Brave New TV World

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

With the recent arrival of AT&T’s HBO Max and the nationwide rollout of NBCUniversal’s Peacock coming July 15, direct-to-consumer streaming video is no longer just a nice thing to have for most programmers. It is essential.

The question is, will streamers generate enough revenue to replace the pay TV dollars they are now being asked to supplement?

The list of direct-to-consumer streaming video offerings from major, established programmers grows almost monthly. The Walt Disney Co., AT&T, NBCUniversal, AMC Networks, Discovery, Fox, ViacomCBS and others all have either launched a direct-to-consumer service or are in the process of doing so. Given the rapid decline of traditional pay TV customers over the past several months, those who aren’t could regret that decision.

“I think it’s proving out that the shift is inevitable,” said Denise Denson, former Viacom programming chief and currently chief operating officer of Molten, a technology firm that specializes in helping content owners track digital rights. “Cord-cutting is higher than ever — it’s almost off a cliff — and everyone’s transitioning to their own direct-to-consumer models. It’s happening.”

While the decline in pay TV subscribers has been going on for more than a decade, Denson said, the erosion has accelerated, making it critical for programmers to at least have an idea of how they will sell and distribute content to consumers.

“I don’t know if many could have prepared sooner,” she said. “It’s all part of the evolution of the consumer as they watch content on-demand. Other than news, sports, live events, it is all on demand, on their time, on their platforms, on their devices. That’s been happening for 15 years, but now it is in full force. There’s no turnaround to such consumer habits.”

