Cable’s ‘VidiPath’ to Retail

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

The cable industry is eager to make a video connection to the blossoming retail market for gaming consoles, streaming players and smart TVs, and increasingly it appears that “VidiPath” will be the technology that will help it bridge that gap.

VidiPath is the consumer brand for CVP-2, guidelines developed by the Digital Living Network Alliance (DLNA) that will be used to identify devices, including set-tops, consoles and tablets sold at retail, that support subscription TV content from cable operators and other types of multichannel video programing distributors (MVPDs).

In addition to supporting an MVPD’s full-freight video service (linear, video-on-demand and DVR recordings, for example) and securing those streams using DTCP-IP, VidiPath will also enable those providers to extend their user interfaces, via HTML-5, to retail devices that conform to the platform’s technical guidelines.

The cable industry is one of VidiPath’s biggest backers, touting support from Comcast, Cox Communications, Time Warner Cable and CableLabs, the industry’s R&D organization. Verizon Communications is also a card-carrying member of the DLNA, as are CE and chipmakers such as Arris, Sony, LG Electronics and Broadcom.

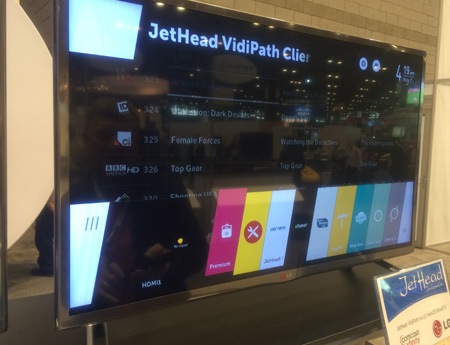

Some of VidiPath’s progress was on display at the INTX event in Chicago earlier this month. The most significant one showed X1, Comcast’s new IP-capable platform, running via the MSO’s production plant on several retail devices without the need for a separate set-top box. Those proof-of-concept integrations and demos ranged from smart TVs from Samsung and LG Electronics, which was running a VidiPath client from JetHead Development, to IP set-top boxes and a tablet outfitted with VidiPath software from AwoX.

Stephen Palm, senior technical director at Broadcom, said the demo during INTX also marked the first time a bona fi de Emergency Alert System (EAS) message sourced from an MVPD — Comcast, in this case — was displayed on a tablet device.

The demo also featured a guide demo from Cox, which has already deployed VidiPath servers on set-tops and gateways that run the MSO’s new “Contour” platform/user interface. Comcast also confirmed that it is in the process of deploying support for VidiPath on XG-class set-tops and gateways that run the MSO’s X1 platform. Two industry sources said Comcast is expected to add VidiPath server capability across its X1 platform as early as June 2015.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

DLNA launched the VidiPath certification program last fall, which is being used to stamp products that adhere to the CVP-2 guidelines. At the time, DLNA said at least 15 companies were working on VidiPath-compatible products.

A DLNA official said operators are expected to launch VidiPath services during the second and third quarter of 2015, and that VidiPath product certifications and retail availability will follow “shortly thereafter.”

VIDIPATH COULD CUT CPE CAPEX

For MVPDs, VidiPath is expected to generate some financial benefits. In addition to allowing them to deliver their full subscription TV service on retail devices, VidiPath should also help MVPDs cut down consumer premises equipment-related capital expenditures.

“Hardware cost has continued to be a pain-point for service providers over time,” Sam Rosen, practice director at ABI Research, said during a May 13 webinar that provided an update on VidiPath activities.

Using a three-TV home deployment as an example, Rosen suggested that matching a gateway with the VidiPath architecture could result in a 32% capex savings for the operator in part because the consumer, rather than the operator, would absorb some of the costs of the CPE (tablets or thin-client streaming players) because they would’ve been purchased at retail rather than leased through the MVPD.

VidiPath, he said, also helps out with scale, because its HTML-5 framework enables MVPDs to unify the experience across a broad set of devices and operating systems without having to develop an app or otherwise go through the additional cost and engineering work to port the experience on a per-device basis.

“Technology fragmentation,” Rosen said, “is a real problem for service providers.”

Rosen is also bullish on how aggressively the pay TV industry will adopt VidiPath (see chart), expecting a “jump function” to occur in 2015 as MVPDs ramp up the deployment of VidiPath-capable gateways. He also expects adoption to increase as cable operators migrate video services to IP, reducing the need to rely on gateways to transcode and translate legacy MPEG/QAM-based video signals to IP.

THE REGULATORY ENVIRONMENT

Several major cable operators are pushing ahead with plans to support the retail CPE ecosystem with VidiPath even as the Federal Communications Commission moves forward with its own plan to develop a successor to the CableCARD, the removable security module that failed to create a robust retail market for set-tops and integrated cable-ready TVs.

The plan is to work toward a downloadable form of removable security that could apply not just to cable, but to telcos, satellite TV service providers and other types of MVPDs. In January, the FCC appointed the Downloadable Security Advisory Committee (DSTAC), a group that includes individuals from companies such as Comcast, Charter Communications, Amazon, Google, Samsung and TiVo. The DLNA is not among those represented on the DSTAC.

The FCC, which did have members stop by the VidiPath demo at INTX, has yet to issue a notice of proposed rulemaking (NPRM) on the downloadable security matter, but the DSTAC is tasked with submitting its recommendations to the FCC by Sept. 4.