At 247 Million Subscribers and Counting, They'll Never Catch Netflix Now

In our latest 'Next Text,' we discuss how the incumbent media companies lost their will to build scale and compete with Netflix ... and why they may never get another chance to try again

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Each week, Corcoran State Prison officials allow Next TV writers Daniel Frankel and David Bloom out in the "yard" to exercise, swap kites and get a little sunshine. Bloom usually lifts weights and glowers, while telling his Bob Iger stories to rapt inmates. Ol' Danny, as he's known, walks around the courtyard under the puzzled gaze of the snipers, discretely emptying his pockets of the decomposed mortar he excavated from his cell wall the evening before. The guards do their best to keep Frankel and Bloom separated, but these dangerously unfocused men still seem to find ways of conversing. Here is their latest exchange:

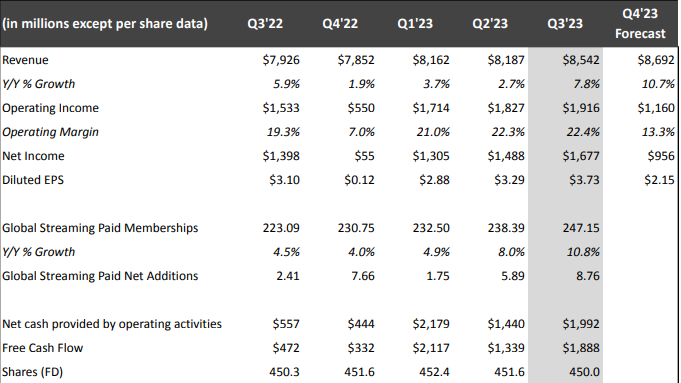

Daniel Frankel: Jeezus, this is a business publication, David. How is that sophomoric tripe an intro? Whatever. On with it I suppose. With global membership surpassing 247 million and free cash flow for the quarter approaching $1.9 billion, Netflix seems to be pulling away from the incumbent video entertainment industry (that you monolithically like to call "Hollywood") ... and pretty much everyone else. It was once decided, like five years ago when money was a lot cheaper and the world was a bit different, that Netflix's model represented the future of video entertainment, and that model needed to be emulated. So everyone set out to swim from Havana to Key West, got a third of the way through, got stung by a few jellyfish ... and turned back. I get that David Zaslav and Gunnar Wiedenfels get to show off those huge reductions in DTC EBITDA losses every quarter now. But I'm wondering, in your conversations with entertainment executives, is there ever a lament that suggests that all the Streaming Wars money has now been rendered sunk cost? ... And that maybe they should have steeled themselves, endured the pain ... and got to the other side?

