Fox Joining Cable Sports Rush

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

When News Corp. this week finally announces

its plans to launch a 24-hour sports cable network, media buyers will have more

choice than ever about where to put their sports ad dollars.

Following a series of private individual meetings with media

buyers and clients, Fox Sports Group on March 5 hosts an upfront-style

presentation where Fox Sports 1 will be unveiled. The rookie network-built on

the foundation of Speed channel-is seen as a heavyweight challenger to ESPN,

whose title as the worldwide leader in sports isn't all hyperbole. And Fox

Sports 1 is following NBC Sports Network and CBS Sports Network into the

national cable sports net fray.

Sports has been one of the brightest parts of the TV

business because the way fans view live events makes commercials during games

practically DVR-proof. The proliferation of cable sports channels means

additional games to sponsor and new shoulder programming- highlights and studio

shows-that will help advertisers reach those fans at lower cost.

Buyers say ESPN should not be too concerned, at least not

yet.

"The impact from a budget standpoint across the marketplace

to ESPN is going to be minimal until these networks establish themselves and

until ratings are relatively consistent," says Neil Vendetti, managing director

for national video at Zenith. "But five years down the road, maybe there are

one or two legitimate competitors to ESPN. I just don't think in the infancy

stages these other networks are going to make that big of a dent."

As the new players try to storm the field, ESPN is pushing

its advantage. "ESPN has been on an innovation agenda in terms of pushing out

Watch ESPN and other digital outputs," says Miraj Parikh, media director at

Spark. "I would have to think they're keeping an eye on what the competition's

doing. That's only the smart thing for them to do. But I think they keep

pushing on providing more innovation opportunities and more consumer engagement

opportunities."

The competition also is good for buyers and their clients

because it presents new choices and added inventory, which should put downward

pressure on prices. "From our vantage point, we always want more competition,"

Parikh says. "It does require ESPN to potentially sharpen their pencil and be

better on their game in terms of how they go to market, what sponsorships they

offer, even what they offer the consumer. Because what it comes down to is

you're only as good as the content you offer."

The smarter way to stay on top of broadcasting and cable industry. Sign up below

ESPN is in a league of its own. It holds an upfront the same

week as the big broadcasters. And it does a substantial part of its business at

the same time primetime upfront budgets are being allocated, according to Ed

Erhardt, ESPN president of global customer marketing and sales. Erhardt expects

this year's market to be strong, particularly when you add in digital video and

mobile video, two areas beyond TV where ESPN is a leader. "Marketers say they

want to follow the consumer from screen to screen, and the content they're

watching is sports," he says.

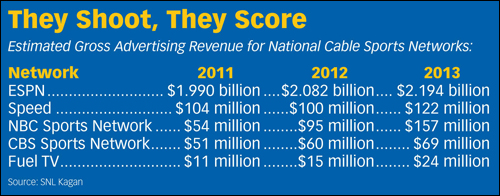

Whether or not it takes a bite out of ESPN, SNL Kagan sees

success ahead for Fox Sports 1. Analyst Derek Baine forecasts that ad revenue

will jump from Speed's $100 million in 2012 to $122 million in 2013, then

skyrocket to $244 million in 2014 and $423 million in 2015. With subscribers

and license fees rising as well, Baine expects Fox Sports 1 to generate $431

million in cash flow in 2015, up from Speed's $100 million in 2010.

Fox will use the sports assets it has to help convince

advertisers to put money on Fox Sports 1. As the new network rolls out, Fox

Sports will also be selling spots on the biggest TV event of the year, the

Super Bowl. In the past two years, CBS and NBC said they had moved a large

percentage of Super Bowl inventory early in the year. This year, Fox has been

quiet. Sports business sources expect that Fox Sports will try to leverage the

Super Bowl to push Fox Sports 1 with both advertisers and viewers.

How will having cable channels affect the way Fox, CBS and

NBC approach the sports advertising market? Can there be too much sports on TV?

"The sports fan's appetite is pretty strong and people seem

to be consuming a lot of sports," says John Bogusz, executive VP for sales at

CBS Sports. "They're engaged and you watch it live, so we've got a lot of good

things going for us."

"It doesn't change our approach," adds Seth Winter,

executive VP for sales for the NBC Sports Group. "We are constantly trying to

create the best intersection of our inventory with the needs of advertisers and

marketers. Our assets-broadcast, cable, regional, digital and radio-are unique

in the marketplace, and we have more platforms and properties than ever

before."

"Will it continue to get more competitive? I think so," adds

Bogusz. "Right now, in terms of the properties we have on our air at CBS, our

revenue has been very healthy. And CBS Sports Network continues to grow. We're

trying to grow distribution. And in terms of advertising, it's double-digit

revenue growth right now."

More channels mean more opportunities. "Marketers who are

interested in extending their brands embrace and value shoulder programming

that surrounds live events," Winter says. "Our assets allow us to offer

packages that provide this deep level of integration."

CBS' Bogusz says right now the market for most sports is

strong. The second-quarter golf market is moving, and it's up from last year,

he says. By the time the broadcast upfront rolls around, CBS will be selling

college football and the NFL again. "We are fortunate enough to sell the SEC

[conference] here. They've won the national championship the last seven years

in a row. That market continues to be very healthy."

And even though ratings were down in the last

regular season and the playoffs, Bogusz says the NFL is rock solid. "Demand has

never been greater," he says.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.