Gray, Hearst, Graham, CoxReps Back New Matrix Sales Gateway

Development proceeds for Admiral, which automates converged ad sales

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Ad tech company Matrix Solutions said that Gray Television, Hearst Television, Graham Media and Cox Media Group’s CoxReps have made an investment in Admiral, a new Gateway Matrix is developing that will automate converged advertising sales.

Admiral initially will use software from Videa, the advanced advertising company shut down by Cox in 2020, as the back-end technology for traditional linear spot ads sales.

Matrix will use an open architecture platform as it builds out the rest of the product, which will manage sales of traditional spot, impression-based dynamic ad insertion in live linear, digital and over-the-top inventory from demand through order fulfillment.

Traditional local media is growing slowly, partly because it’s difficult and complicated to buy. “If we can start as an industry making it easy to understand, easy to execute and easy to measure, I’m a believer that we can then start capturing more of that advertising pie again,” Mark Gorman, CEO of Matrix Solutions told Broadcasting+Cable.

Gorman said that most of the ad sales systems have been designed for buyers. Stations throw their inventory into those systems but don’t have control over it.

“We’re a sell-side company and we’re building a product that allows our clients and our future clients to control their inventory,” Gorman said. “This is really about putting them in the driver's seat, being able to optimize their inventory and optimize their revenue.”

Matrix announced it was developing a sales gateway portal in 2019. Gorman said its plans have been enhanced by getting the financial backing and expertise from Gray, Hearst, Graham and CoxReps. Gray and Hearst have been using Matrix software, Graham has come aboard to help develop the new gateway.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Gorman said the gateway was originally being designed to help stations transition from selling based on rating to selling based on impressions, like digital. “But our clients said ‘listen, we need you to help us bridge the past to the future.”

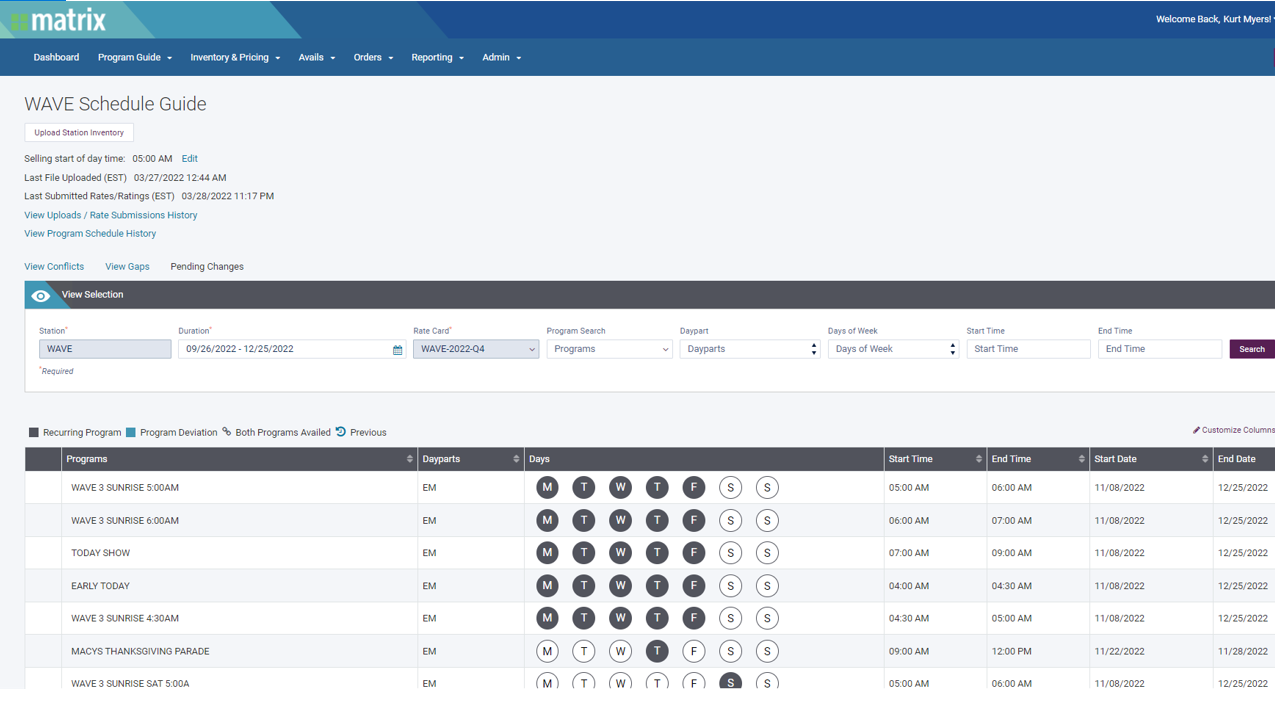

The product will provide an automated workflow that tracks all types of inventory demand, ingest RFPs and enables management to track available inventory, monitor pricing and maximize revenue.

Karen Youger, senior VP of sales operations for Gray Television, said it was unusual for the broadcast to work this way with a tech vendor. “We’ve used their CRM tools here at Gray very extensively and they’ve always been a really good business partner for us, so it was pretty easy to make the decision to move in this direction.”

Youger noted that the TV industry for years has been talking about creating a more frictionless ad pipeline and a gateway was vital to meeting that goal and solving what she called the “swivel chair problem” facing stations ad sales account executives.

“They’re getting orders and avails and information from so many different directions now, and having a sales gateway for them to focus on where everything can come in and converge in one place will help streamline that process and get them out selling,” she said.

Admiral will be able to handle buy-side aggregation, providing visibility into all available inventory; inventory management, build proposals and electronically negotiate with buyers, manage orders and take care of make goods and campaign management.

The Admiral gateway will be interoperable with Matrix’s Monarch media ad sales platform, which is being used by more than 85% of the top 25 stations groups in the U.S., according to Gorman.

The integration will mean that as a station sends out proposals through Monarch, it will automatically update the pipeline status and forecasting on Admiral. Because Admiral is being built on an open platform, stations using other CRM systems will be able to integrate with Admiral as well, Gorman said.

Matrix plans to build and release Admiral in phases. “I think a mistake that ad tech companies do make oftentimes is they try to boil the ocean with everything they develop,” Gorman said. “I have been very upfront with people that the first product we’re going to have is a product that works. You won’t have every bell and whistle, but we’re really determined to get something that’s usable out to the market and then over time expand on that product.”

The first phase of Admiral will cover traditional spot linear sales, building on the Videa software, which was handling about $800 million worth of revenue before Videa was shut down. Matrix has hired some of Videa’s engineers to get the product up and running, which is expected to be completed in the next six to eight months and in market by fourth quarter of 2022.

At that point, Matrix plans to start selling Admiral to other potential customers. Admiral is being developed by a subsidiary of Matrix called Matrix Sales Gateway LLC. Metrix Solutions is the majority shareholder and Gray, Hearst Graham and CoxReps all have stakes.

As Admiral is developed, Matrix plans to change out the Videa software front end in favor of its own technology.

The next phase of Admiral will be getting the digital and OTT workflows from beginning to end up and running, which should take another six to eight months

“All in all we’re saying within a year to 18 month, the initial release will be up and running,” Gorman said.

Later development will include impression-based linear with dynamic ad insertion workflows, execution systems for ATSC 3.0 and advanced reporting and analytics.

Gorman said Matrix Solutions is also working on a product for network advertising and can also see the product being used by global media companies.

“I have my sights set on world domination,'' he said.■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.