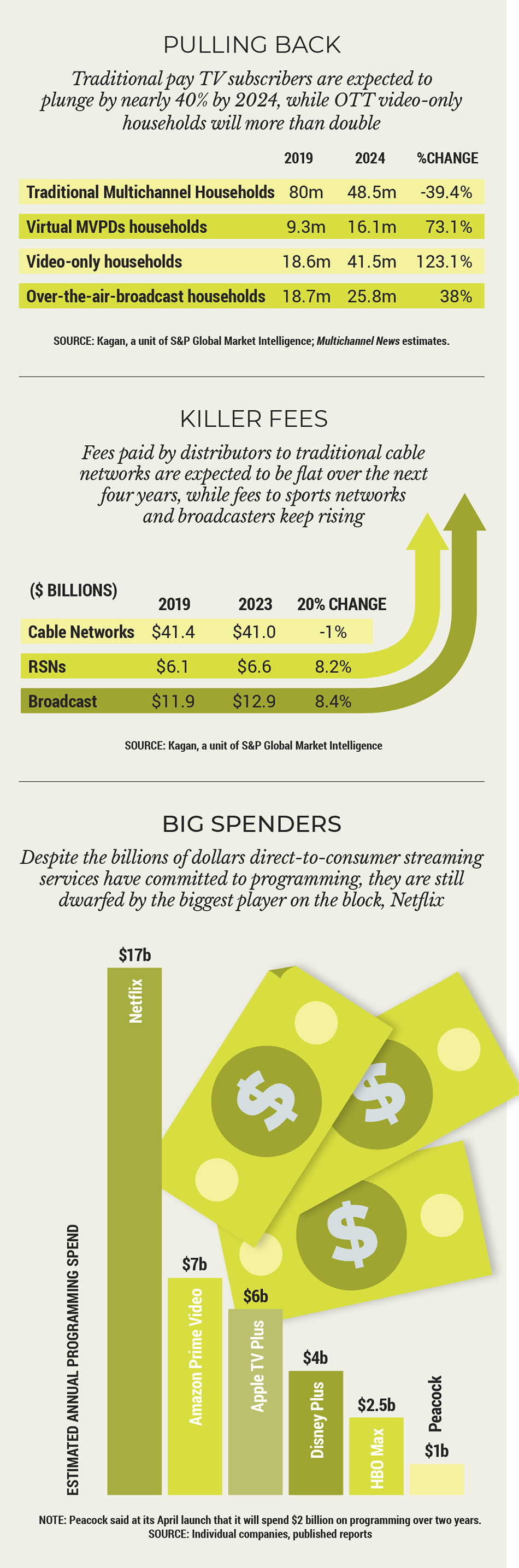

The loss of pay TV homes is a big problem for programmers, and the losses are accelerating. Pay TV distributors in 2019 shelled out $47.5 billion in fees to cable programmers, including regional sports networks, up about 2.6% from the year before, according to Kagan, a unit of S&P Global Market Intelligence. Those fees may have hit a plateau, though. By 2023 Kagan predicts a rise of just 0.2%, to $47.6 billion, as subscriber numbers erode and direct-to-consumer streaming offerings increase.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Last Line of Defense

According to Kagan, subscribers to traditional multichannel video programming distributors (MVPDs) will drop by 31.5 million households to 48.5 million households by 2024, while virtual MVPD households will rise by 6.8 million, to 16.1 million households; and OTT or multichannel substitute homes will grow by 22.9 million, to 41.5 million. Over-the-air households will rise by 7.1 million to 25.8 million by 2024, Kagan said.

MoffettNathanson principal and senior analyst Craig Moffett calculated that traditional pay TV subscribers fell by 1.8 million in the first three months of 2020. That’s a decline of about 7.6% year to year, nearly twice the 4.7% decline in the 2019 period. Factoring in vMVPDs, the decline was about 5.3%, another record.

What might be most troubling is that those lost subscribers didn’t just choose another platform. They left the pay TV ecosystem.

The pay TV industry has dealt with competition from new technologies before, with cable losing customers to upstart satellite-TV platforms, fiber “overbuilders” or, more recently, streaming “virtual” pay TV providers that use the internet to deliver programming. In the first quarter of 2020, amid a COVID-19 pandemic that kept most Americans confined to their homes, people didn’t defect to new platforms, they just dropped out.

