GroupM Eyes ‘Modest’ Drop in ‘20 Global Ad Spending

Double-gains expected in 2021 in many large markets

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Giant media agency GroupM expects that global ad spending, not including U.S. political activity, will decline 11.9% during 2020, followed by 8.2% growth in 2021.

GroupM said the plunge in spending should be considered “modest,” given the impact of the COVID-19 pandemic on global GDP. As spending fell more during the global financial crisis in 2009.

Spending is expected to be down 20% in Brazil, 20% in Japan, 10% in Australia, 15% in France, 12.5% in the U.K, 5.1% in Canada and 1.8% in South Korea.

The agency expects ad spending to grow by double digits in half of the world’s top 10 markets, and by single digits in the other half of the biggest countries.

The forecast is based on countries taking steps, including “hibernation” policies for their economies, to slow the spread of the coronavirus.

“In our forecasts we assume that a vaccine will be developed and distributed by some time in the first half of next year, although even the world’s foremost experts are hardly certain,” GroupM said.

“In our forecasts we assume that a vaccine will be developed and distributed by some time in the first half of next year, although even the world’s foremost experts are hardly certain,” the agency said.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

TV advertising is expected to drop by 17.6% in 020, not including U.S. political advertising. It is expected to rebound with 5.9% growth in 2021.

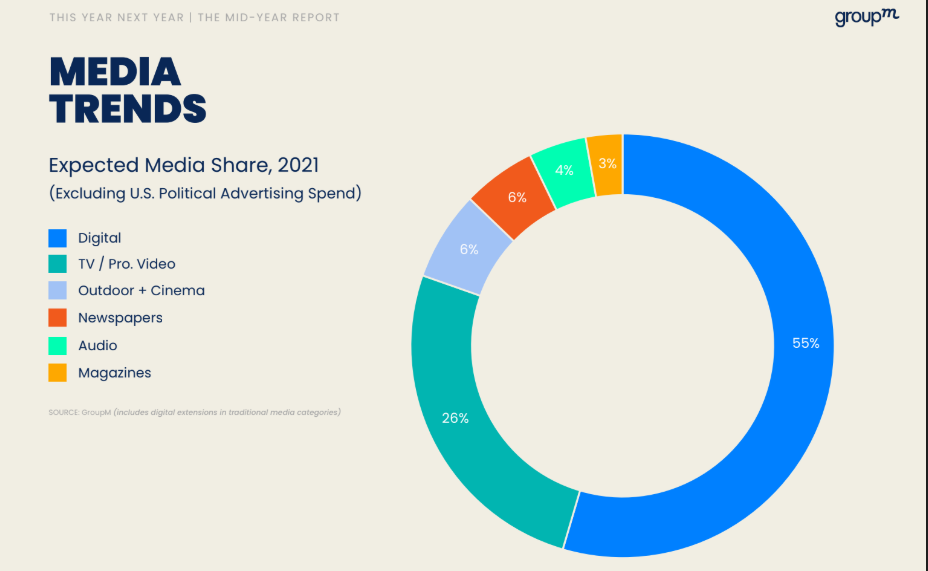

TV’s share of spending is dropping to 27% in 2020, from about 37% 10 years ago.

For 2020, GroupM is breaking out digital extensions of TV, radio, print and outdoor advertising as a separate estimate. GroupM said these digital extensions account for $31 billion in spending, or a 13% share of all advertising activity. That’s up from $22 billion, or 7% five years ago. Digital extensions of traditional television drew $12 billion in spending, or about 9% of global TV spending.

Digital advertising is expected to decline by 2.3% in 2020 after nearly a decade of double-digit growth. Digital’s share of ad spending is growing to 52% in 2020 from 48% in 2019 because traditional media was hurt even more by the pandemic.

Digital extensions of TV, including Hulu, Roku and other streaming video, will grow 3.7% in 2020 and 11.3% in 2021, accounting for about 9% of total TV spending.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.