AT&T’s New DirecTV Now Plan: ‘Thin Out’ Bundle, Reset Price Point to ‘$50-$60’

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

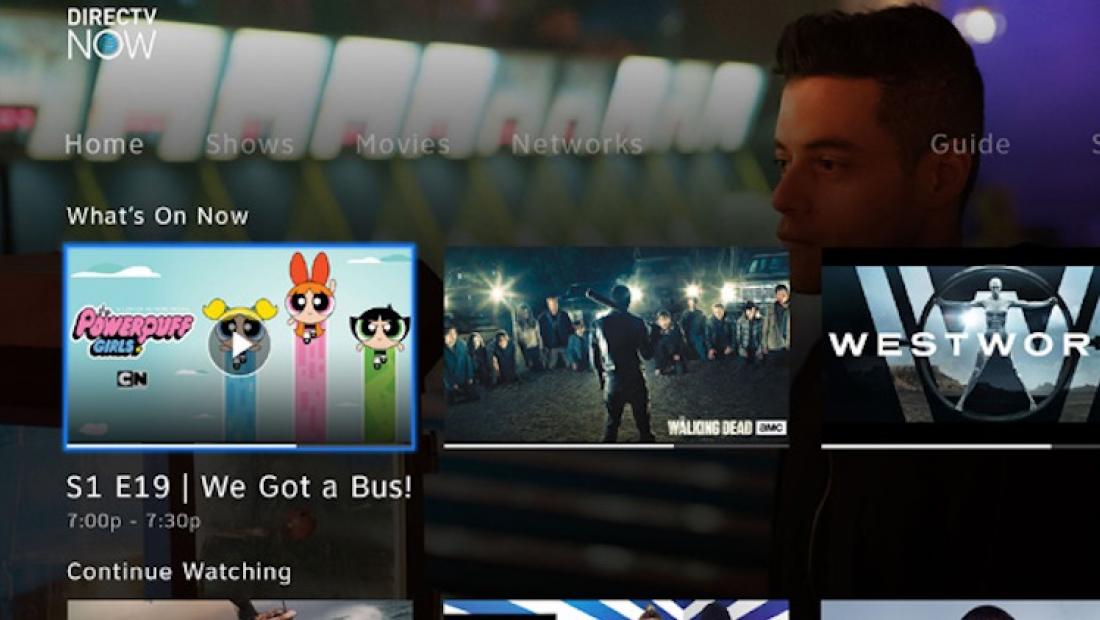

As it prepares to launch an IP-based video service that is more of a direct replacement to traditional satellite TV service in the first quarter of next year, AT&T will reconfigure and reposition its seminal streaming pay TV product, DirecTV Now.

Speaking at the UBS Global Media and Communications conference earlier this week, AT&T CEO Randall Stephenson said work is underway to “thin the content out” on the DirecTV Now bundle and “get the content out that’s really relevant to the consumer.”

Simultaneously, Stephenson seemed to indicate that further price hikes are in store for DirecTV Now, which already increased its base monthly fee from $35 to $40 over the summer.

Related: AT&T Sees Turner Selling Addressable Ads in 2019

“We’re talking $50 to $60,” he said. “We’ve learned this product, we think we know this market really, really well. We built a 2 million subscriber base. But we were asking this DirecTV Now product to do too much work. So we’re thinning out the content and getting the price point right; getting it to where it’s profitable.”

It’s widely understood that AT&T—as well most operators of virtual MVPD services—operates its vMVPD at a loss, with monthly price points that average around $40 market-wide simply not providing enough revenue to offset fast-rising programming costs.

For example, asked by an investment analyst last month if Dish Network’s vMVPD service, Sling TV, was profitable, company chairman Charlie Ergen said, “It depends on how you look at it. But under Charlie Ergen's definition of profitability, I think I'd like to make a little bit more money than we're making today.”

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Related: WarnerMedia Plans 3-Tier Streaming SVOD Service

Both Dish and AT&T have expressed hope that innovation in advanced targeted advertising enabled by these IP-delivered services will eventually offset their generally lower subscriber revenue.

“Sling is really seeing explosive growth with its advertising revenue,” said Warren Schlichting, keynoting last month’s Streaming Media West conference in Huntington Beach, Calif. “We’re seeing incredible results with targeted advertising.”

But when pressed, Schlichting conceded that these results weren’t yet incredible enough to move the needle in any significant way on the balance sheet.

For its part, AT&T—which already is seeing DirecTV Now customer growth decelerate from its previously torrid pace—seems to be biting the bullet, and trading profitability for growth. AT&T is in effect re-positioning DirecTV Now to sit in the middle of its video value proposition, between its upcoming premium OTT service in its bottom-end AT&T Watch streaming service.

AT&T is prepping the launch of what Stephenson called “an over-the-top thin-client service” in the first quarter. The IP-based service will run on the open internet, with users plugging in a proprietary set-top that connects via USB port. AT&T hasn’t announced a price point for the new service, but it’s expected that it will be more expensive, and offer more channels, than DirecTV Now.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!