Comcast Wins Sky Prize, But at What Cost?

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Comcast pulled out its considerable checkbook to win what it apparently considers the real prize in 21st Century Fox’s recent asset sales — Sky plc — ponying up more than $50 billion for the United Kingdom satellite-TV service provider.

Now, all the top U.S. cable operator has to do is convince its shareholders that the long and the considerable cost was worth it.

That persuasion might take a while. Comcast shareholders, unsurprisingly, reacted quickly and negatively to the “win”: Shares were down as much as 8% on Sept. 24, the first trading day after the deal announcement was made on Sept. 22. Comcast finished the day down 6%. The stock continued to slide in later trading, closing at $35.34 on Sept. 25, down 7% from Sept. 21.

Shareholders had been nervous about Comcast paying top dollar for an asset that is the biggest international player in a business declining even more rapidly than the cable industry — satellite — and wondered whether Sky’s other components — content assets, a streaming service and a fledgling broadband business — would justify the cost.

That cost is going to be considerable. Comcast won a blind auction against 21st Century Fox — which already owned 39% of Sky — for the satellite company with a bid worth nearly $40 billion on Sept. 22.

A few days later, Fox said it too would either tender its Sky shares as part of the deal or sell them directly to Comcast, piling another $15 billion on the transaction.

Sky Was Always Comcast’s Prize

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Some analysts wondered aloud why Comcast would continue its pursuit of Sky, especially as it dropped out of the bidding for other Fox content assets that were eventually sold to The Walt Disney Co. in a deal valued at $71.3 billion.

Comcast, though, had always seen Sky as the crown jewel. It bid for Sky first, and dropped its pursuit of the other Fox assets to concentrate on its Sky bid.

Comcast didn’t say much about its victory. Chairman and CEO Brian Roberts briefly commented Saturday that the purchase will “allow us to quickly, efficiently and meaningfully increase our customer base and expand internationally. We couldn’t be more excited by the opportunities in front of us.”

Comcast will nearly double its total customer base to about 52 million customers — 29 million in the U.S., 23 million in the U.K. and Europe.

