Comcast Backs Bet on X1

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

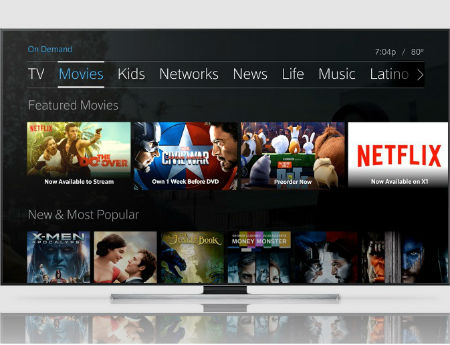

As a further recognition that X1 has played a major role in putting Comcast's video sub growth back in the black last year, the operator has plans to broaden and deepen the penetration of the platform significantly in 2017

RELATED: Comcast Adds 161K Video Subs in 2016

About 48% of Comcast’s 22.5 million video subs were on X1 at the end of 2016, up from 30% a year earlier, as the MSO deployed X1 to 936,000 net new and existing customers in Q4.

The aim is to drive that penetration percentage into the low 60s in 2017.

“We’ll keep driving X1 into our base and add features along the way to help further differentiate the experience as well as adding to our x1 licensing partners,” Brian Roberts, Comcast’s chairman and CEO, said on Thursday’s earnings call.

Cox Communications, Shaw Communications and, most recently, Rogers Communications have licensed X1, and Cox and Shaw have already deployed next-gen video products based on Comcast’s platform.

RELATED: Shaw Launches ‘BlueSky TV,’ Powered by Comcast’s X1 Platform

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Neil Smit, president and CEO of Comcast Cable, said he sees X1 penetration ultimately reaching 75% to 80% while noting positive metrics from X1 subs, including a 3x DVR uptake versus subs on Comcast’s legacy platform, a 2x increase in PPV, the utilization of more outlets and increased VOD viewing.

“In every way you study this thing, it looks like a…game-changing product,” Roberts said.

Integration of X1 with OTT services like Netflix also came up on the call.

“We want to offer more and complementary content to make the viewing experience as rich and easy to access as possible, so we’ll continue to seek other partners and integrate them into the overall experience,” Smit said.

Comcast is in the process of integrating Sling TV on X1. Smit reiterated that the focus of that tie-in is Sling TV’s multicultural content and services.

Smit also expanded on Comcast’s anticipated role and participation in the coming deployment of 5G, an ultra low-latency, high capacity technology that’s expected to help some ISPs deliver gigabit-class speeds wirelessly.

Comcast, which plans to launch a mobile product by mid-year and offer it as part of service bundles, is conducting some 5G trials today, Smit said.

“5G is an exciting evolution in the business,” he said, noting that it will need economical space, power and backhaul, and that Comcast has 150,000 miles of fiber deployed across 650,000 miles of total plant to contribute to the cause. “We think we're well positioned to participate in the 5G rollout no matter how it happen as a result of having all of those assets in place already."

Comcast also remains bullish about the growth potential of business services.

The MSO pulled in $1.44 billion in revenues from business services in Q4, establishing an annual revenue run rate of $5.76 billion.

Smit said he expects that part of the business to produce double-digit revenue growth for years as Comcast continues to capture share.

He said Comcast had 20% share in small-business in its footprint, and 15% in the mid-sized business sector, and that large enterprise represents a $13 billion to $15 billion opportunity in its markets.