comScore: OTT Skinny Bundles in 3.1M Homes

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

More than 3.1 million homes had over-the-top skinny bundles as of April, according to new data from comScore.

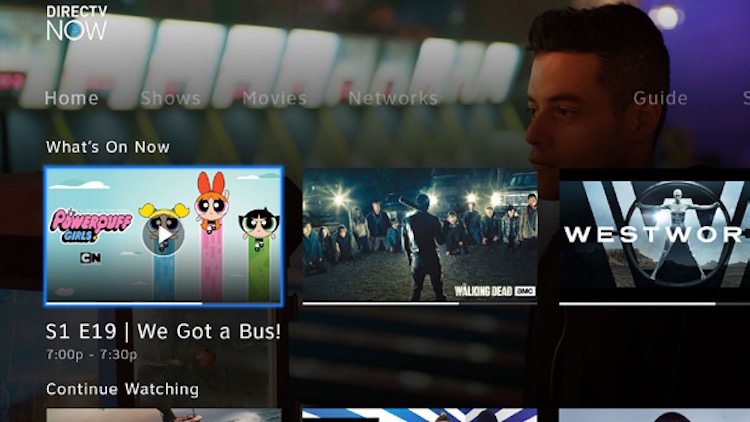

At that point, Hulu’s live service and YouTube TV had not yet launched. Sling TV, the first skinny bundle to launch, was the biggest with more than 2 million subscribers, comScore said, followed by Sony’s PlayStation Vue and DirecTV Now, which became available at the end of 2016.

comScore found that skinny bundle customers were highly engaged with the services, watching for 5.3 hours on the average viewing day.

In those households, the programming available via the skinny bundle accounted for more than half of the OTT viewing time.

But there was still significant viewing of other OTT services in skinny bundle homes, including Netflix at 17%, Hulu at 9%, YouTube at 7.1% and Amazon at 3.2%.

In 91% of the homes, the skinny bundle was being streamed via either a streaming stick or box.

comScore gathered viewers on streaming content consumption using its comScore Total Home Panel, which is comprised of about 12,500 homes and 150,000 digital devices and measured 52 OTT services.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Overall, OTT viewing is going on in 51 million homes or about half of those with a WiFi connection. OTT viewing accounts for 1 hour and 40 minutes a day of viewing.

About 1/3 of OTT households are cordless, while 52% are streaming only.

comScore found that consumers identified as cord cutters watched bout 81 hours of programming per month, while cord nevers—more likely to be millennials with lower incomes and first jobs—watched 61 hours per month.

In those OTT homes, 10.1 million were watching programming via network TV apps, accounting for about 14% of OTT viewing. That compares to 29% of the viewing going to Netflix, 16% to Hulu, 14% to YouTube and 7% to Amazon.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.