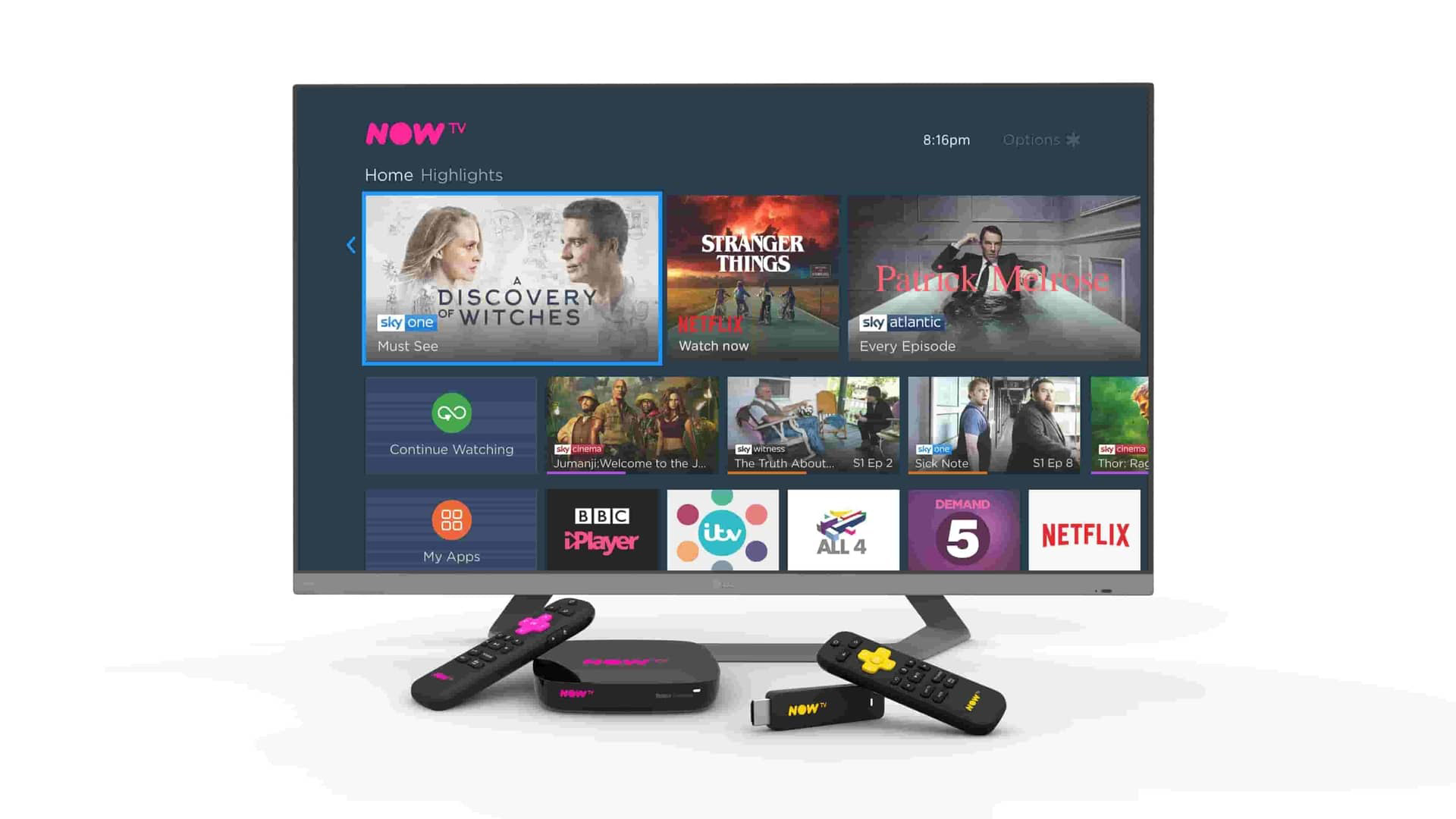

Perhaps more important are the other, smaller aspects of Sky: content (Sky News and Sky Atlantic) and production (Sky Original Productions and Sky Vision) assets, a mobile business (Sky Mobile), a broadband offering (Sky Broadband) and a streaming video service (Now TV) may prove to be the most attractive.

Comcast’s NBCUniversal arm has about a dozen networks, including Syfy, Bravo, and CNBC, with an international presence that can only be enhanced by the Sky deal.

Sky launched a broadband streaming video service — called NOW TV — in 2016 and so far the service has about 2 million customers. Sky also launched a new video platform in 2016, called Q, that has similarities to Comcast’s X1 platform. Sky’s broadband business is the second largest high-speed data subscriber in the U.K and Ireland, with an estimated 6 million customers.

“Innovation is a hallmark for both companies,” Roberts said in February when announcing the Sky bid. “Comcast’s X1, Sky’s Q have both redefined what watching television is all about. Both companies are focused on delivering more value to customers, be it by broadband, by mobile or home security. In short, the combination of Sky and Comcast creates a fantastic leader in entertainment and technology for today and for the future.”

Intriguing Content Assets

Sky also has some interesting programming plays. It has exclusive European content rights for sports stalwarts the English Premier League, Bundesliga and Formula 1, as well as for HBO, Showtime and Disney. While those content rights help, they won’t last forever.

“Comcast appears to be betting that Sky’s proprietary programming agreements will protect it from cord-cutting, and indeed will allow it to grow its fledgling OTT business to truly global scale,” MoffettNathanson principal and senior analyst Craig Moffett said in a note to clients. “The challenge will be doing so before those proprietary programming agreements expire.”

Moffett noted that several of those partners — HBO, Showtime and Disney — have already announced plans to offer a direct-to-consumer product in the future. Sky could face competition from tech companies, like Facebook, when Premier League soccer rights expire in 2022.

Moffett noted that to compensate for the loss of proprietary programming, Comcast would have to ramp up production at its own studios, spending more money at a time when it is attempting to transition higher-margin satellite customers to a lower-margin over-the-top service.

“A similar pivot for DirecTV in the United States hasn’t worked very well,” Moffett noted.

Scale does have its own rewards, though, for content companies. NBCUniversal CEO Steve Burke observed in February: “We believe that if you’re in these businesses, you need to try to distribute as broadly as you can. And one way to think about it is our footprint, our English-language footprint, roughly doubles with this deal. And the way we run the company, we’re intimately tied between the studio side of the company and the channel side of the company, and that has allowed us to produce a lot of our own programming for NBC and USA and Syfy and Bravo, and that has proved to be a good business.”