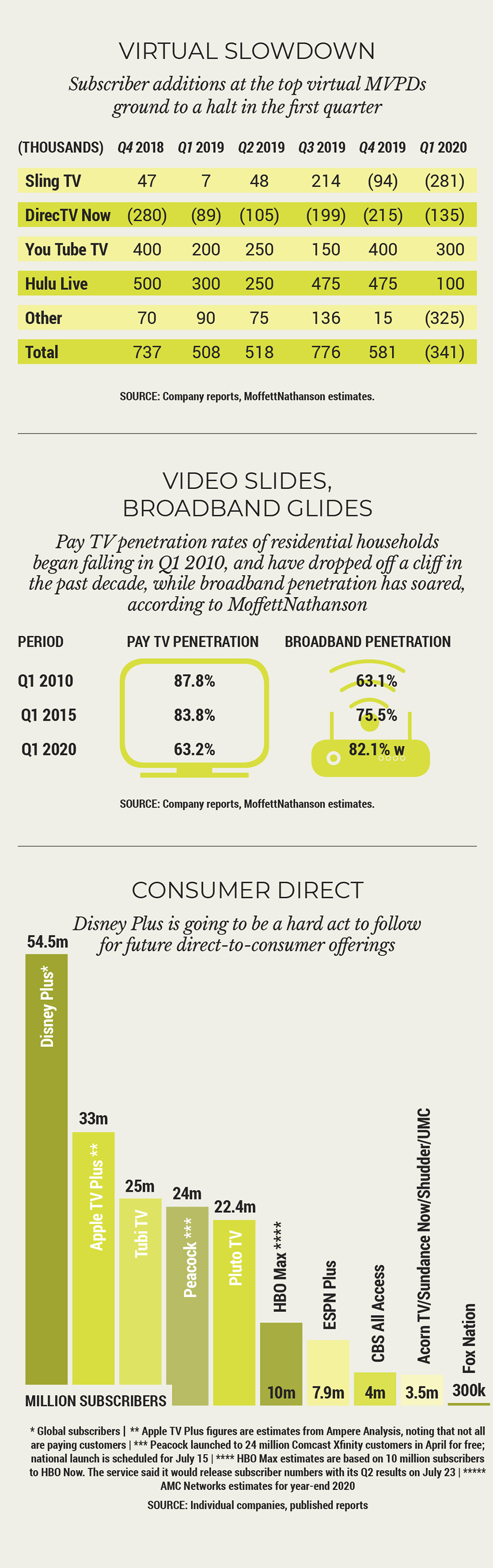

The vMVPDs that had been picking up customers, partly by underpricing the cable competition, lost about 341,000 subscribers in Q1, in part because they have raised prices amid the economic pressures that crimp cable providers’ video profits.

The slowdown was apparent across the board, Moffett noted. AT&T TV Now and fuboTV both lost subscribers, while Hulu Plus Live TV gained around 100,000 customers in Q1 after adding between 200,000 and 500,000 subscribers in each of the previous eight quarters. Sony’s PlayStation Vue, with about 500,000 customers, closed down altogether in January. YouTube TV is the fastest growing vMVPD, but it did not see major gains after Sony’s departure.

“The pay TV network business’ last line of defense has been breached,” Moffett wrote. “The vMVPD category is unraveling.”

In the face of dwindling pay TV homes, programmers began to develop direct-to-consumer channels in 2016, hoping to diversify revenue streams amid the decline.

Subscription on-demand services, notably Netflix, have given consumers alternatives to the pay TV bundle of entertainment, news and sports channels. Now even the content companies whose channels are mainstays of pay TV bundles have piled on with direct-to-consumer (DTC) offerings of their own, Moffett noted. “The deceased is survived by Disney Plus and Peacock,” he wrote. “A shiva will be held over Zoom.”

DTC services like Disney Plus, HBO Max and Peacock may be “lifeboats” for programmers, Moffett said, but consumers who jump in are “leaving the (sinking) motherships behind. Notwithstanding the princely valuations being accorded SVOD platforms like Disney Plus, we doubt the DTC lifeboats will ever come close to matching the profitability of the business they are ostensibly designed to replace.”

It’s understandable, then, that programmers are loath to give up on the traditional model. The direct-to-consumer route is a way for them to hedge their bets, just in case the bottom falls out of the traditional distribution model sooner rather than later.

NBCUniversal’s Peacock launched to Comcast Xfinity cable customers in April and will be available nationwide on July 15. Peacock will be free to Comcast cable customers; to customers of NBCUniversal cable networks, through other distributors; and to Comcast’s Flex broadband-only subscribers. For the rest, the ad-supported Peacock will be available for $4.99 per month. An ad-free version will be priced at $9.99 per month.

“The way I look at it is, we have a business of making great content,” NBCUniversal chairman of content distribution Matt Bond told Multichannel News. “And it’s increasingly global as well. That business is the same as it was in 1950 for NBC, and we’re going to keep going. That’s why we’re launching Peacock. It’s another platform, it’s another way to engage customers with content and monetize content.”

The new service also protects NBCU should the shift to the streaming model happen faster than expected, Bond said.

“This product is designed to greatly enhance the value of NBC in the traditional linear business, but also it’s available outside of that,” Bond said. “Whichever direction and however this marketplace moves, we’re both respecting and improving the value of the existing product, but we’re also going to be available to people who are not subscribers to that package.”

At HBO Max, Tony Goncalves, CEO of AT&T’s Otter Media, also oversees development and general management of the streaming service. He sees HBO Max as another step in the evolution of pay TV. Goncalves has some experience on the distribution side of the house — he led strategy at and helped launch streaming service DirecTV Now (now AT&T TV Now) in 2016 and served in several executive roles at the satellite-TV unit — before joining the content side.

“For years, pay TV aggregated video content in a convenient way for consumers,” Goncalves said. “During my time at DirecTV I would point to the fact that we were aggregators and curators of great content. But we didn’t own any IP, which is ultimately what consumers connect with. WarnerMedia has the advantage of owning the content and we want to get in front of consumers in as many ways as possible.