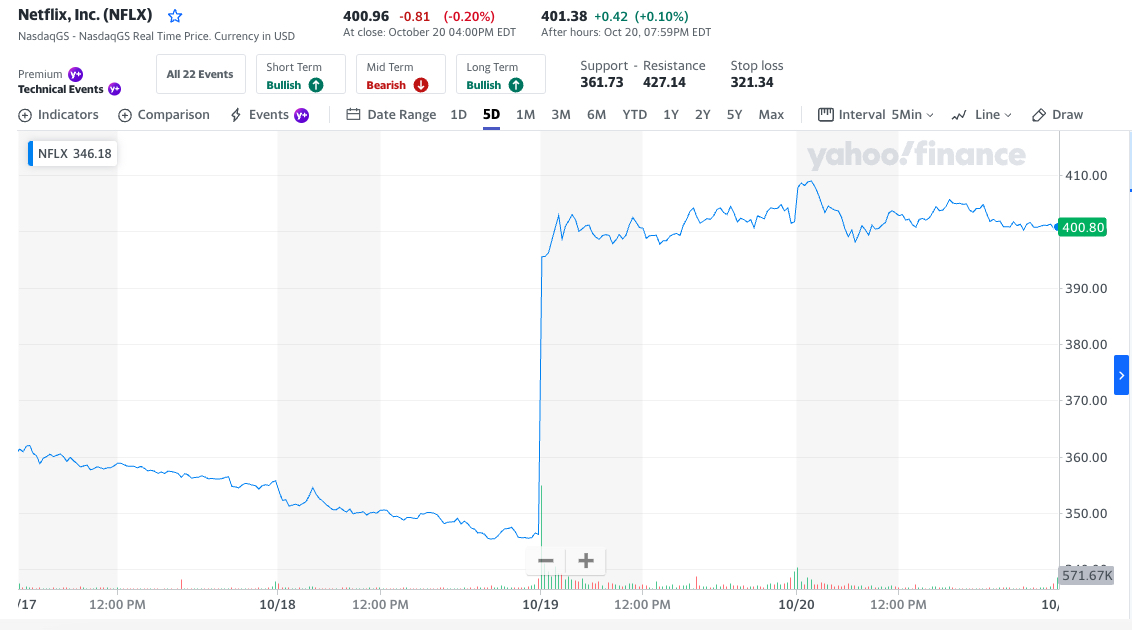

David Bloom: Not everyone (perhaps not anyone?) in Hollywood is the financial equivalent of Diana Nyad, swimming for the long haul, enduring the stings of Wall Street jellyfish, focused on the distant shore. If there’s regret though, I suspect that it centers on the bet-it-all mindset that began with the run-up and launch of Disney Plus. In fact, the Hollywood guys from Bob Iger on down knew that streaming was something they had to do. But really, they weren’t chasing the new distribution platform, they were chasing the same crazy multiples on price-earnings ratios that Wall Street jellyfish were, according to tech companies in general and Netflix in particular. The Street’s enthusiasm for $NFLX appears to be warming back up, which is not to say it’s red hot. But as I write this, the stock price was still above $400, up 59% at the end of a remarkably crummy week for the stock market, even for tech-focused video-connected stocks such as Apple, Amazon and Roku. The traditional media companies have been pounded even harder as the market panics over international wars, Congressional chaos, and interest rates that make just about anything other than stocks look pretty good for what may be a long time to come.

Bloom continued: Netflix’ earnings include some other bits that I find particularly interesting. One is a somewhat less smug tone of superiority than usual in the company’s letter to investors. But also, that it was able to do this despite the strikes (which helped the free cash flow), and despite its ad venture, which hasn’t scaled as fast as they wanted, or achieved the CPMs they wanted. What does this look like when the ad venture, which just changed leadership, starts to really kick in at scale around the planet? Also, I’m bemused by critics who are surprised that the “paid sharing” password crackdown generated millions of new subscribers.

People liked Netflix enough to keep using it, even when they had to pay for it. That suggests, despite grumbling about the quality of some shows, there’s enough that millions of people will pony up. Now, we’ll see if they stick around. But also, I can’t wait to see what kind of membership growth Elon Musk’s X experiment generates now that it actually expects new members to pay even $1 a year. That’ll cut some bot traffic, no doubt, but it’ll also show whether people actually value the service in its current, badly eroded condition.

Frankel: There's a great line in Tony Kaye's, er, complexly birthed, deeply flawed but still interesting, racial-tension-themed 1998 drama American History X, when the African-American high school teacher played by Avery Brooks asks the increasingly conflicted skinhead protagonist played by star Ed Norton, "Has anything you've done made your life better?" I think of that line whenever Elon Musk announces a new Twitter policy ... or brand name, or anything else regarding the groundbreaking social media platform he's run into the ground in just 12 months. It's either the result of startling ineptitude, or a plan concocted by some well-funded conservative think tank to undermine one of the more powerful, democratizing communications tools ever developed by mankind. By Musk's own math, Twitter has lost 90% of its value since he purchased it. If we are a country that truly values free markets and success, why hasn't this guy been more vilified than he already has? Doesn't business acumen matter to the Party of Big Big Business? (Well, there's Donald Trump and his six bankruptcies, so maybe not anymore.) Speaking of free markets, I was in Denver this past week for the cable industry's big annual technology show, SCTE Cable-Tec Expo. And Big Cable's biggest lobbyist, NCTA chief Michael Powell, showed up to tell us all how Jessica Rosenworcel and the FCC were once again ginning up the case for net neutrality. What's the problem? Powell asked. The cable industry hasn't clogged your pipes yet. Why would it start now. A Stanford Law fellow emailed me last week to remind me that in his final days of FCC Commission Chairman back in 2005, Powell charged DSL provider Madison River with violating a nondiscrimination principle the FCC found buried within federal statutes after the telecom tried to stop its customers from using Vonage's voice-over-IP service.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

Bloom: Revisiting the long-running wars over net neutrality for the cable, er, "broadband and mobile provider industry that still offers some TV channels in an abiding fit of nostalgia" feels like a serious blast from the past. It's like harkening back to when Twitter was actually useful for fomenting democracy during the Arab Spring about 1,000 years ago. Days long gone by. Regardless, there are reasons for concern about any chokepoint in access to the internet, such as favorable treatment for carriage of some content/providers over others. But the net neutrality fight feels less pressing these days, given the rise of fixed wireless and other competitors now delivering broadband along with $50 billion in federal funding to close holes in broadband access in rural and other internet deserts. Maybe the FCC is just feeling like starting another fight.

Also read: FCC Reasserts Authority Over Internet Access

I personally would prefer that SOMEBODY cast their regulatory frameworks in a different direction, toward the potential impacts with AI that may arise as a result of what the tech types like to call “lock-in.” Needham & Co. senior analyst Laura Martin spotlighted this in an August report (and on a panel that I moderated that included her). Basically, if you train your AI tools/datasets/documents on, say, the cloud and AI services of Google’s Bard, you’re kind of stuck with Bard for all your AI needs for a long time to come. Pulling it off Bard to go to Microsoft’s Azure or Amazon’s AWS will be extremely difficult. So, we could be making sure everyone can get online, but the tools that are used to produce, market, manage, and deliver whatever it is we want to watch will be controlled by one of, probably, three or four big cloud and AI providers. Choose carefully. Anyway, speaking of momentous blasts from the past, how are you enjoying episodes of this new show on CBS that I just heard of, Yellowstone. Talk about a quick pickup on season 2. It’s already about to start on Friday. Must be a pretty good show.

