Cord-cutting 'Slowed' 18% to 1.23 Million Customers in Q2

U.S. pay TV business is down around 25% from seven years ago

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

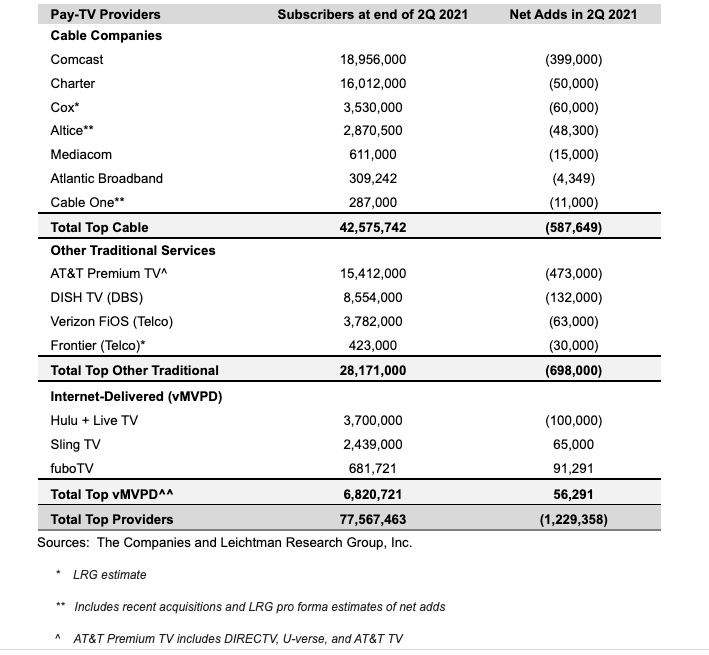

The top 13 U.S. pay TV operators, accounting for around 95% of the market, lost 1.23 million subscribers in the second quarter, an 18% improvement over the 1.5 million bled out in the same period of 2020, according to Leichtman Research Group (LRG).

AT&T, which recently spun off its pay TV operation in a joint venture with private equity firm TPG, once again drove the market, nearly halving its losses year over year to 473,000--the factor perhaps most responsible for the overall industry's improved metrics.

But save for the surprising Q2 performance by Dish virtual MVPD Sling TV (up 65,000 customers) and the deficit-fueled growth of fellow virtual service fuboTV (up 91,291 subscribers), every other major service was down in the quarter.

And save for AT&T, there were no major improvements.

Top cable operator Comcast, for example, reported the loss of 399,000 video customers in the second quarter, an improvement over the 478,000 shed in Q2 of 2020. But No. 2 cable operator Charter Communications lost 50,000 TV customers after gaining 94,000 in the second quarter of last year--a strange dynamic the company attributed to customers frantically adding broadband as they entered quarantine, many of them tacking on linear pay TV service, sold on promotion, in the process.

And satellite TV got a little worse, too. DirecTV's figures are buried within AT&T's bundled "premium TV" reporting, a monolith that also includes AT&T TV and U-verse TV. But Dish Network lost 132,000 customers in Q2, vs. just 40,000 in the year-ago quarter.

And despite Sling TV and fuboTV getting into the green in Q2, the vMVPD business barely grew, as well, with market leader Hulu + Live TV shedding 100,000 customers in the quarter. (Notably, LRG doesn't include YouTube TV, but parent company Google/Alphabet didn't say anything about the OTT service growing customers in its second quarter earnings report last month.)

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

On Monday, fuboTV CEO David Gandler made the bold prediction during a CNBC appearance that his service, which is integrating sports betting features, will add 5 million subscribers by the end of 2026.

But there are plenty of skeptics out there. German research company Statista, for example, predicts that the overall pay TV business will decline to around 60 million subscribers by 2025, which would be around 60% of the base it enjoyed just a decade prior.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!