Future-Focused at ‘New Fox’

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

After nearly seven decades in the media business, beginning with a string of small local Australian newspapers in the 1950s that he built into the television, film and publishing behemoth that became News Corp. and 21st Century Fox, Rupert Murdoch again managed to shock the world with his decision last year to sell the bulk of his empire to The Walt Disney Co.

While the elder Murdoch has made a career out of going against the grain, mainly in buying assets at what others thought were exorbitant prices, this time was different. This time, Murdoch and Fox were sellers, and many pundits took their action as a sign that it may be time to throw in the media towel.

By now, Murdoch and Fox should be used to being underestimated. Whether it be the $1.58 billion the fledgling Fox broadcast network spent in 1993 to win National Football League television rights — an unheard of sum at the time, but almost quaint today — the 1996 decision to launch an all-news channel with a conservative bent (Fox News Channel) or the $5.7 billion Murdoch paid in 2007 for The Wall Street Journal (a 67% premium), there has been a common theme to his company’s actions: They knew something others didn’t.

That maverick sensibility has driven Rupert Murdoch, now 21st Century Fox’s executive co-chairman, since the beginning. It’s a trait he has passed on to sons Lachlan, also executive co-chairman, and James, 21st Century Fox’s CEO. Collectively, the three Fox leaders are the 2018 Multichannel News Executives of the Year.

Driving Up the Price

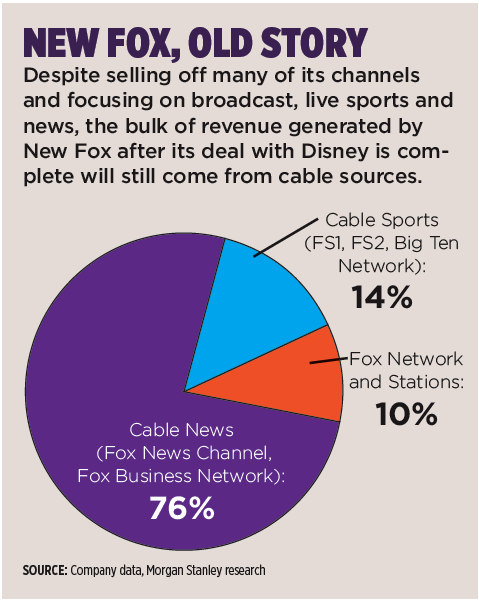

In typical Murdoch fashion, the most recent deal didn’t go down without some controversy. Disney, which had agreed to buy roughly two-thirds of 21st Century Fox in December 2017 for $52 billion, ended up paying $71.3 billion for the assets after a month-long bidding war with Comcast. After the deal is closed — expected within the first quarter of 2019 — the Murdochs will be among the largest individual shareholders in Disney and will control New Fox, consisting of 28 owned-and-operated television stations, the Fox broadcast network, cable news stalwarts Fox News Channel and Fox Business Network and national sports channels FS1, FS2 and Big Ten Network.

In one fell swoop, the Murdochs have transformed one of the world’s biggest cable and broadcast content companies into a leaner, meaner and more streamlined entity mainly focused on live news and sports.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Disney has doubled down on content under the premise that in the new streaming video paradigm, volume will win the day. Fox, though, has taken the opposite tack, focusing on live fare that will hopefully drive viewership, ratings and ad dollars its way.

The Murdochs were not available for this report. but there has been plenty written and speculated about the Disney deal and the New Fox entity that will emerge. For the most part, New Fox will be run by current 21st Century Fox co-executive chairman Lachlan Murdoch, who will be chairman and CEO of the new business. Lachlan came back into the family business in 2014 after a nine-year hiatus running an Australian investment fund, Illyria Pty Ltd.

While Lachlan will get an assist from 87-year-old father Rupert, who will be co-chairman of New Fox, James Murdoch, who had been CEO of Fox’s Sky satellite TV business in the U.K., and served as CEO of Fox for the past three years, won’t be a part of the new entity, instead opting to go off on his own, at least for a while.

Speculation has been rampant about where James Murdoch will end up. Early guesses that it would be in a senior leadership role at Disney or as chairman of electric car and aerospace company Tesla (he’s a board member) were wrong. For his part, Lachlan has said James was integral in running Fox and in making Sky plc into the leading European satellite platform — it was sold in October to Comcast after another bidding war — but that the Disney sale process was “cathartic” and that his brother decided it was time for a change.

James put it pretty succinctly himself at the Recode conference in May, months before the sale was even decided. “I think it’s time to do something new,” he said.

Comcast dropped out of the bidding for the Fox U.S. assets, but it stayed in the fray for another prized Fox property: U.K. satellite giant Sky. Fox had been trying to consolidate Sky for years (it owned 39%), but was rebuffed by U.K. regulators that feared full control would put too much power in the Murdochs’ hands. When Comcast lobbed in its $31 billion bid for Sky in February, it touched off a second bidding contest that the cable operator ultimately won with a nearly $40 billion commitment. At that price, Comcast also agreed to purchase Fox’s Sky stake for about $15 billion, further filling up the Murdoch’s coffers.

