GroupM Forecasts U.S. TV Ad Spending Edging up in 2023

Decline in traditional TV offset by growth in CTV

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

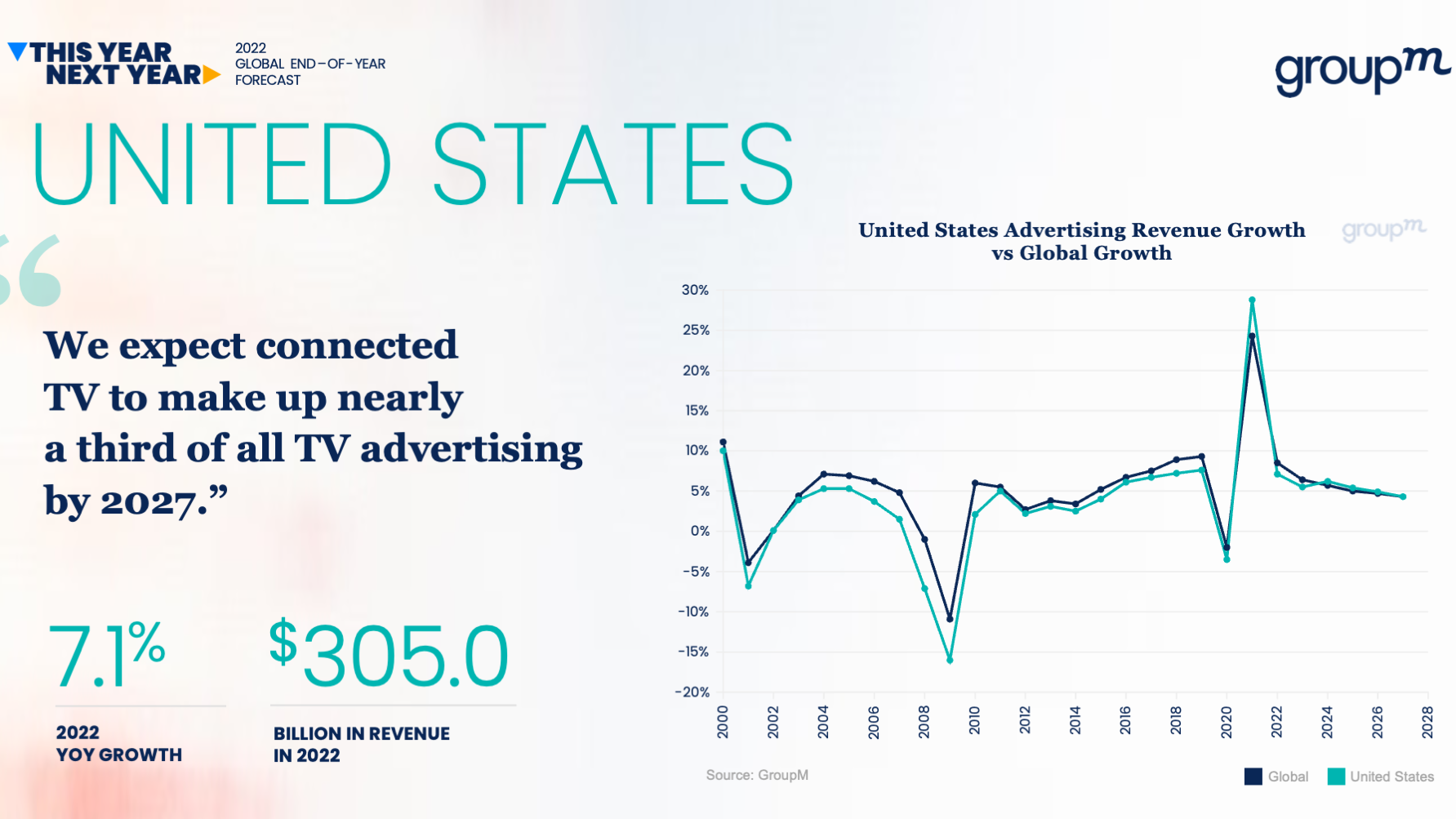

Media buyer GroupM expects ad spending on television and professional video will edge up 0.1% to $67.7 billion as part of a less optimistic forecast released Monday.

GroupM sees traditional TV down 3.8% to $64.4 billion in 2023, with the decline offset by a 19% increase in spending on connected TV to $13.3 billion.

The media buyer sees a similar pattern in 2024 and 2025, followed by overall TV and provide falling 0.5% in 2026 and dropping 1.3% to $67.4 billion in 2027. At that point, traditional TV will be falling 2.8% to $47.4 billion, while CTV will be increasing 1.8% to $20 billion.

Also Read: GroupM Sees Pay TV Reaching Less than 50% of U.S. Homes By 2025

Globally, GroupM execs TV and professional video advertising to grow 1.5% to $157.8 billion in 2023. And 2.7% to $162.1 billion in 2024.

Across all media, GroupM expects global advertising to grow 5.9% in 2023, a bit slower than inflation and down from a forecast of 6.4% growth GroupM made in June. Strong gains are predicted for connected TV, retail media and fast-growing markets including India.

Also Read: Magna Sees National TV Network Ad Revenue Down 6.3% in 2023

The smarter way to stay on top of broadcasting and cable industry. Sign up below

In the U.S., GroupM expects ad spending across all media to increase 5.5% to $321.9 billion. Barring an escalation of the war in Ukraine or another COVID-19-sized global disaster, Beyond that, GroupM expects advertising to increase 6.2% in 2024 before returning to a trend of decelerating mid-single-digit growth through 2027.

GroupM says the reduced global expectations are largely caused by developments in China.

The media buyer also notes a change in what it calls digital endemic companies.

Digital endemics could afford a “grow at all costs” mindset while the cost of capital was cheap, GroupM said. “But as central banks globally have raised interest rates this year, venture capital funded companies and newly public companies have had to become more conservative, and we have seen a significant deceleration in sales and marketing expenses across this category. There is also an element of maturation among this group that has likely led to deceleration in advertising growth.”

GroupM notes that retail media is expected to reach $110.7 billion this year, an upgrade from a prediction of $101 billion made in September. Retail media will grow another 10.1% to $121.9 billion in 2023.

Media buyer Zenith also released a global ad forecast and predicted 4.5% growth in 2023.

Zenith expects the ad business to be resilient despite the current economic headwinds, with the expansion of new channels such as retail media and advertising on subscription video on demand (SVOD) services being strong spots.

Zenith estimates total video ad spending will make up 30% of the overall advertising market and will grow at a 4.8% compounded average growth rate between 2022 and 2025, supported by the growth of advertising on platforms such as SVOD, FAST and all other AVOD, which includes platforms such as YouTube and TikTok.

Advertising on SVOD services will grow strongly, reaching $13.1 billion in 2025 at a compounded average growth rate of 27.9% from 2022 to 2025. While the launch of advertising on Disney Plus and Netflix has gained the most attention, other platforms are likely to follow suit.

Retail Media, which consists of display and search advertising on e-commerce sites and/or the online sites of traditional retailers, will also drive significant growth as retailers increasingly focus on retail advertising solutions. Outside of China, where Retail Media is already prevalent, Retail Media is expected to grow from $39.2 billion in 2022 to $64.2 billion in 2025, representing a compounded annual growth rate of 17.8% over the period. ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.