“Over the past few years, we’ve seen an evolution as consumers seek more choice, and technology has enabled a shift from a broadcast to a ‘one to one’ world,” Goncalves added. “As consumers turn to more on-demand viewing, we expect consumers to ‘reaggregate’ multiple services and platforms into their bundle, and we believe HBO Max is well positioned to be an anchor in consumers’ lives year round.”

What’s a Network to Do?

While the traditional distribution model continues to show signs of drying up, programmers have begun to embrace the DTC model with mixed results. Disney set the bar high in November, launching Disney Plus to more than 10 million app downloads on its first day. As of May 4, Disney Plus had about 54.5 million global customers, and the Disney Plus app apparently enjoyed a download surge ahead of the July 3 premiere of the filmed version of the Broadway musical Hamilton.

Other DTC launches have had mixed results. Apple TV Plus launched on Nov. 1 and, according to Bloomberg, has about 10 million customers (others have said that number is around 30 million). HBO Max launched on May 27 amid a flurry of hype, but only managed to attract about 90,000 downloads on its first day, according to reports.

Numbers have been hard to come by for HBO Max, especially because it is automatically available to the 30 million or so existing subscribers to HBO’s linear pay TV service. Confusion around the launch has added to its problems. With four different services — HBO, HBO Now, HBO Go and HBO Max — some consumers weren’t sure of what they were getting. HBO parent AT&T has promised to clear up some of that confusion on its July 23 Q2 earnings call, and earlier last month said it would discontinue the HBO Go online service in favor of HBO Max by the end of July.

Goncalves acknowledged the confusion, adding that HBO Max started from a different place than its peers: it had a large existing base with the HBO linear service, which has evolved over the years to include a streaming version (HBO Now) and a complementary online offering (HBO Go). Because of that, he said, HBO Max was “unable to start from a clean slate and our plan had to ensure that customers were able to access HBO content across linear, on demand and digital platforms.”

But now, with most of its customers able to access all of HBO through the HBO Max app, the product can be streamlined to eliminate confusion.

“We intend for HBO Max to be the primary digital platform for customers to access HBO along with even more fantastic library, acquired and new content,” he said.

Nevertheless, content companies are clamoring to either release new DTC products or substantially beef up existing offerings.

In late June, ViacomCBS CEO Bob Bakish said the programmer would add substantially to its CBS All Access streaming service, currently offering CBS library and original content to consumers for $5.99 per month. At the Credit Suisse Virtual Media Conference June 16, Bakish said the plan is to add programming from ViacomCBS cable networks including MTV Networks, Nickelodeon, Smithsonian Network, Paramount Network and Comedy Central.

Bakish pledged to add another 15,000 hours of content to CBS All Access next year, transforming the streamer into a “super service” with more than 30,000 hours of programming.

"We have a good position in the older segment with the current All Access product, but this really brings a lot of young audience to the table,” Bakish said at the conference.

CBS All Access also will beef up its sports offerings, which include streams of Sunday-afternoon National Football League games broadcast on the CBS network, and will add PGA Tour Golf to the mix. ViacomCBS also has ad-supported streaming services Pluto TV (with around 24 million customers), news-focused CBSN, CBS Sports HQ and ET Live, as well as premium ad-free subscription services Showtime, BET Plus and Noggin.

Streaming revenue was up 60% in 2019, to $1.6 billion, and up 50% in the first quarter of 2020, according to Bakish — the company’s strongest quarter ever on that front.

“Q1 was our strongest streaming quarter ever, even though we didn’t have the Super Bowl and we had the COVID-driven cancellation of the NCAA [men’s basketball tournament],” Bakish said at the conference, adding that those trends were continuing in April and May. “So there is a lot of momentum there.”

Other broadcasters also are taking a hybrid approach. Fox sold most of its cable networks and studios to Disney last year for $71.3 billion to focus on live news and sports programming. It launched streaming offering Fox Nation and acquired Tubi TV.

