Cord Cutting Spikes 31% ... And At a Particularly Bad Time for TMT

The top 8 U.S. pay TV platforms combined lost over 1.5 million subscribers in the first quarter. That's bad news for a tech/media/telecom sector that's suddenly enduring slowed subscription streaming uptake

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

The other shoe seems to have dropped for U.S. media companies in the first quarter, which were already facing declining growth for subscription streaming services.

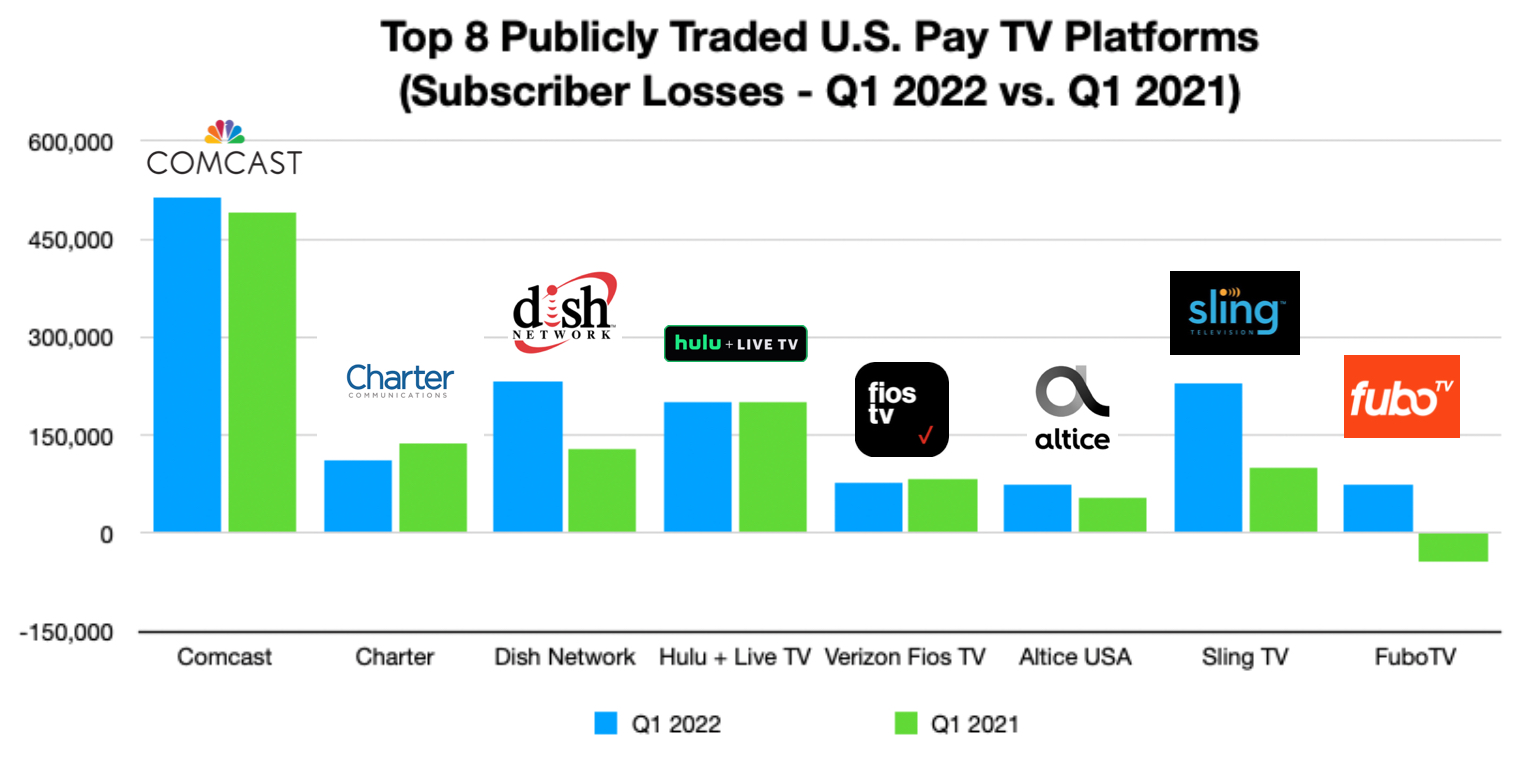

According to an analysis conducted by Next TV of the top eight pay TV platforms operated by publicly traded companies, cord cutting increased by 31% in the first three months of 2022 vs. the comparable time frame of 2021.

Collectively, Comcast, Charter Communications, Dish Network, Hulu + Live TV, Verizon Fios TV, Altice USA, Sling TV and fuboTV lost just over 1.5 million video customers in the first quarter, vs. just over 1.15 million in Q1 2021.

The biggest cable operators, Comcast and Charter, were largely flat, but Dish Network saw a significant uptick in cord-cutting, losing around 230,000 subscribers each for its satellite TV and vMVPD platforms.

FuboTV also reported a loss of 75,000 users vs. a gain of just over 42,500 in the first quarter of last year.

Notably omitted from our analysis was DirecTV, which had been the U.S. pay TV business' biggest subscriber loser the last several years, but is no longer reported on in quarterly earnings reports following AT&T's spinoff of the operation with private equity interest last year.

Also read: Disney Adds 9.2 Million Streaming Customers in Q1, Gets Set to Run Down Netflix (Chart)

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

DirecTV controls nearly 16 million U.S. pay TV homes across its satellite TV, vMVPD and legacy AT&T U-verse TV brands.

Privately traded cable operator Cox Communications, which serves around 3.6 million pay TV homes, was also not included.

Also left out was YouTube TV. Alphabet rarely discusses specific YouTube TV customer metrics in its quarterly earnings reports, but Wells Fargo analyst Steven Cahall estimated earlier Thursday that the Alphabet vMVPD lost around 200,000 customers in Q1.

Notably, in his note to investors Thursday, the analyst tied the acceleration of cord cutting to an unfortunate and concurrent slowdown in SVOD subscriber growth, particularly in the U.S.

As The Walt Disney Company reported Wednesday, Disney Plus Hotstar is growing quickly in India, accounting for nearly half of the company's global streaming expansion in its fiscal second quarter. But Disney Plus added only 1.5 million North American customers during the three-month period ending April 2, while Hulu tacked on only 300,000.

This comes three weeks after Netflix's bombshell revelation that it lost 200,000 customers globally in Q1 and will likely lose another 2 million in the second quarter.

Cahall tallied just 29 million subscriber adds for U.S. DTC services in the first quarter vs. 42 million in Q1 2021.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!