Changes at Sinclair’s RSNs Just Start With Name Change To Bally's Sports

Bally’s Sports Networks suit up for opening day with new graphics, signage

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

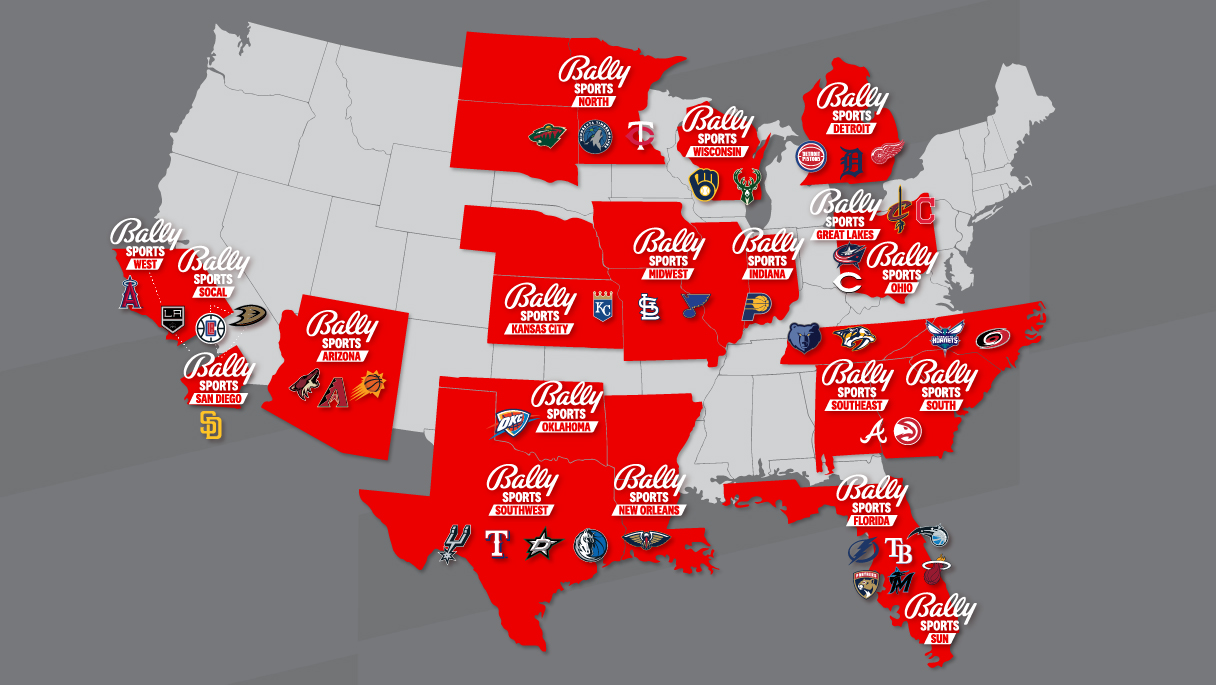

Sinclair Broadcast Group’s regional sports networks relaunched under the Bally’s Sports Networks brand Thursday, but while a lot of work has been done, there are still many innings to go.

The rebrand coincides with the start of the baseball season and all 14 teams Sinclair has deals with will be in action on day one.

Getting ready for opening day meant, changing signage in stadiums, reskinning about 74 studios and creating new graphic packages.

Also Read: Bally Sports Networks Strike Out with Streamers on Opening Day

“We have a lot of dedicated employees and they’ve done a lot of hard work,” said Rob Weisbord, president of broadcast and chief revenue officer at Sinclair. But the work has only begun on what Weisbord calls the RSN 2.0, which means not just show games on cable, but having engaging, interactive programming 24 hours a day all year long on all platforms.

Sinclair acquired the 21 Fox-branded RSN from The Walt Disney Co. for $9.6 billion in 2019. That investment put the company under financial pressure when the pandemic cancelled games, wiping out viewership and ad revenue.