Fox bought ad-supported Tubi TV in March for $440 million, which Fox chief financial officer John Nallen has said provides a foothold with younger viewers. Fox has said that it believes the future of TV lies in bundles more tailored to individual consumers.

“I’m not sure entertainment is as core to the bundle and the pay TV universe as it has been,” Nallen said at the Credit Suisse conference June 16. “I think what will happen is you’ll get distributors squeezing down to a core product, maybe led by a digital MVPD, and then people just bringing their own entertainment into their household. Just like the connectivity companies are more bring your own — bring your own video, bring

your own audio, bring your own security — there will be more ‘bring your owns.’ Certainly in entertainment, SVOD will be ‘bring your own.’ ”

A Less-Traditional Future

Signs continue to point to erosion of the pay TV backbone for programmers.

In late June, The Walt Disney Co. dropped its linear Disney kids’ networks in the United Kingdom, shifting content to Disney Plus after failing to reach a distribution deal with British satellite-TV giant Sky. In a research note, Barclays media analyst Kannan Venkateshwar said the change could have broader implications in the U.S.

Disney did not reply to requests for comment.

Venkateshwar said replacing the linear channels, which attract about $1.61 per subscriber per month in affiliate fees, for the $6.99-per-month Disney Plus service seems like a no-brainer, despite starting from a smaller subscriber base than heavily penetrated pay TV. The problem, though, is it could lead to a “long-term pivot away from pay TV even for its most premium networks, like ESPN.”

While most of the world’s focus has been on Disney Plus, Disney launched ESPN Plus in 2018, offering sports programming and games not part of the linear channels’ packages for $4.99 per month. In 2019, ESPN Plus became the exclusive outlet for UFC pay-per-view events, for an additional charge. As of this May, ESPN Plus had about 7.9 million subscribers, according to Disney.

With rights deals for the National Football League and Major League Baseball coming up in the next few years, and with broader changes in viewing habits brought about by COVID-19, Venkateshwar said in his note that “this could also provide an opportune moment for Disney to think about a more aggressive transition away from legacy pay TV.”

Transitioning to a fully direct-to-consumer streaming model wouldn’t be easy, Venkateshwar noted. By definition, its distribution structure would be more fragmented compared to riding on pay TV platforms, which enable nearly 100% household penetration. But streaming, especially sports streaming, gives networks like ESPN the ability “to slice the demand curve a lot more effectively resulting in much higher ARPUs than the ~$11/sub/month that the ESPN/SEC [Network] family at present seems to get,” Venkateshwar noted.

He used NFL Sunday regular season games as an example, with NFL Sunday Ticket, NFL Sunday afternoon broadcast games and NFL Red Zone all delivering the same contests for three different price points. Sunday Ticket customers pay the most ($295 for the season) for the most games, while local games are offered for “free” via broadcast and those wanting recaps of games throughout the league can pay around $10 per month for Red Zone.

But Venkateshwar said that NFL pie could be sliced further, by time (similar to NBA League Pass’s 10-Minute Pass) and interactivity (different camera angles, fantasy sports info and the ability to place bets), enabling even greater tiering of sports content. Following that model, Disney potentially could charge $30 per month for ESPN across 30 million homes instead of $10 per month across 100 million households.

“Such a model could also help change the cost structure from fixed to variable by allowing for partnerships with leagues and revenue-sharing models to ease the path to scaling the business over time,” Venkateswar wrote. “ESPN is also uniquely positioned to do this as of now given its strong brand association with sports. Unlike scripted content, where Disney was effectively the last media company to enter into streaming, 12 years after Netflix started streaming, in sports, the company could have a unique first-mover advantage.”

Walking the Line

In this transitional time, programmers are straddling the line between the traditional distributors that currently pay most of the bills and streaming offerings aimed at consumers directly.

For now, most networks are holding on tightly to the current model. Many DTC offerings are tied to traditional pay TV subscriptions, a la Peacock and HBO Max. Other programmers are offering a mix.

