Cord Cutting Nearly Doubled in 2018 to 2.9M: Leichtman

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

The top 11 U.S. pay TV operators lost 2.87 million customers in 2018, nearly double the 1.5 million the domestic ecosystem shed in 2017.

These are the latest quarterly findings by Leichtman Research Group (LRG), which measures the leading operators covering 95% of the U.S. market.

The big negative drivers were the two satellite TV companies, DirecTV and Dish Network, which lost a ton of customers on the linear side, but this time couldn’t make up for it with gains by their low-margin virtual pay TV services.

The two satellite carriers lost a combined 2.36 million linear customers in 2018, about 7.5% of their collective base, compared to 1.55 million in 2017.

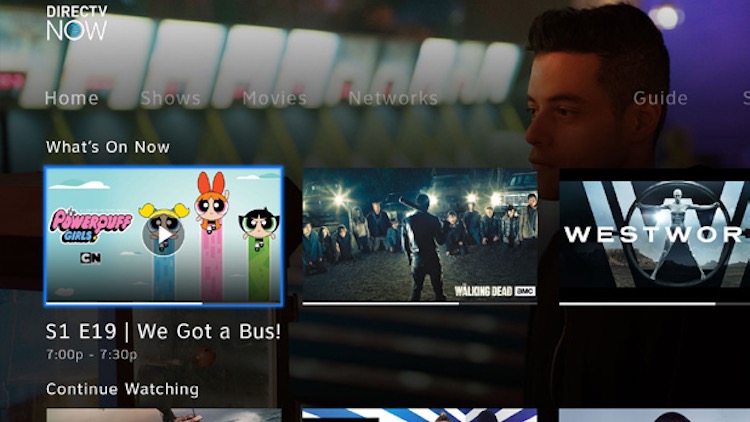

Meanwhile, vMVPDs Sling TV from Dish and DirecTV Now from AT&T added only 641,000 subscribers last year, compared to growth of around 1.6 million in 2017.

The downer satellite news masked improvements by telecom services Verizon Fios and AT&T U-verse. Telecom video services lost about 245,000 subscribers last year compared to 885,000 in 2017, according to LRG.

Meanwhile, video cord cutting among the top six cable TV companies was up, albeit slightly—910,000 compared to 680,000 in 2017. The big factor was Comcast, which lost 371,000 pay TV users in 2018 vs. 151,000 in 2017.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!