Free Over-the-Top Starts to Pay Off

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Over-the-top video continues to grow in popularity from a consumer perspective, but it remains a business challenge for both ad- and subscription-based service providers as they try to gather scale in what’s been a highly fragmented market.

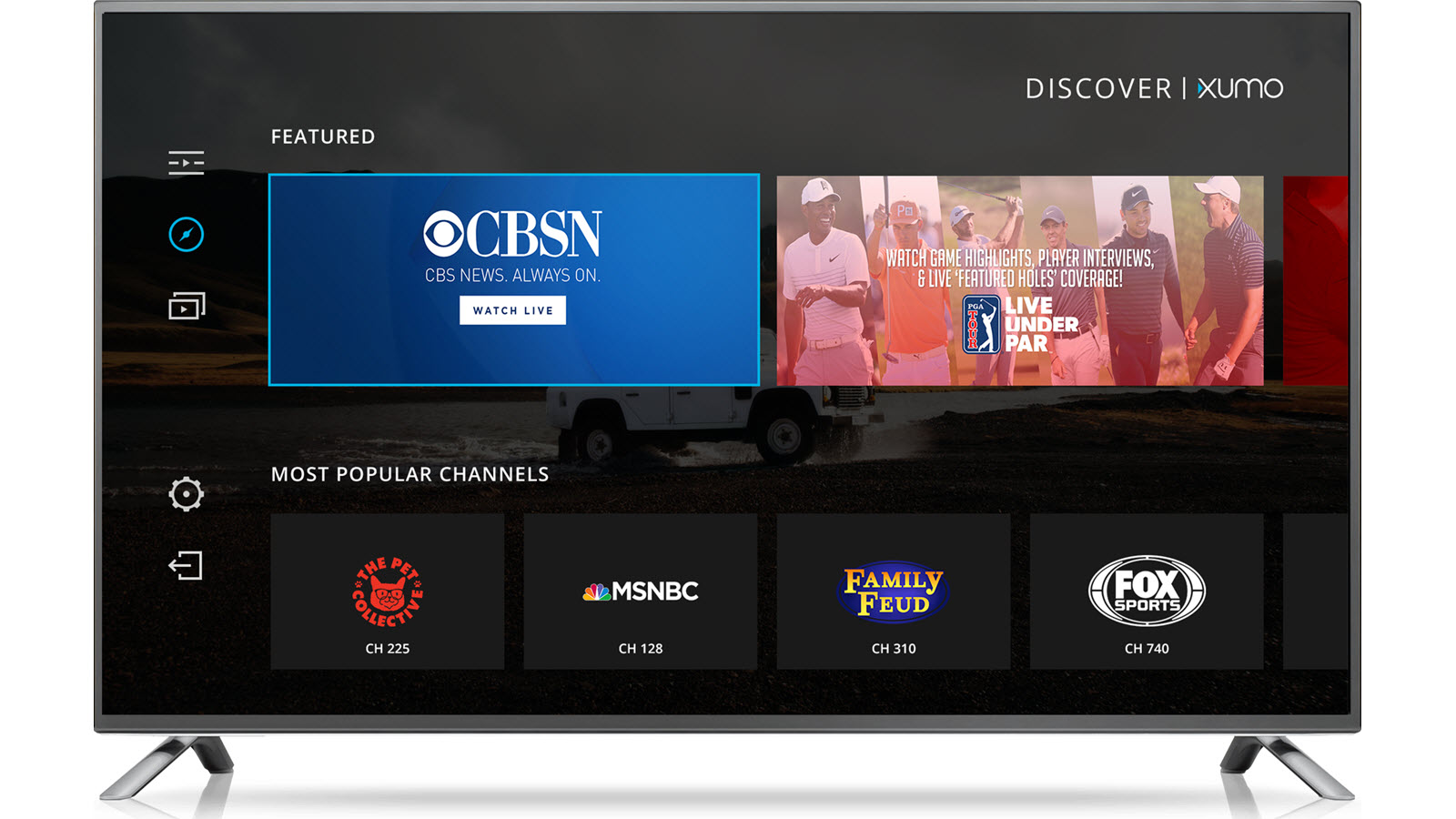

On the ad-based, free side of the OTT ledger, Xumo claims it is making significant progress in scale, reach and financial profitability.

With respect to scale, Xumo’s lineup now spans more than 150 digital “channels,” including CBSN, Newsy, NBC News, Fail Army, PGA Tour, The Pet Collective, Baeble Music, Machinima, History and Fox Sports, to name only a few.

Thanks to deep, “native” integrations with smart TV makers such as LG Electronics, Vizio, Hisense, Panasonic and Sharp, alongside Xumo apps for Roku players and Roku TVs, Samsung smart TVs and a set-top box integration agreement with Layer3 TV (the Denver-based pay TV service that’s now part of T-Mobile), Xumo also touts a reach of about 30 million U.S. homes.

Related: Layer3 TV Expands OTT Slate With Xumo

“On the distribution side, we’ve hit a critical mass,” Colin Petrie-Norris, Xumo’s CEO, said. “I’m a big believer that distribution drives everything else.”

Regarding audience and usage, Xumo says it has 3.5 million monthly active users, saw a 325% boost in viewership in 2017 over 2016, and is seeing this area grow through the first half of 2018.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Petrie-Norris said the average Xumo user watches four hours of content per month, with the vast majority — north of 90% — viewing the service on TV-connected platforms, and the balance on Xumo’s apps for mobile devices and web browsers.

Exclusive Agent

Based on ACR (automatic content recognition) data analyzed from TV-maker partners, Xumo estimated that upward of 20% of its users watch its lineup of channels as their exclusive TV experience. “That’s a massive cord-cutter segment,” Petrie-Norris said.

Xumo is privately held and doesn’t disclose financials, but Petrie-Norris said the company is flirting with profitability.

“We’ve brushed up against it a couple of times,” he said, adding that Xumo expects to turn the corner sometime this summer.

That progress comes by way of a business model that is entirely based on a free, ad-based standard.

The bulk of that comes from a programmatic system that enables private marketplace deals, allowing, for example, advertisers to buy against specific audiences and channels for a premium rate.

Xumo also has a sales team in Los Angeles and New York focused on bigger sponsorships and integrated marketing campaigns. The company also works directly with its digital channel partners, allowing them to sell ads on the service.

Looking Ahead

As for priorities for the rest of the year, Xumo will focus on expanding distribution, exploring interactive advertising packages and targeted, data-based products, while also continuing to build out its content lineup, possibly with a greater focus on live sports.

“Live drives a lot of engagement for us,” Petrie-Norris said.

Expect Xumo to stick to its knitting with an ad-fueled option and steer away from subscription-based services, even as some content partners ask them about supporting transaction-based models.

“We’ll never say no to anything, but we’re seeing tremendous interest in the ad-supported option,” Petrie-Norris said, adding that Xumo can live on ad-loads that are a third or less smaller than those on traditional TV. “I think we’ll be doubling down on the ad business.”

Xumo has the technological capability to offer digital channels in 4K, as much of its content comes in a high-resolution mezzanine format. For now, Xumo will not be pursuing 4K yet, due to the higher costs of streaming in that format; at least not until the advertising market gets more strongly behind OTT-delivered 4K content.