“At a very high level, it’s incontrovertible that the streaming universe is expanding,” AMC Networks president, distribution & development Josh Reader said in an interview. AMC Networks was one of the pioneers in DTC streaming: it launched the documentary-focused Doc Club app (now SundanceNow) in 2014 and its streaming lineup now includes Acorn TV, AMC Premier, Shudder, IFC Films, and UMC.

“We view the streaming space as an expansion of the universe,” Reader said. “There will always be that relationship with distributors, MVPDs. There is still a significant market for that product. Of course as subscriber numbers on the traditional pay TV pack decrease, you’ll have an increase in the market for streaming services. We always viewed it as a balance.”

In June, AMC said it would expand its streaming offerings, making AMC Plus and We TV Plus available to Comcast Xfinity and Flex customers for $4.99 per month each. The streaming service will be offered to other distributors.

“One of the things we strongly believe and are particularly excited about, we’ve always had really strong relationships with our distribution partners,” Reader said. “The things that are driving all the trends are happening because of changing customer behavior.”

Distributors also seem to be warming up to a streaming future, particularly through their offerings of broadband-only with attached free programming. Comcast’s Flex broadband-only product, for example, offers access to thousands of hours of programming via free streaming services like Pluto TV and Tubi TV, as well as Peacock Premium, a $4.99 value, for no additional monthly charge. AMC’s Reader also pointed to Altice USA’s Altice One platform and Verizon’s Flex-like broadband-only service called Stream TV that offer consumers access to Netflix, Hulu, Disney Plus and other programming apps.

“For us that is something that is very exciting because it allows us to stay true

to ourselves and those relationships. We think of it as an expansion of our business,” Reader said.

Reader said he believes that there will always be a place for traditional video distribution. Although cord-cutting is accelerating, he said, that could level off. The trick will then be how to balance traditional TV subscribers with those who want a more flexible relationship.

“There is still a substantial portion of the country out there that sees value in that expanded basic television package, or that price point,” Reader said. “You continue to serve those customers and then the question becomes, how do we grow with our distribution partners to serve their customers on the broadband-only side, who say, ‘Maybe expanded basic is not for me anymore, given the price of that package, everything that I’m getting isn’t worth it for me? I’m willing to do a little more work for my video, I’m willing to choose to spend the time making those choices and managing the subscriptions.’ ”

On its Q1 earnings call with analysts in May, AMC Networks CEO Josh Sapan said viewers to its streaming services were up substantially during the COVID-19 lockdown and the company expects to have 3.5 million to 4 million subscribers to those services by the end of 2020, a full two years ahead of schedule.

Chief financial officer Sean Sullivan said on the same call that AMC continues to believe “that the highest return for our capital is to invest in content and reposition our company for a more streaming-focused landscape.”

Reader said the trick is to not alienate the core business while going after the future. So far, in his view, AMC Networks is managing that tightrope walk effectively.

“At the end of the day we are a content company and we need to be able to keep producing great content, and we have a very strong track record of being successful in that space,” Reader said. “How do we continue to invest in that content and rationalize it across multiple platforms? The way we think about it is by evolving the way our distribution partners are evolving.”

Models, Models Everywhere

Although the consensus points to continual disintegration of the traditional pay TV model, the jury is still out concerning what replaces it. Content creators’ runs at the subscription model have been successful (Disney Plus) and not-quite-as-successful (pretty much everyone else). Some believe an ad-supported approach has the best chance of survival.

Peacock has embraced the ad-supported approach (it also has an ad-free version available to consumers for $9.99 per month). Bond told Multichannel News that he believes eventually every service will at least consider an ad-supported path.

Netflix and Disney Plus are ad-free, but Hulu has an ad-supported version of its subscription VOD service as well as a more expensive, ad-free option: More than two-thirds of subscribers opt for the version with ads, Hulu has said. HBO Max is expected to launch an ad-supported version of its service next year.

“I think this is an instance where the marketplace hasn't settled out and there may be different versions of this like in the way Hulu has done it,” Bond said, adding that customers will ultimately make the final decision.

