Comcast Flexes Its Broadband Muscles

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

A week after letting analysts kick the tires on its upcoming streaming video service Peacock, Comcast got down to business Jan. 23, showing Wall Street that the engine of its past and future growth — broadband — is still humming along.

Peacock has been dominating headlines since Comcast held its Jan. 16 Investor Day, revealing details for the ad-supported service to generally favorable reviews. And though Peacock is thought by many to be the future of Comcast’s content distribution business, the cable operator showed that broadband, the platform over which streaming services travel, is still winning the day.

Comcast, the biggest U.S. cable company, added 442,000 broadband customers in the fourth quarter and 1.4 million for the full year, its largest yearly growth in 12 years. Broadband revenue was up 8.8% for the quarter and 9.4% for the year and shows no signs of slowing. In contrast, video subscribers fell by 149,000 in the quarter (compared to a loss of 29,000 in 2018) and video revenue declined 1.2% in the quarter and 0.8% for the year. For the full year, video subscriber declines nearly doubled to 733,000 from 370,000 in the prior year.

The industry seems to have come to terms with the decline of video customers, and the numbers seem to prove that out. With the fourth-quarter results, Comcast’s video base is declining at an annual rate of 3.3%, higher than the Q3 pace of 2.8% but still well behind the 6% clip for the rest of the industry.

In a research report, Sanford Bernstein media analyst Peter Supino called the Comcast results “rock solid.” He noted that the cable company’s performance underscores his “ ‘losing to win’ theme for cable,” meaning that as internet customers rise and video customers fall, margins and returns on invested capital (ROIC) will improve.

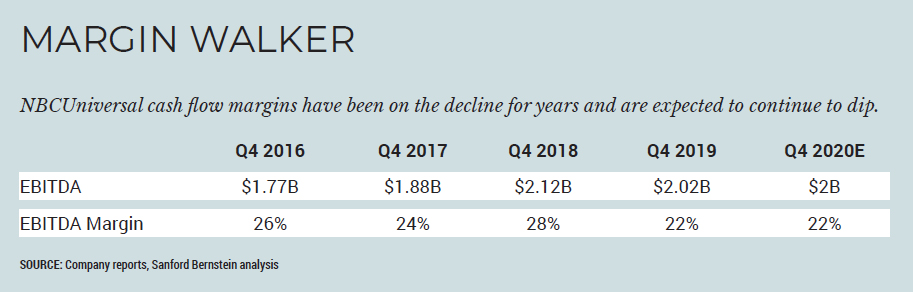

But for NBCUniversal, where revenue dipped 2.6% in the quarter (and 5% for the year), the picture seems to be getting worse. Earlier, LightShed partner Rich Greenfield wrote in a note to clients that Peacock is a sure sign that Comcast sees the handwriting on the wall.

“We walked out of the Peacock Investor Day with the clear sense that Comcast truly understands that consumer interest in linear TV and the bloated video bundle is fading and that it needs a replacement for both subscription and advertising revenue that leverages its robust broadband pipes,” Greenfield wrote.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

In his research note, Supino was also encouraged by Comcast’s broadband-only service Flex. Comcast can’t keep up with the demand for free Flex boxes, Supino said, adding that the product has the potential to be a meaningful contributor to stemming internet churn, as well as a new profit stream from retailing streaming services. In an earlier note, he estimated that Flex could account for 1.2 million internet customers by 2023.

Comcast has said it will spend about $2 billion over two years on content for Peacock, and there have been questions as to how NBC’s broadcast affiliates will react to the free service.

On a Jan. 23 conference call with analysts to discuss Q4 results, Comcast chairman and CEO Brian Roberts said the Peacock service will complement all of NBCU’s content offerings.

Feathering the Nest

“We’re going to make more money from the television ecosystem and that will allow us to continue to invest in the linear platform,” Roberts said on the call. “So if I were talking to an affiliate, if I were talking to a cable company, I would say Peacock is a way to make us a better, stronger competitor in a way that’s good for all of our businesses, not just streaming.”

Peacock will be the third recent entrant in an increasingly crowded direct-to-consumer field: Disney+ and Apple TV+ arrived in November, and AT&T’s HBO Max is slated for launch in May. Still, NBCU chairman Steve Burke said he believes Peacock is poised to come out on top.

“I think our company is better positioned as the world moves to streaming than any other company in the world,” Burke said on the call. “And I think you could argue in the next 10 or 20 years, if you look at all those three businesses combined, we could make more money in streaming than anyone else by a lot.”