Dish’s 5G Network Plan Faces Doubt

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

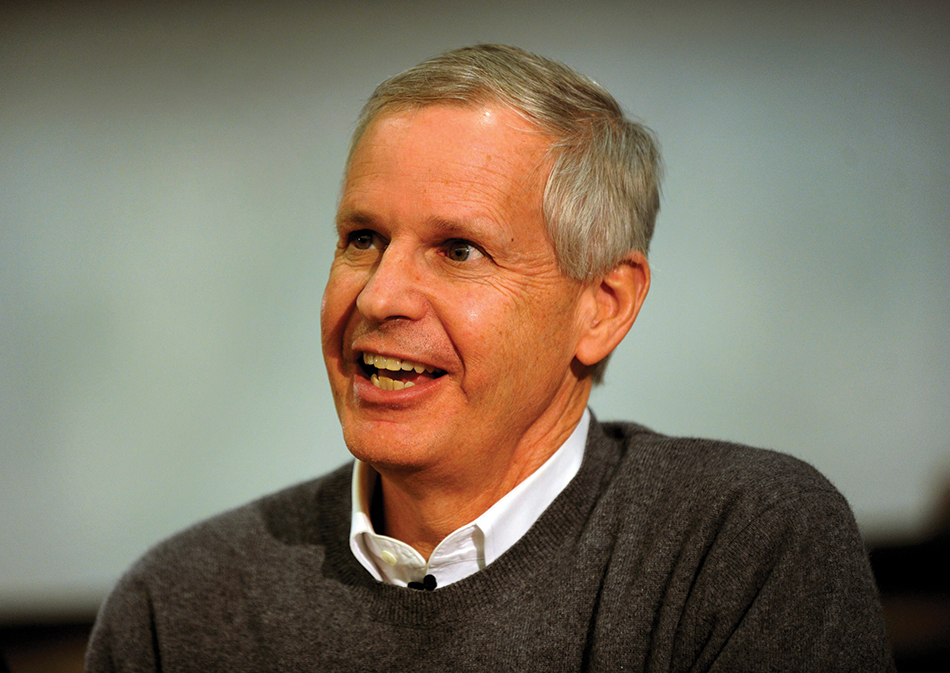

Already facing some skepticism even before the COVID-19 pandemic crashed the global economy, Dish Network chairman Charlie Ergen’s quest to build a fourth U.S. wireless 5G network has come under serious doubt.

Just as the satellite-TV provider confirmed that it would lay off an unspecified number of workers, The New York Post quoted an unnamed source, identified as a part of Dish’s lending group for the network build-out, damning the project.

“I think whatever rosy projections Charlie had are now very questionable,” the source told the Post. “There is no financing to build a telecom network.”

Last summer, Dish and Ergen emerged as key catalysts in T-Mobile’s ultimately successful $26 billion bid to buy Sprint. Dish agreed to pay T-Mobile $5 billion to transform itself into the nation’s fourth major wireless carrier, thus alleviating U.S. Justice Department concerns about reduced competition.

Dish now owns T-Mobile’s prepaid wireless business, Boost Mobile, along with its 9 million customers. The satellite-TV operator also received more wireless spectrum, on top of the gobs it already owns. And it now has seven years to use T-Mobile’s broader wireless network, including its emerging 5G infrastructure, on relatively advantageous wholesale “MVNO” (mobile virtual network operator) terms while building out its own 5G wireless capacity.

Dish also has a tight Federal Communications Commission deadline to build out that 5G network, needing to cover 70% of the country by 2023.

Ergen already caught flack for pegging the cost of the build-out at only $10 billion.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

“Verizon spends $15 billion annually to maintain a network that they’ve already built. The idea that Dish might spend $10 billion (their own estimate on previous conference calls) and then somehow be finished is, well, just silly,” MoffettNathanson principal and senior analyst Craig Moffett wrote.

In his staff-wide memo announcing the job cuts earlier this month, Dish CEO Erik Carlson expressed continued commitment to the infrastructure project. “We are committed to entering the wireless business, bringing full, standalone 5G to America, and delivering unparalleled innovation that will benefit U.S. consumers,” he wrote.

Meanwhile, other analysts aren’t so quick to write off Ergen’s determination.

“Two months of severe market uncertainty doesn’t really alter my view of a company to execute on a three-year plan,” LightShed Partners analyst Walt Piecyk told the Post.

If it fails to meet the 2023 deadline, Dish could face $2 billion in fines and the forfeiture of $12 billion worth of wireless spectrum.

But in a note to investors, Goldman Sachs suggested Dish could use an “act of God” clause to ease that commitment.

In December, while testifying in a Manhattan federal court to Dish’s abilities to replace Sprint as the No. 4 U.S. wireless carrier, Ergen included an interesting hedge in terms of what might prevent Dish from obtaining needed capital.

“Where the markets are today — if we don’t have another 9/11, God forbid — the banks are confident,” Ergen told the packed courtroom.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!