“If you look around your world, there are commercials everywhere in just about everything you do,” he said. “So, it would surprise me if there is no commercial opportunity in the context of television.”

The decision to be or not to be ad-supported will depend on the offering and its target audience, Denson said. Young viewers have already shown a propensity to watch ads in return for lower monthly charges. Older viewers are more willing to pay for convenience.

Denson pointed to her earlier Viacom days and the initial launch of Hulu, which offered an ad-free version that was priced about $4 more per month than the ad-supported version, a price point that many felt would drive viewers towards commercials.

“Within 30 days, something like 3 or 4 million of their subscribers took the ad-free product,” Denson said. “We were shocked as a programmer on Hulu, but it really showed that there were audiences that will pay for their time.”

Analysts that have been a little skeptical concerning the ad-free nature of streaming have nearly universally come out in favor of the ad-supported model.

In a research note, Moody’s Investors Service senior VP Neil Begley said Peacock’s ad-supported focus will allow it to “throw its weight around in the streaming wars given the breadth and avidity of NBCU’s largely existing content. The ad-light nature of the service and innovative advertising formats may also resonate strongly with customers and drive engagement and advertiser returns.”

It’s All About That Base

While content companies seem intent on dismantling the existing TV model, distributors seem to be encouraging it as well, and not only the ones that own programming. Even Charter Communications, which in the past has defended the validity of the thicker cable video bundle, has said it won’t rue the day when the model has changed.

Perhaps the biggest factor in shifting that stance has been the exponential rise in the cost of programming over the years. On Charter’s Q1 earnings conference call in May, chairman and CEO Tom Rutledge said “the biggest driver of negativity in the cable business, I think, has been the price of video.”

It helps that cable has a broadband business to fall back on that is not only hugely profitable (with 80% to 90% profit margins) but is also essential for viewing any of the streaming services. Streaming content over the internet requires a fast, reliable broadband connection, and cable has that in spades.

The day when cable operators only worry about providing reliable access to apps and DTC services, instead of haggling with programmers over affiliate fees, looks appealing to most cable companies. Rutledge, who has held the cable video value banner high for years, sees a day when both can coexist.

“There is an opportunity in us marketing direct-to-consumer products in our relationship with programmers,” Rutledge said on Charter’s Q4 earnings call in January. “And those relationships, in many cases, are also operating under the old model, too, which is the bundled cable model. We can hold both thoughts in our head at the same time and sell bundled products, which I think we’ll be selling for years to come, but also selling direct-to-consumer products.”

Even distributors without a broadband service to fall back on see working with DTC products as inevitable. At satellite-TV service Orby TV, CEO Michael Thornton said in the not-too-distant future, distributors will be selling packages of apps and DTC services instead of individual channels. Orby TV offers about 44 channels of entertainment programming for $40 per month.

“I for sure see the industry moving in that direction,” Thornton said. “Obviously it’s a little more rational and sensible for someone like Comcast or a Charter that is selling broadband. I think the more things in a single place, the better. If you have that customer’s attention because you are able to resell other people’s products, that’s only a good thing.

“Is it something that we think about?” Thornton continued. “Not in the next three to six months, but for sure down the road being a reseller, and being able to package other folks' services with ours, would be an attractive thing.”

To some, all the talk about DTC products and apps and individual programmers bypassing distributors sounds like another way to say selling programming a la carte. But there are big differences, at least for now.

A la carte programming has been something consumers and cable companies have wanted the flexibility to buy and sell for years. But there are reasons why the channel bundle has held together. A big one is how much channels would cost if sold separately.

About 15 years ago, Bear Stearns analyst Ray Katz calculated that ESPN would cost upwards of $15 per month if sold a la carte — and that was when ESPN was getting a $3 per subscriber, per month affiliate fee; it gets about $9 for the single channel today. Replacing the cable bundle with channels sold on an individual per channel basis still seems out of reach, even with the launch of DTC services.

