Gray TV to Buy Raycom for $3.6B

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Gray Television has agreed to buy Raycom Media for $3.6 billion, a move they say will create the single largest owner of top-rated TV stations in the country.

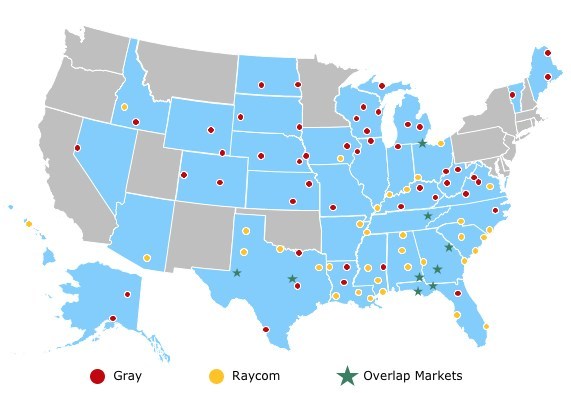

Gray, based in Atlanta, currently owns or operates about 100 stations in 57 markets, while Raycom owns or provides services for 65 stations in 44 markets. The cash and stock deal, expected to close in the fourth quarter of this year, will create a 142-station powerhouse in 92 separate markets, reaching 24% of the TV homes in the U.S.

According to Gray TV, the combined company would have 62 stations that are ranked No. 1 in all-day ratings in their respective markets, according to Nielsen, the largest concentration of top-rated stations owned by any single broadcaster.

Gray TV shares surged on the NASDAQ Exchange after the deal was announced, up 15% ($1.95 per share) to $14.75 each in early trading Monday.

To facilitate regulatory approval of the deal, Gray has agreed to divest stations in nine overlap markets – Knoxville, Tenn.; Waco, Texas; Albany, Ga.; Toledo, Ohio; Tallahassee, Fla.; Augusta, Ga.; Panama City. Fla.; and Dothan, Ga. Wells Fargo, which is underwriting a portion of the Raycom deal, will immediately begin to market those stations to third parties.

The deal comes on the heels of another mega-broadcast deal – Sinclair Broadcast Group’s pending $3.9 billion purchase of Tribune Media, which is currently winding through the regulatory approval process.

Related: Sinclair Inks Deal to Buy Tribune for $3.9B

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

In addition to stations, Gray also will receive Raycom Sports, a marketing, production and events management and distribution company; Tupelo Raycom, a sports and entertainment production company; RTM Productions, an automotive programming production and marketing solutions company; and Broadview Media, a post-production/digital signage company.

Raycom president and CEO, Pat LaPlatney, will become Gray's president and co-CEO, after the deal is completed, expected in about . LaPlatney and Raycom's former CEO, Paul McTear, both of whom are currently members of Raycom's board of directors, will join the new company ‘s board of directors. At that time, Gray chairman Hilton Howell will become executive chairman and co-CEO of the new entity.

"Combining our company with the excellent Raycom stations and the superb Raycom employees will create a powerhouse local media operation,” Howell said in a statement. “Together, this new portfolio of leading local media outlets will excel at what they do best, which is to provide the local news that local communities trust, the entertainment and sports content that viewers crave, and the incredible reach that advertisers demand. Indeed, this is a transaction in which there can be no doubt that local community standards will be honored and embraced."

Wells Fargo Securities, LLC served as financial advisor and Cooley LLP and Jones Day served as legal counsel for Gray. Stonebridge Capital served as financial advisor and Robinson Bradshaw and Covington & Burling served as legal counsel for Raycom.

"Together, we will be a stronger, more impactful force for our audiences, advertisers, and communities,” LaPlatney said in a statement. “I have tremendous respect for the way Hilton Howell and Gray Television have grown their portfolio with a focus on localism. I look forward to working alongside Hilton and the wonderfully talented people of Gray Television as the combined entities create an even greater opportunity for growth as a leader in the broadcast industry.”