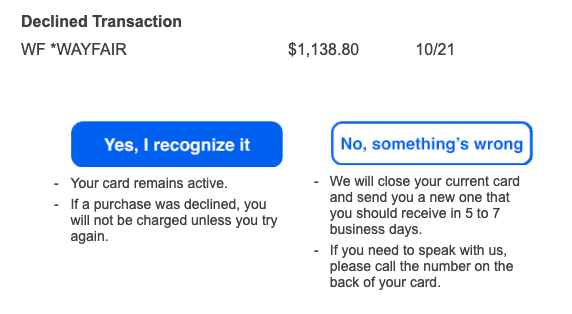

Frankel: If my recollection hasn't betrayed me like our USC Trojans defense did once again Saturday, Yellowstone was gestated as the erstwhile Viacom and CBS Corp. were re-merging, and Les Moonves was still running CBS. I get that Taylor Sheridan was little known back in June 2018 when Yellowstone debuted on the Paramount Network. But how did that show get relegated to a fringe cable channel? By season 2, the show was averaging 5 million viewers an episode. Not only did Paramount not have the good sense to put it on its biggest platform (the CBS broadcast network) at the time, it licensed exclusive domestic streaming rights for it to NBCU and Peacock. Don't get me wrong -- great flashlight to have around in the blackout that is the big Hollywood talent strikes, but confounding decision-making up until that point. As for AI, my son's English professor emailed him Friday night and said his latest essay tested "21%" as being written by artificial intelligence. The boy, of course, insists the work is authentic whole cloth. So while they're arguing on zoom about that, I get an email from Chase saying someone just charged $1,139 at Wayfair to my credit card. Press "Yes" for "It's OK, I did it," or "No" for "I didn't make the purchase and it's fraud." I pressed no. My credit card is cancelled instantly and they say they're going to send me a new one. Not sure a human, besides me, was involved in the whole transaction. Made me realize that AI isn't a forward-looking topic. It's here.

Bloom: Condolences about your credit card and our Trojans defense, but yes, it’s likely that fraud-detection algorithm that saved you a nice chunk of change didn’t involve any humans other than the fraudster on the other end. Isn’t technology grand, at least sometimes? Also, I don’t want to lose the far more intriguing opportunity to assess how the traditional media companies have fared during six months of strike-addled perdition. The writers, thankfully, found a deal they could live with; the actors, unfortunately, now seem months from a similar outcome. One estimate I saw this week suggested the strikes have already cost the region $6 billion in lost economic activity. Yes, it gave CBS a chance to make up for that years-long mishandling of Yellowstone, but who else is doing anything in the new fall season that might stick around and have a long-term impact on their company’s fortunes? Pretty much nobody. I’d suggest the two biggest things that happened in the industry during this lost half-year were 1) the Disney-Charter deal that provides an on-ramp for streaming services to connect with the cable bundle, and 2) those Netflix earnings from last week, because the results show the global streaming leader only lengthened its lead.

Netflix's free cash flow jumped to $6.5 billion for the year, thanks to reduced spending from the strike. It continued to have big hits like the live-action remake of Japanese anime franchise One Piece and the return of French-made Lupin, among much else. Everyone else, it appears likely, will report a bunch more losses in streaming and misery pretty much everywhere else. Remind me why they’re all still in the AMPTP together? Speaking of CBS, there are reports that controlling shareholder Shari Redstone is finally ready to sell her patrimony, but no one’s in a buying mood, at least a price she can stomach. It’s a bad time to sell if you want a good price, given the highest interest rates in more than a decade, soft ad markets, sky-high sports rights, and of course, Paramount Plus’ black hole of spending amid consumer indifference. No surprise, then, that Paramount Global's “mountain of entertainment” can’t get a good price. The company’s public shares are trading at less than half their one-year high, at just $11.50 apiece. That translates to a market capitalization of just $7.6 billion, i.e., less than what Amazon spent 19 months ago on MGM (for $8.5 billion). MGM, where I once worked, had its own mountain-sized library, and some nice TV shows in production. But unlike Paramount Global, MGM didn’t have a dominant broadcast network, a collection of high-profile cable networks, premier sports rights, a skein of owned & operated broadcast stations in major markets, a sprawling back lot in the heart of (actual, physical) Hollywood, and that streaming service, which could really buff up someone else’s streaming service in an acquisition. Timing is, as always, everything. Everyone seems to agree that industry consolidation is inevitable. But given the conditions, is it possible we won’t see any deals until late 2024, other than the long-expected sale of Comcast’s chunk of Hulu to Disney?

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!