While some pundits had earlier believed the Sky stake was an asset the Murdochs would never give up, it again became a question of value. Lachlan Murdoch said the family holds no grudge against Comcast over Sky. “We don’t have skin in the game anymore,” he said at The New York Times DealBook conference on Nov. 1. “I think [Comcast chairman and CEO] Brian [Roberts] will be a great steward of Sky and they will do very well.”

To understand the impact of the Disney deal, one only has to look at Fox just four years ago when, sensing a shift in the content business, it made an unsolicited offer to buy Time Warner Inc. for $80 billion. That offer was rebuffed, but it was partially based on Fox’s belief that Time Warner properties, especially premium channel HBO, weren’t being properly utilized on the internet.

Less than a year after Fox made its offer, Time Warner launched its standalone HBO streaming service HBO Now and, a year after that, agreed to a $108.7 billion sale to AT&T.

Fox said back in 2014 that, after losing out on Time Warner, it was through with acquisitions and would instead focus on growing the business organically. Just two years later, while the AT&T-Time Warner regulatory approval dance was going on, the idea of selling assets rose to the forefront after Verizon Communications knocked on Fox’s door about a potential deal, Lachlan Murdoch said at the DealBook conference.

Though the family had been considering its moves in the new TV and entertainment landscape, Lachlan Murdoch said the prospect of being owned by a phone company was not so attractive.

“We didn’t think Time Warner would be a better-run media company because it was owned by a phone company,” he said at the DealBook conference. “We didn’t see the strategic fit.”

Lachlan Murdoch said the ultimate decision to sell was not made emotionally or lightly.

“The journey to sell such a large part of the business was one that took some time, took some time to really think about,” he said at DealBook. “To think about where the industry has gone, what the challenges were that we saw on the horizon, particularly in the entertainment business, but also about where these assets could sit to make them more viable and stronger than with us.”

A few months after the initial Verizon overture, Disney chairman and CEO Bob Iger called with a proposal, which Murdoch said “immediately made sense. My brother and I went to my father’s office and had a long conversation about it.”

When Disney announced on Dec. 14, 2017, that it had agreed to purchase the Fox assets — cable channels FX, FXX and National Geographic; the 20th Century Fox film and production studios; 22 regional sports networks; and Fox’s 30% interest in online video pioneer Hulu — it had expected to sew up the deal in a few months. But six months later, after weeks of speculation, Comcast lobbed in an all-cash bid for the assets, touching off a bidding war that made Fox and the Murdochs considerably richer.

Lachlan Murdoch hinted that even after signing the first Disney agreement, Fox knew the battle wasn’t quite over.

“Comcast was there in the beginning, they came shortly after we heard from Disney,” he said at the DealBook conference. “We couldn’t get our heads around the regulatory risk. I thought that our initial negotiation with Disney was very good, but that we could get a higher price if we could get a bidding war going. We felt there was more value.”

That bidding war lasted for about five weeks and ultimately kicked up the price for the Fox assets by nearly $20 billion. In addition, as part of the regulatory approval of the deal, Disney has agreed to sell off the 22 regional sports networks — valued by some at around $20 billion — within 90 days of closing its larger Fox deal.

Able to Buy More Assets

Now flush with cash, New Fox is expected to be on the hunt for more assets to beef up its existing lineup. So far the company has ponied up $3.3 billion over five years for rights to NFL Thursday Night Football, and another $1 billion over five years for WWE programming beginning in 2019. And there will be more.

“We will buy other things,” Lachlan Murdoch said at the DealBook conference. That could include its former regional sports networks, currently being auctioned by Disney; additional television stations; more sports assets or practically anything else. Lachlan Murdoch said the guiding principle to any additional acquisitions will be if they add to Fox’s already strong position in the industry.

“We are must-have channels for our distributors,” Lachlan Murdoch said at the DealBook conference. “What we don’t want to do is use that leverage in businesses that are not must-have.”

New Fox also appears to be bucking the trend for media companies to chase the Netflix streaming model, focusing more on direct-to-consumer offerings than on traditional distribution methods. Disney is a prime example: it launched a sports-themed DTC offering in April (ESPN+) and plans to launch an entertainment streaming offering, Disney+, next year that will include the recently acquired Fox content.

While Fox also has streaming plans — Fox News launched on-demand OTT service Fox Nation on Nov. 27 — it also realizes that an entertainment streaming service would require bulk the company simply doesn’t have.

At the DealBook conference last month, Lachlan Murdoch said Netflix really has two businesses, distribution and content generation, which both require tremendous scale to be successful.

