Assessing HBO Max’s Reach Is Complicated

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

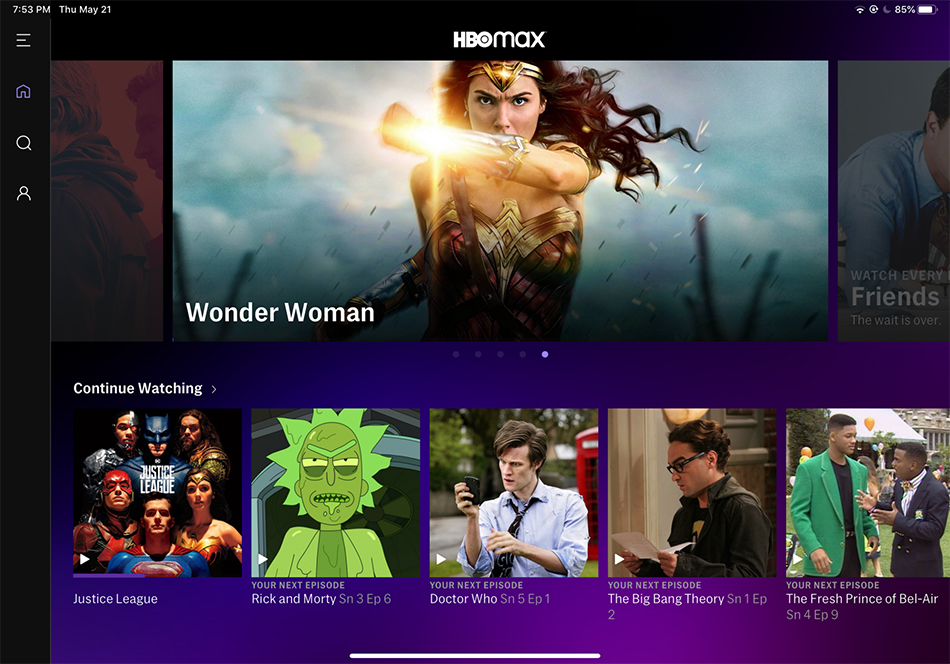

A week after its May 27 launch, the HBO Max app ranked as No. 1 in the Apple TV App Store, according to research company App Annie.

Simultaneously, some pundits were knocking HBO Max’s performance in the mobile realm, with Sensor Tower reporting only 87,000 first-day downloads for the HBO Max app on iOS and Android.

Does that mean the new AT&T and WarnerMedia streaming service is a dud? Is it a hit? That’s real tough to say.

Given the complicated engineering of HBO Max distribution, it’s difficult to get a clear picture of the platform’s early performance. The typical comparison model — the Nov. 12 mega-successful launch of Disney Plus — is hardly applicable.

While The Walt Disney Co. rocked the media technology world by revealing that its brand new direct-to-consumer streaming service signed up 10 million paid users on its first day in the North American market, it’s unlikely WarnerMedia will be able to tout a similarly clean, simple tour de force benchmark.

For Disney Plus, every new app download could be tied to a new customer: There was no overplayed legacy “Disney Now” service to cloud the benchmarks. And Disney Plus distribution was primarily direct to consumer, occurring in widely visible OTT and mobile platforms, not diffused into proprietary pay TV systems.

Because HBO Max is overlaying the legacy HBO Now and HBO Go apps, things are confusing.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

For example, the Sensor Tower mobile app figure is somewhat misleading. It doesn’t include Max updates to WarnerMedia’s legacy HBO apps. HBO Now has infiltrated millions of smartphones since launching back in 2015, and was averaging around 16,000 app downloads per day before the launch of Max. Another way to look at it: the launch of HBO Max spiked daily WarnerMedia OTT app installs by 71,000 downloads.

In the connected TV realm, HBO Max measurement is even more shrouded.

Start with the fact that WarnerMedia has not been able to strike agreements to include HBO Max in the top two OTT device ecosystems, Roku and Amazon Fire TV.

The high ranking on Apple TV— one of the bigger OTT device ecosystems — does indicate high living-room demand for the $14.99-a-month WarnerMedia subscription video service.

Much of HBO Max’s distribution is tied to linear pay TV services, with a WarnerMedia spokesperson telling Yahoo Finance, “HBO subscribers of our distribution partners—Comcast, Charter, Cox, Altice, Verizon and others all had immediate access to HBO Max on the day of launch.”

Indeed, with the HBO Max natively integrated into the proprietary video systems of these operators that don’t use off-the-shelf OTT devices, such as Altice One, it’s hard to get a clear picture as to how many pay TV users are accessing the service in these early days.

“This is a unique platform in many ways, including the way it is distributed,” recently appointed WarnerMedia CEO Jason Kilar said in a statement.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!