Hastings: Netflix Growth Due to ‘Tipping Point’ in Content Choices

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

During his company’s fourth-quarter earnings presentation Jan. 18, NetflixCEO Reed Hastings was asked if specific shows are the explanation behind the company’s continued subscriber growth. His answer: Not exactly.

“Very few people will join Netflix for just one title, but there's a tipping point, one more title you’re hearing about, that causes you to join,” he said.

To end 2016, Netflix’s worldwide subscriber membership hit 93.8 million, with the streaming giant adding more than 7 million net new subscribers, beating the company’s forecast of 5.2 million, and up from the 5.6 million the company added in the fourth quarter of 2015. More than 1.9 million of those net adds came in the U.S., beating a forecast of 1.45 million (and up from 1.56 million during the same quarter in 2015).

Related: 'Comedians in Cars Getting Coffee' Shifts to Netflix

International subs grew by more than 5.1 million, beating a forecast of 3.75 million, and up from just over 4 million in the previous fourth quarter.

And the company is nowhere near done: For the first quarter, Netflix expects to add another 1.5 million subscribers in the U.S., and as many as 3.7 million internationally, thanks to further expansion in Europe and Asia.

Yes, the addition of offline viewing in the fourth quarter was a draw for new subscribers, as was the integration of Netflix in Comcast’s X1 set-top boxes, making Netflix content easily navigated by Comcast subscribers, but Hastings and Ted Sarandos, chief content officer for Netflix, kept coming back to the same thing: Content is king.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Related: Analyst Downplays Disney’s Need to Acquire Netflix

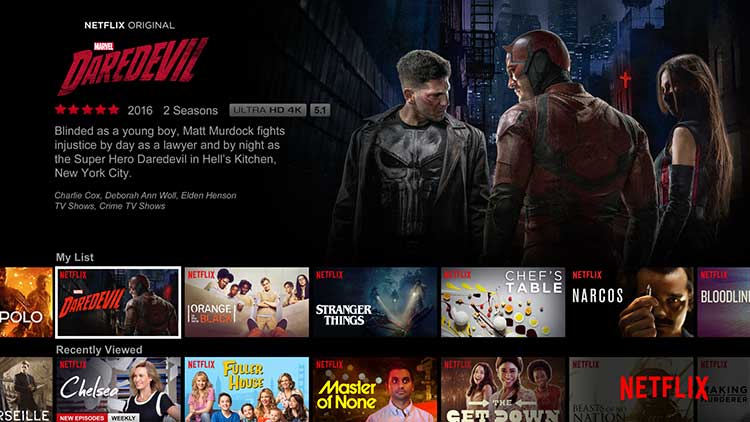

“We had particularly powerful releases in the fourth quarter,” Sarandos said, pointing to Marvel and other original titles. “We still have 42 originals to launch during this quarter.”

In 2016, Netflix produced approximately 600 hours of original content, and in its last letter to investors, said 1,000 hours of original content were in line for 2017. On Jan. 18, analysts on the earnings presentation suggested that number may be conservative.

“Yes, it’s a lot of volume, but it’s also a lot of quality consumers are falling in love with,” Sarandos said.

Wall Street reacted favorably to the company’s quarterly profit of $67 million (on revenue of $2.5 billion), with after-hours trading sending company stock past the $140 mark. 2016 saw Netflix generate $8.3 billion in worldwide streaming revenue, up 35% year over year, with the company’s 93.8 million members a net growth of 19 million subscribers, up 1.6 million from 2015. That was despite Netflix upping its monthly subscriber fee from $7.99 to $9.99 over the summer, a move that caused some subscriber losses, but only in the short term.

“Yes there was a reaction to the price change, but we got a lot of those subscribers back,” Hastings said. “The big picture is remarkably steady.”

With the first quarter of 2017 marking Netflix’s 10-year anniversary in the streaming space, Netflix’s statement to investors made note of how internet video has tread into the traditional, linear TV arena, and how Netflix is still working to “remain a leader” in the space.

“It’s becoming an internet TV world, which presents both challenges and opportunities for Netflix as we strive to earn screen time,” the statement read.