Linear Still Has Lots to Watch

While DTC offerings are robust — Disney Plus has 500 movies and more than 7,500 television episodes, while Peacock has 7,500 hours of programming via its free service and 15,000 hours for premium — that’s still less than what is offered on linear networks.

Bond is the first to say that Peacock does not have the same programming that is on NBCUniversal’s linear channels.

“There is a lot that is not on there,” he said, adding that Peacock is a general entertainment service comprising broadcast primetime TV and cable shows, library, original and third-party content. “It’s not 100% distinct from NBCU, but it is definitely distinct from those linear channels.”

Denson said replicating linear offerings would be a bad idea anyway. Consumers have shown that they are not like their grandparents. For them, less is more.

“I don't think cord-cutting was saving money; I think cord-cutting was buying what I want,” Denson said. “And I want Netflix and I want Hulu and I want Amazon and I want HBO Max. It’s not necessarily that I cut my budget, it’s that I got the products that were serving me the best.”

Winners and Losers

But if less is indeed more, that means there will be a winnowing of programming choices. Smaller networks that can’t afford to weather a period of high marketing costs, to get their brand in front of consumers’ minds, and lower revenue, will fall by the wayside.

“The marketing spend is going to be enormous, defining your brand, making sure you're driving customers to it, reinforcing why they want to pay you directly,” Denson said. “I don’t think many companies will be able to break through. We’re going to have six or seven, maybe no more than 10, that will be able to define themselves with the right marketing to be able to stand out. And then what happens to the others? I think it will be tough.”

Marketing spend isn’t the only big cost for going directly to consumers. Disney Plus and Peacock have committed $4 billion and $2 billion, respectively, to creating original content. Even at that level, they are dwarfed by the $17 billion Netflix and the $7 billion Amazon Prime Video is expected to spend this year on content.

Denson said the migration away from the traditional programming model could free up content producers and studios in that it would expand how and to whom they can sell their shows.

“The positive side is as you let go of that model, it opens up a lot of different ways to make money,” Denson said, adding that could mean more flexible windows that allow producers to sell shows to thousands of other platforms and providers. “And maybe that means a longer lifecycle for that content. And maybe the money will be greater over time because of that.”

In Search of Baby Yoda

But programming isn’t just a cost issue, either. Quality content, especially in an era where producing shows can be expensive, is critical. Analysts that have touted the success of Disney Plus have said its breakout hit The Mandalorian — which, according to reports, costs about $15 million an episode to produce — and the viral popularity of The Child (the character nicknamed Baby Yoda by fans) is as much the reason for the service’s overall success as its $6.99 monthly price point.

That kind of breakaway hit not only will separate a DTC service from the increasingly crowded pack, executives said, but is becoming necessary as the competition continues to pump money into shows.

“Not only do you need a Baby Yoda, you need the prospect of a Baby Yoda every month,” said Thornton, who was chief revenue officer at Starz before co-founding Orby TV in 2019. “If you look at Netflix, the amount of programming that Netflix releases week to week, month to month, dwarves Disney Plus or HBO Max. It’s great that they have these deep libraries and these brands, but people are looking for the shiniest new object.”

Goncalves said HBO Max is quite aware of the importance of content, adding that chief content officer Kevin Reilly is doling out a steady stream of compelling shows for every member of the house.

“Rather than leaning on just one property, we are enthusiastic about offering a regular pulse of new Max Originals alongside the entire HBO catalog as well as beloved franchises, titles past and present from Warner Bros., and international programming across all genres and formats for all demographics,” Goncalves said.

To that aim, HBO Max plans to have about 21 original series, four comedy specials, one animated special and four feature films by the end of August (it launched with six original series) and in 2021, that slate will expand to 60 original series, not counting 30 HBO originals.

“I personally am counting down for the Snyder Cut of the Justice League and the Friends Reunion Special and, from HBO, the House of the Dragon,” he said.

So, at least for now, programmers seem to be enthusiastically committing to the video industry’s latest shiny new object. Just how long it can keep its sheen will be anyone’s guess.