“What we were seeing, and one of the reasons we sold to Disney, [was] for us to have scale in a direct streaming service, whether it is an FX streaming service or you could bundle some of our channels in an on-demand service, you can get to 2 [million] or 3 million subscribers, like CBS All Access, but then you get capped,” he said. “You need to have the scale of 20, 22, 30, 50 million subscribers to have enough significant scale to make that a real business.”

Although the Disney deal isn’t expected to close until next year, New Fox already has assembled much of its management team. Aside from Lachlan, who will become co-chairman and CEO of New Fox after the deal is closed (Rupert Murdoch will be co-chairman), the company has named 21st Century Fox chief financial officer John Nallen as chief operating officer, while Fox Sports chief operating officer Eric Shanks will become CEO of that unit. Fox News and Fox Business CEO Suzanne Scott and Fox Television Stations CEO Jack Abernethy will continue in those roles in the new company.

The company also poached longtime AMC Networks executive Charlie Collier to become CEO of entertainment at New Fox. Collier, who brought such scripted hits as Mad Men, The Walking Dead and Breaking Bad to AMC, on the surface seems an odd choice given the company’s expected focus on live news and sports, but Lachlan Murdoch said the different genres can reside comfortably and in a complementary manner within the new structure.

Building Around Live Programming

“We see a strength and strategic narrative in New Fox around live programming,” Lachlan Murdoch said. “Having said that, if you look, the amount of entertainment programming is declining at an incredible rate. What we can do is invest in the NFL, invest in baseball, the WWE, and use those to promote our entertainment programming as well. The way I look at is you have a tentpole with the best live news programming in the country, a tentpole with the best broadcast sports in the country, and how do you lift up the entertainment to that?”

A prime example of that strategy is the Tim Allen sitcom Last Man Standing, which Fox took after ABC cancelled the show last year. Moving the show to Friday nights allowed Fox to heavily promote the programming on Thursday nights — when it airs Thursday Night Football — into Friday. Ratings, Lachlan Murdoch said, are 80% better on Fox than they were on ABC.

News and sports has been a powerful draw for Fox and will continue to be. Lachlan Murdoch noted that during Major League Baseball’s World Series and a heavy news cycle in October, Fox networks had 50% of the live primetime U.S. television audience. He added that in late September and early October, the one-two punch of Thursday Night Football and the Senate confirmation hearings of now-Supreme Court Justice Brett Kavanaugh meant that 74% of live viewers in the country were watching live content on a Fox platform.

The Murdochs aren’t the only cheerleaders for New Fox. The Disney deal helped drive 21st Century Fox stock to new highs, with shares up by more than 40% for the year. Some analysts believe there is even more room for growth.

Morgan Stanley media analyst Ben Swinburne estimates that with a leaner, meaner New Fox, the Murdochs will be able to grow affiliate fees for the remaining cable networks by 7% to 8% and retrans fees by about 18% annually.

“Secular headwinds in traditional TV are well known, and we believe Fox’s focus on exclusive sports and the ratings success at Fox News support its ability to drive higher affiliate revenue growth as a smaller portfolio of U.S. networks,” Swinburne wrote in a recent note to clients.

Overall, Swinburne predicts New Fox can generate about 10% adjusted cash flow growth annually, after a flattish fiscal 2019 due to increased sports investments, through fiscal 2023.

Sports will be key to that success. While the news division has driven strong growth over the years — Swinburne estimates that Fox News has grown its share of C3 household ratings from 3.5% in 2010 to 5.3% in 2018 — Fox’s 2013 decision to convert its Speed and Fuel TV networks to FS1 and FS2 helped drive a 40% increase in affiliate revenue between 2014 and 2018. Over the next five years Swinburne sees the sports channels growing affiliate revenue between 7% and 8% annually.

Room to Grow Fees, Retrans Cash

MoffettNathanson media analyst Michael Nathanson, although bearish on linear TV prospects in general, also noted in a recent research report that Fox has ample runway for affiliate fee and retrans gains.

While operating profits in fiscal 2018 were down significantly at the television unit — $362 million, compared to $894 million in the prior year — and will continued to be pressured in fiscal 2019 as increased sports costs are factored in, Nathanson said it would be a mistake to use that as a benchmark for the future.

That massive investment in sports “equates to an unrivaled negotiating hand that will lead to accelerated revenue growth over the next five years,” Nathanson wrote.

At current valuations, most analysts peg New Fox at between $9 and $13 per share, based on the $38-pershare price Disney is paying for the other Fox assets. But most see that valuation — roughly nine times estimated 2018 earnings — as missing the point.

In his report, Nathanson wrote that there is a danger that too much focus on near term numbers “clouds the view of the compelling story at New Fox,” adding that all signs point to strong growth ahead.

For Fox and the Murdochs, it’s just another case of being underestimated. We’ve all seen how that usually pans out.