Pace chairman Allan Leighton. “We believe this is a great fit for both companies, our employees, customers and trading partners.”

Pace, primarily known as an international set-top box supplier, expanded into the access network technology business in the fall of 2013 via a $310 million deal for Aurora Networks, a company that has been operating as a strategic business unit of Pace. At the time of the Pace/Aurora deal, it was viewed as one that could help Pace counteract the competitive effects of the Arris/Motorola Home merger and ongoing competition with Cisco Systems, as both Arris and Cisco are strong in the set-top and access network side of the telecom and cable tech business. In December 2012, Pace put in a bid to buy Motorola Home from Google, but ultimately lost out to Arris.

Under the terms of the deal announced Wednesday, Pace shareholders will receive £1.325 of cash and a fixed exchange ratio of 0.1455 New ARRIS shares for each Pace share, reflecting aggregate consideration as of April 21, 2015 of £4.265 per share, representing a 28% premium to the Pace closing share price as of April 21, 2015, the companies said. The cash portion will be funded through a combination of cash and debt.

Arris said it has secured a fully committed facility from Bank of America Merrill Lynch to meet the funding requirements.

Developing…