GroupM Sees U.S. TV Ad Revenues Falling 2.4% in 2023

A continuing writers strike would favor media outlets with sports rights

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Giant media buyer GroupM forecasts TV ad revenue will drop 2.4% to $67.7 billion in 2023 amid a questionable economy and industry issues including the strike by the Writers Guild of America.

GroupM’s figure incorporates traditional linear television as well as what the agency dubs connected TV, which includes all digital ad supported revenue from networks, smart TV providers and pure-play apps, excluding YouTube.

In December, GroupM said it expected a 0.1% increase in TV ad spending

Traditional TV is seen dropping 4.7% to $62.8 billion. The drop is partially offset by 7.2% growth of connected TV in 2003. The agency expects connected TV growth to return to double digits in 2024, when an 11.6% gain is forecast.

By 2028, connected TV revenues are expected to hit $21.5 billion, GroupM said.

GroupM noted that first-quarter revenues were down for all of the major broadcast networks excluding the Olympics and Super Bowl, but that the auto category is expected to fuel a recovery in the second half of the year.

It might take a while for the writers strike to have an impact on streamers like Disney Plus, Netflix and Amazon Prime Video because many films are already in the can and international content won’t be impacted, while new episodes of late night shows and fall primetime scripted shows won’t be available to the broadcast networks.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

The disruption could ratchet up if the actors go on strike as well.

“We believe the largest media owners, especially those with sports rights, are likely best placed to be able to manage through an extended strike,” GroupM said.

Also Read: GroupM Unit Finds Addressable Ads Generate More Impact and Emotion

Sports accounted for 21% of all viewing in 2022, up from 15% in 2018, and Amazon, YouTube and Apple TV already have some sports rights and are likely to compete when future rights become available.

“If we take the recent example of pandemic-related production shutdowns, audiences proved remarkably resilient in time spent with media across gaming, library content and user generated content (remember sourdough starter tutorials?). But if more time spent (and media investment) shift to UGC as a result of writer and actor strikes, it may be a challenge to reverse it,” GroupM said.

The TV numbers were part of GroupM’s global This Year Next Year global mid-year forecast.

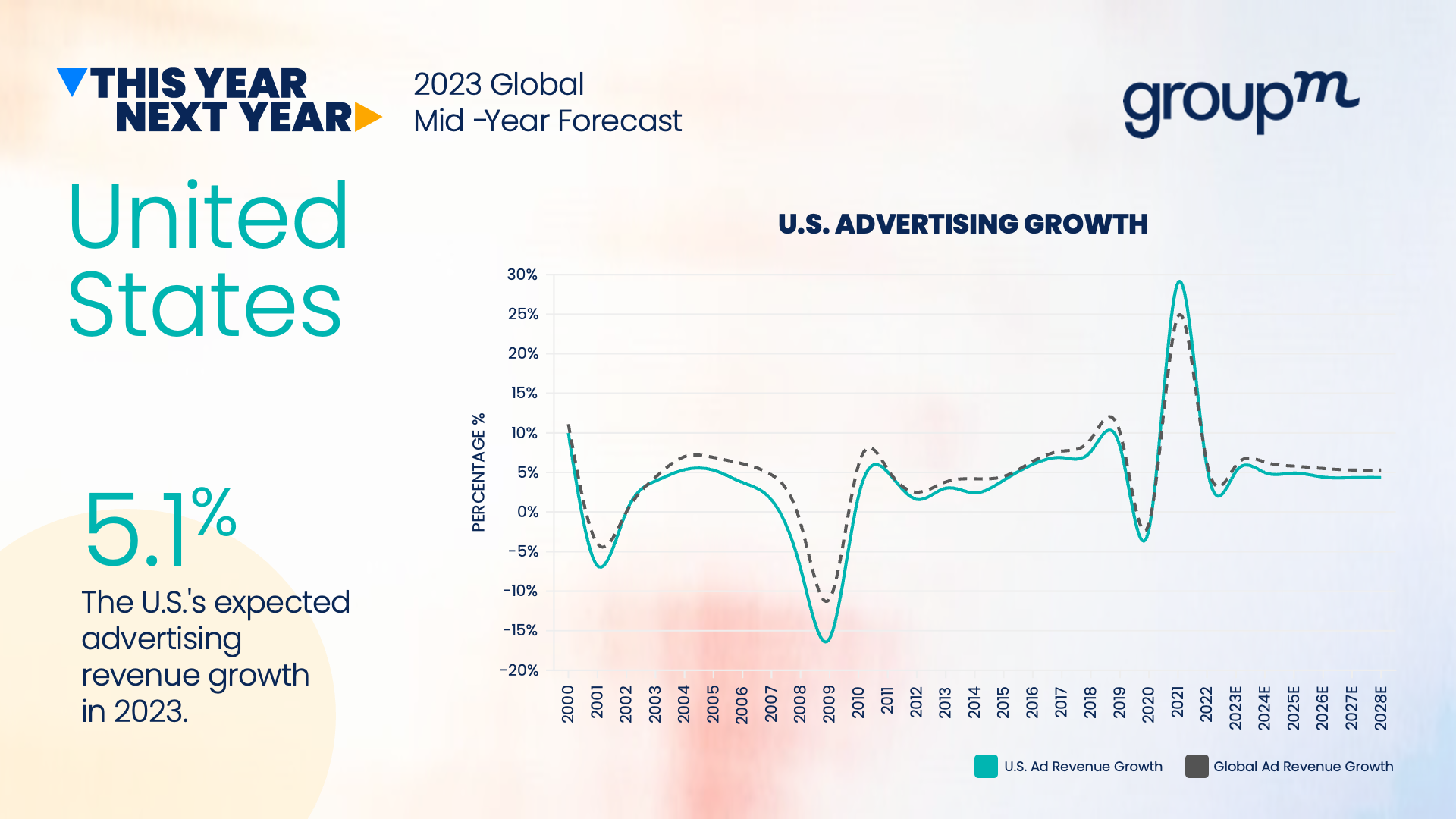

GroupM noted that overall, U.S. advertising has had a “lousy” six months since the agency’s December forecast. GroupM predicts ad revenue growth (excluding political spending) in 2023 to be 5.1%. Political spending is expected to total $2.8 billion.

Digital ad revenue in the U.S. is expected to grow 9.7% in 2023 excluding political. GroupM says one of the main drivers of digital growth is retail media, which is forecast to jump 13% to $37.9 billion in 2023.

GroupM’s global forecast is little changed from December with a 5.9% growth rate for 2023 and spending hitting $874.5 billion.

Global traditional TV revenue is forecast for a decline of 1.2%, excluding U.S. political advertising. By comparison, CTV revenue in 2023 is estimated at $25.9 billion, an increase of 13.2% over 2022 revenue of $22.9 billion. The global compounded annual growth rate for CTV through 2028 currently stands at 10.4% with expected revenue of $42.5 billion in 2028.

Retail media is expected to be the third-fastest growing advertising channel in 2023, behind digital out-of-home and CTV. Retail media, which GroupM defines as including ad revenue from last mile delivery services, will grow 9.9% to reach $125.7 billion in 2023, and is forecast to exceed TV revenue (including CTV) in 2028.

GroupM also says that AI is likely to inform, or touch in some way, at least half of all advertising revenue by the end of 2023. AI has long been used extensively across media optimization and, with new tools being developed by platforms and agencies, as well as the rapid development and deployment of generative AI technology, it will disrupt more elements of advertising and media.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.