Attention to Connected TV Ads Grew in Q1, TVision Study Finds

Amazon’s ‘Reacher’ was top show; ‘Road House’ led movies

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Connected TV is becoming a bigger deal for consumers and advertisers, according to a new report from TVision.

According to TVision’s Q1 2024 State of CTV Advertising Report, the attention paid to CTV advertising rose from the end of last year.

Overall CTV ad attention rose to 51.5% from 49.2% in Q4 2023, but attention paid to ads in premium CTV jumped to 56.1% from 51.7%.

That makes attention to premium CTV higher than attention to linear ads. Attention to linear ads rose to 54.5% from 54%.

TVision defines premium apps as those with both ad-supported and subscription-only tiers.

"Each quarter we see advancements in CTV advertising - in terms of reach and scale but also in terms of attention and engagement from viewers,” said Yan Liu, CEO of TVision. “The latest report highlights these trends and is a useful tool for marketers to better understand CTV attention norms, and how to leverage these metrics within their own campaign processes.”

TVision found that in Q1, most household tuned into three or fewer apps. Lower income households were more likely to use 10 more more apps than more affluent households.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Households used 2.5 devices on average and watched 9.4 over-the-top programs per person.

TVision noted that equipment-makers’ free ad-supported streaming television apps have a household reach of 24%, That’s up 9% from Q4 2023.

The streaming leaders in terms of reach were Netflix with 64%, YouTube with 57%, Hulu with 41%, Amazon Prime Video with 34%, Max with 29%, Peacock with 23%, Disney Plus with 22%, Paramount Plus with 21 and Tubi with 18%.

Ranked by viewing time, YouTube was No. 1, followed by Netflix, Hulu, YouTube TV and Prime Video.

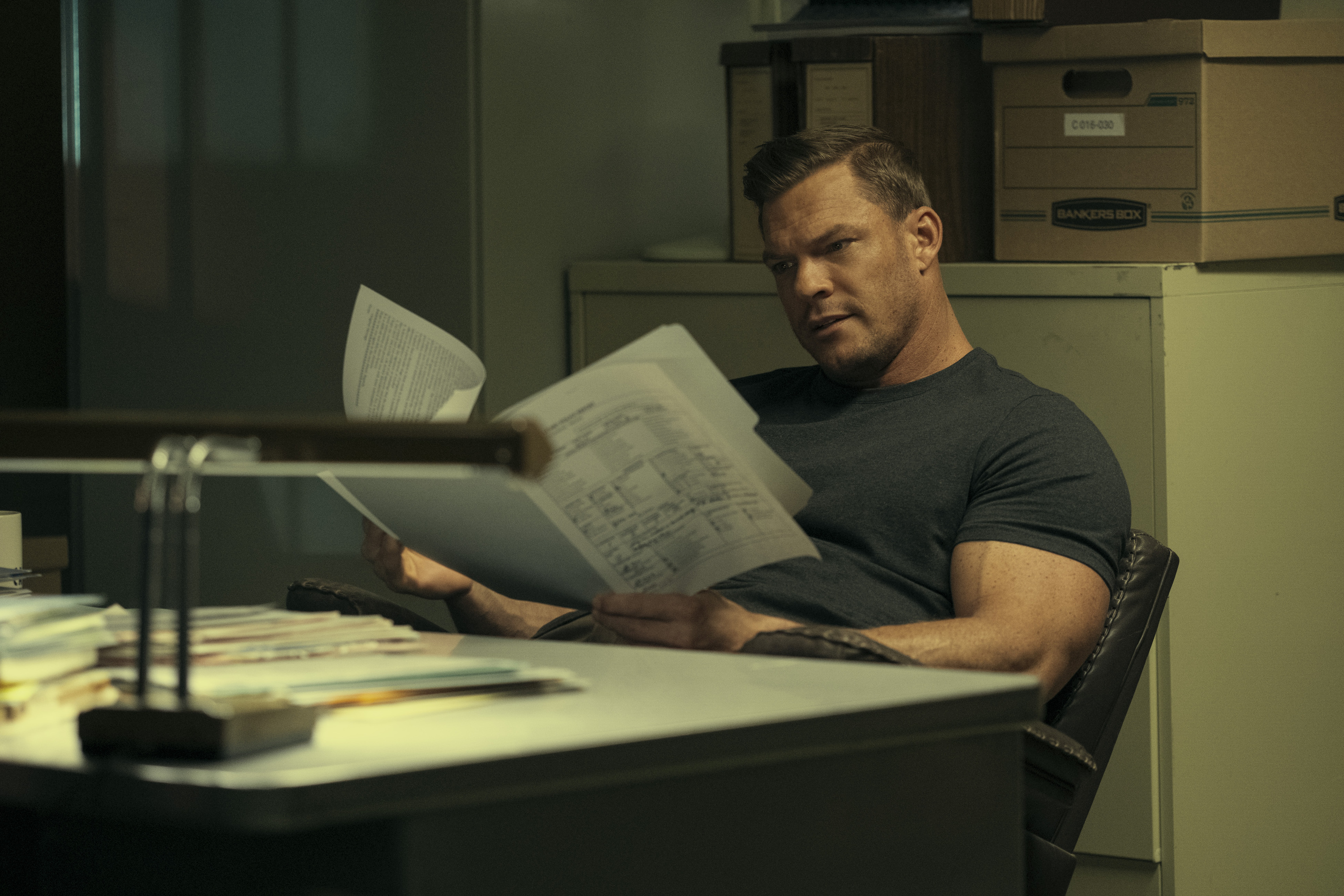

The top show for the quarter was Season 2 of Amazon Prime Video’s Reacher, based on TVision’s Power Score formula.

Other top shows included Netflix’s Griselda, Prime Video’s Mr. & Mrs. Smith, Disney Plus’ Percy Jackson and the Olympians and Peacocks’ Ted.

The top movie was Amazon Prime Video’s remake of Road House.

TVision found that shorter ad break yield higher attention scores, with breaks of less than one minute getting a 55.4% attention score, compared to a break of two to three minutes getting a 50.8% attention score. Breaks o five minutes and up had a 48.4% attention score.

As wilth linear, the first commercial in a pod garnered the most attention, while the final ad in a pod did better than spots in the middle.

Industries buying the largest share of CTV ads included entertainment, health and legal/financial.

Categories that are growing including government and organizations, education, electronics/technology and consumer products.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.