Auto Dealers To Shift Ad Dollars Away From Broadcast and Cable

Borrell sees spending on streaming video and OTT rising 20.1% in 2022

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

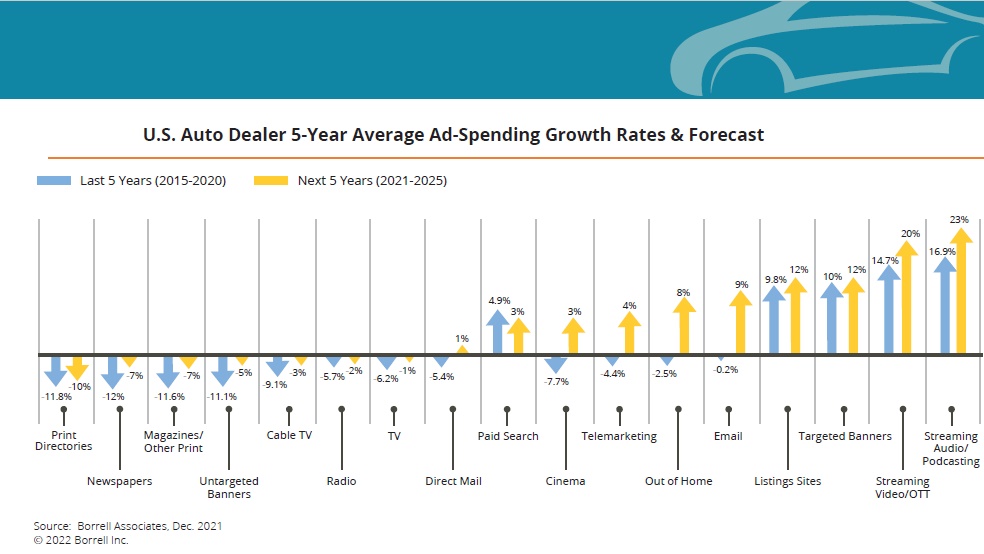

Auto dealers, one of the most important local advertising segments, will be shifting ad dollars away from broadcast TV and cable and increasing their spending on digital media, including streaming video and over-the-top, according to a new report from Borrell Associates.

TV spending by auto dealers fell 11.2% in 2021 and Borell expects to see another 6% drop to $568.3 million 2022. The declines come after a 26% plunge in 2020.

The next few years don’t have that new car smell either: Borrell forecasts a 10.4% decline in 2023, a 0.2% dip in 2024 and a 14% drop to $437.1 million in 2025.

Cable is also stuck in reverse. According to Borrell, auto dealer spending on cable dropped 15% in 2020 and 3.1% in 2021. Borrell sees a 4.4% increase in spending on cable to $156.3 million in 2022, but declines of 5% in 2023, 2% in 2024 and 10% in 2025 to $131.1 million.

For auto dealers, the shiny new model in video media is streaming and over-the top. Dealers spent $1 billion on streaming for the first time in 2019.

Also: Linear TV Advertising Spending Drops 1% in November: SMI

Despite the pandemic, auto dealers increased spending on streaming and OTT by 6.4% in 2020. Spending jumped 35.7% in 2021 and Borrell sees a 20.1% increase in 2022 to $1.75 billion.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Despite the pullback by auto dealers, local television ad revenue is expected to grow in 2022, thanks to increased political ad spending and digital activity by stations.

Borrell sees spending increases on streaming video and OTT leveling off, forecasting increases of 11.4% in 2023, 7.7% in 2024 and 1.7% to $2.16 billion in 2025.

Also: GroupM Sees 23% CTV Growth, More Political Spending, Boosting TV

Overall, Borrell expects auto dealer ad spending to increase 8.8% to $9.47 billion in 2022.

Beyond increasing their spending on digital media, car dealers spent $38 billion to maintain their online presence through SEO, web maintenance and hosting, online video production, social media management and other digital marketing services. That’s 4.5 times what they spend on advertising.

Indeed Borrell raises the question of why dealers need to advertise at all at a time when demand for new and used cars is way up and inventory is remarkably tight.

“We believe that 2022 marks the beginning of a transition where dealerships will respond to major changes in the automotive marketplace by spending more to rebrand themselves, educate consumers about what their stores offer, and drive buyers to their websites to interact,” the Borrell report said. “Whereas total spending by dealers declined at an average annual rate of 2% in the past five years, we’re forecasting it will grow 3% annually over the next five.”

Borrell listed several reasons for auto dealers to continue to advertise. They include buying back vehicles, especially trucks, to meet online buyers, to get consumers to test drive electric cars, to promote their parts and service departments and to familiarize viewers with the dealers’ financing and insurance offerings.

The new messages are being used by outfits like CarMax, which doubled its ad budget in 2021, and Carvana, which boosted advertising 71%. ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.