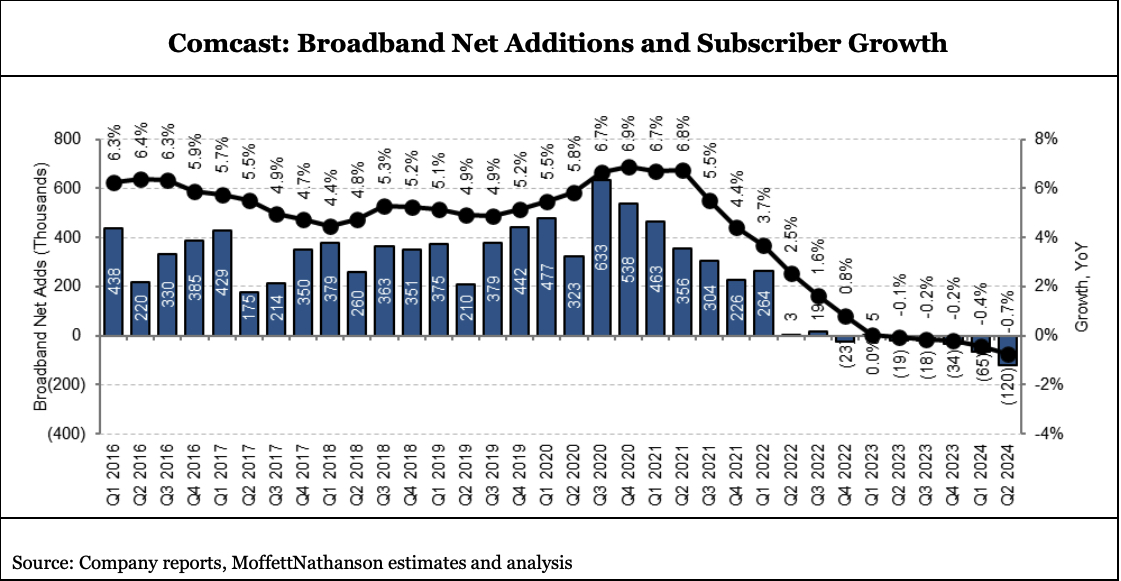

Comcast Has Its Worst Broadband Customer Quarter Ever at 120,000 Lost Subscribers

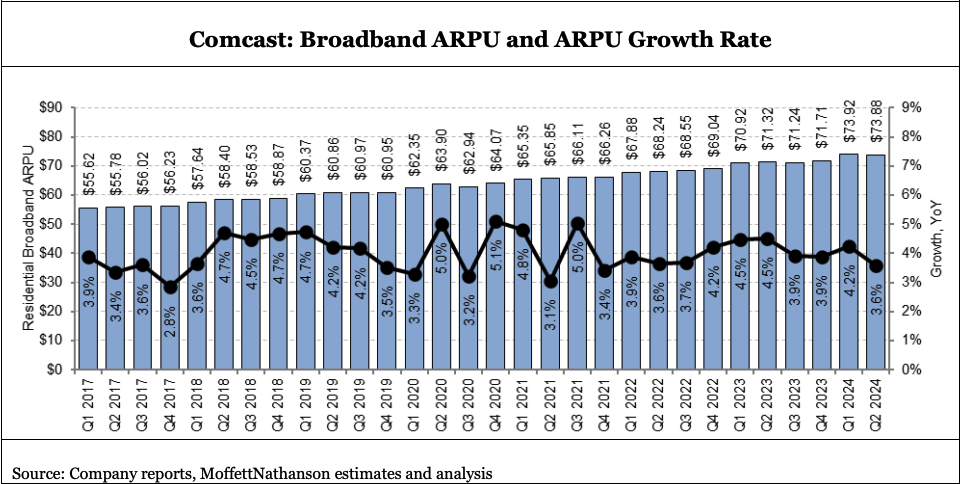

But Comcast’s broadband ARPU keeps rising, up 3.6% to $73.88, suggesting those lost ACP customers weren’t big revenue drivers

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Comcast lost 120,000 high-speed internet users in the second quarter, its biggest quarterly loss of broadband subscribers ever.

The result marked a significant acceleration of erosion, relative to the 19,000 subscribers lost in the second quarter of 2023. According to researcher Bruce Leichtman, Comcast’s previous worst broadband quarter was Q1, during which it lost 65,000 customers.

Analysts, who weren’t surprised by the amount of blood loss, attribute the result not so much from competition from fiber and fixed wireless access, but to the Republican-led defunding of the Affordable Connectivity Program (ACP).

“Comcast’s loss of 120K broadband subscribers was much worse than a year ago, but it was actually less bad than feared,” wrote equity analyst Craig Moffett. “The culprit for the decline was unlikely to have been higher competitive churn — Verizon already reported lower FWA and FiOS net additions than a year ago, and T-Mobile will almost certainly report lower FWA net adds as well — but instead lower gross additions. Lower gross adds are traceable to the end of ACP new enrollments; additionally, when an ACP customer moved in Q2 they weren’t able to resubscribe at their new address.”

Also read: Comcast’s Mike Cavanagh Expects NBA Deal To Score With Advertising, Subscription Revenue

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

Notably, however, Comcast’s average revenue per broadband user keeps rising, up 3.6% in the second quarter to $73.88. Overall domestic broadband revenue of $6.6 billion was up 3.0% year over year, right in line with consensus forecasts.

Those lost ACP customers weren't necessarily APRU drivers.

The growth was “a step down from last quarter, as expected — they’re still at the higher end of their target range — but it’s still below the rate of increase at competitors, making it reasonable to project continued growth in this range going forward,” Moffett added.

Speaking to equity analyst on Tuesday, Comcast Cable CEO Dave Watson said the operator is close to covering 50% of its network footprint with "mid-splits," a task necessary to upgrade its hybrid fiber-coaxial infrastructure to next-generation DOCSIS 4.0 speeds.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!