In 2020 it made a deal with Bally’s, getting Bally’s stock while agreeing to integrate Bally’s programming into its stations and RSN as more states approve legalized sports betting.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Also Read: CEO Chris Ripley Likes Sinclair’s Gamble on Local Content

New graphics during ballgames will be the first change most viewers will notice, Weisbord said. Sinclair’s priority is to strengthen the game broadcasts, which are the tentpoles around which the networks are built. Next Sinclair will launch shows in conjunction with Bally’s that will be interactive and bring a full programming lineup to its RSNs over the next 12 months.

A richer programming lineup would make the channels more attractive to distributors. Some distributors such as Dish Network and virtual multichannel video program distributors like YouTube TV and Hulu have decided RSNs are too expensive to carry.

With baseball season starting, Weisbord said Sinclair’s distribution team is in talks with MVPDs. “We’re trying to figure out how to get to a deal,” he said. Eventually, the RSNs will have some sort of direct-to-consumer offering, so fans who want to watch games will have access to them, he added.

Also Read: Dish Adds MASN to Potential RSN Chopping Block

“The apparent weakness of [RSNs] them was the fact that they have a tent pole, which is the live teams which deliver strong ratings--so does the pre- and post game--but after that, it basically became a non-watched channel,” he said. “And so the best way to build an audience and build programming is to have a tent pole--and we already have the tentpole. So we think we can build a programming lineup off of the live games.”

The new programming will have gaming elements, to attract younger viewers raised on XBox and Fortnite. Sinclair is talking to some of the teams it works with now to do some predictive games to get their fan bases participating by giving them chances to win merchandise or tickets.

Once viewers are used to the free-to-play games where they can win prizes, they’ll move on to fantasy sports and then to live gaming.

For now, some leagues and teams have restrictions that will keep the RSNs from putting point spread in news tickers, for example Eventually those rules will loosen and there will be shows about odds, discussions about propositions and inside information for people considering wagering on a team or game.

At some point the Bally’s Sports might produce two game telecasts, a traditional one plus one for people interested in gaming “You can’t take the game away from the purists,” he said.

Sinclair has other programming ideas. Some involve going inside the team’s training facilities to look at advances in health and data science, staging a three-on-three hockey tournament or a “Hockey University” show that would help teach viewers the sport’s rules.

Sinclair will take a crawl, walk, run approach to new programming, trying it out at one of its RSNs before rolling it out to the entire group.

A key to Sinclair’s new approach to the RSN’s is a new app that should be ready to go in a week or so, Weisbord said. The authenticated apps will let users watch games and other video and play interactive games. Users will have to shift to a Bally’s app to make bets.

Other gaming companies, such as FanDuel and DraftKings, will be able to advertise on the RSNs as well, Weisbord added.

In some ways, Sinclair plans to nationalize its RSN operations. “We are a company of scale. In the past, these have been treated as one-offs. We look at it as a whole ecosystem,” Weisbord said.

In addition to the RSNs, the sports programming Sinclair develops could also run on its CW and MyNetworkTV affiliated stations, he said.

Sinclair It is building a Network Operations Center in Atlanta to replace the Fox master control set up.

There may also be national programming on the RSNs. It has studios in Chicago and Santa Barbara, Calif. It owns the digital sports network Stadium, which also has studios in Chicago.

Weisbord mentioned Shams Charnania, Stadium’s NBA reporter, as possible talent for a national show.

The RSN’s sell ads on a local, regional and national basis. National ads are sold through HTS, the rep firm that handled the RSN when they were owned by Fox.

All together, Sinclair assets generate 12 billion sports impressions a year,” Weisbord said. “When advertisers are looking for that national scale and local reach, we’re able to activate them through our House of Brands sales group,” he said. “We will eventually go into the branded content world as well.”

Sinclair also owns pieces of YES Network, which carries the Yankees in New York, and Marquee Sports Network, the Chicago Cubs' new flagship. Those networks will also be involved in program development and could participate in programming and advertising initiatives.

On opening day, Weisbord said he will be test-watching all of the games on Bally’s Sports app to see how close it is to going live.

“I’ve got to make sure everything's working properly before I think I could feel comfortable being out of pocket, he said. “Because if I go to a game, I really want to go enjoy the game.”

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.