High RollersPlacing Their Bets

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

RELATED: Top 25 Station Groups 2013

The story of today's hot TV station trading market starts with two words: retransmission consent. It’s a phrase that sets teeth gnashing among everyone involved, from the stations and broadcasters who must forge tough deals to the viewers who must sometimes deal with the tough reality of missing important shows and sports events when those retrans negotiations don’t go smoothly.

These days, obtaining the highest possible retransmission fees is the sign of a well-run broadcaster. And the injection of that money back into the station market is the biggest reason that stations are again being sold.

“Cash-flow growth has come back to the industry, and the principal reason that’s happened is because of the evolution of the retrans revenue stream,” says John Tupper, head of Hilton Head, S.C.-based investment firm Kepper, Tupper and Co. “After the network’s share is deducted, 100% of that revenue falls to the station’s bottom line.”

Retrans deals may be a prime mover in the uptick of station trading, but other factors have evolved to make this something of a renaissance period for acquisitions. Everything from the brightening economy to deeper post-election pockets to hungry private equity firms has been a contributing factor.

And retrans numbers have only increased stations’ value, whether they are on the trading block or not.

“In 2009, the average retransmission consent fee was somewhere between 8 and 15 cents per subscriber. Now, it’s somewhere between 50 and 70 cents,” says Erik Brannon, an analyst at research firm IHS Inc. “Fifty or 70 cents across 2 million subs may not sound like a lot of money. But when you consider the total reach across all station groups, we’re talking $135 million to $150 million in retrans fees paid to broadcasters every month.”

Battle Scars

It’s an end result—after often tough fights—that might not have ever been anticipated back on Jan. 1, 2005, when Nexstar CEO Perry Sook pulled his station group’s signals off the air in Abilene, San Angelo and Texarkana, Texas and in Joplin, Mo., rather than allow them to stay on the air without being paid a persubscriber fee by the local cable operators.

The battle was long and hard, and ultimately cable operators in those four markets lost up to one-third of their subscribers to direct broadcast satellite (DBS) competitors. In the end, Nexstar cut retransmission-consent deals with about 150 distributors of its stations’ signals.

In 2009, Chase Carey returned to News Corp. after a stint running DirecTV. By December of that year, Carey had made it his mission to extract the value for the Fox-owned TV stations that he thought they warranted. Fox also faced protracted, bloody battles, but today the Fox stations are paid well for their signals.

“There’s been explosive growth in retransmission consent fees,” says IHS’ Brannon. “It’s fair to say that total annual revenue from [retrans] fees [is] somewhere in the neighborhood of $1.5 billion and $2 billion and growing.”

Politics also led to the very strong years enjoyed by many stations in 2010 and 2012, mostly due to election advertising. In 2010, politicians were !ghting tough midterm elections battles, while 2012 saw a drawn-out presidential campaign.

“That’s courtesy of the Citizens United decision,” says Tupper, referring to the Supreme Court decision that found corporations possess free-speech rights which allow them to spend money for or against candidates and issues. “That [decision] opened up the political coffers.”

And while the economic recovery has been slow, it also has been steady enough to help buyers’ prospects, although not as much as other factors.

“Money’s been cheap for quite a while,” says Tupper. “But the availability of money for the acquisition of TV stations is still not where it was.”

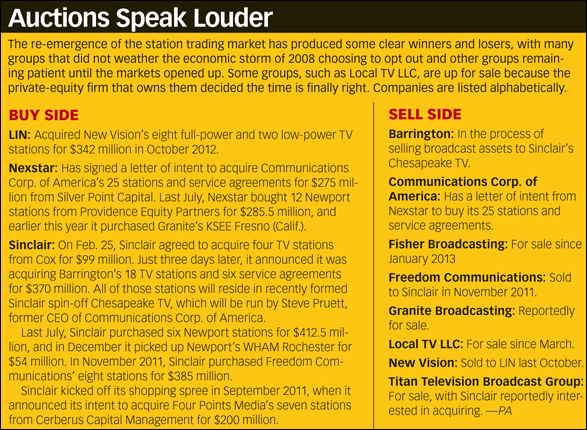

That has limited a lot of station trading to groups that can pull off the bigger deals, such as LIN’s purchase last October of New Vision Broadcasting’s eight fullpower and two low-power stations for $342 million, or Sinclair’s deal last month to acquire Barrington’s 18 TV stations and six service agreements for $370 million.

Size Matters

Groups doing deals in the hundreds of millions can access the bond markets, which need the deals to be very big in order to be attractive.

“Bond markets will only deal with you if you are dealing with a transaction size that is big enough to create a fee that’s worth the !nanciers’ while,” says Tupper. “If you do a $10 million bond offering, no one makes any money.”

That dynamic also is leading to the big getting bigger, as B&C’s Michael Malone pointed out in his Jan. 31 cover story, “The Rise of the Station Super-Groups.” Groups such as Sinclair or Nexstar gain substantial efficiencies when acquiring syndicated programming, Nielsen data or even healthcare for employees if they are very big.

“[Those efficiencies] can amount to a 10%-15% revenue jump and a 10% expense cut,” says Larry Patrick, founder and managing partner of Patrick Communications. “There are cases where the seller will say that they sold a station for eight times cash flow, and the buyer will say after we take over and make adjustments the deal becomes 5½ times cash flow. That’s why some of the more aggressive people want to get so big.”

Playing the Waiting Game

Another factor coming into play is that private-equity firms have been sitting on the sidelines, waiting to sell stations that they acquired several years ago. That’s why Silver Point Capital is selling Communications Corp. of America, why Oak Hill Capital Partners last month put Local TV LLC on the block, and why Providence Equity Partners unloaded Newport Television last summer.

“Local TV has done well, they’ve increased the stations’ operational revenues, they’ve added a station here and there and they will get a very nice return,” says Patrick. “Private equity is usually a five-to-seven-year horizon, and when they hit their numbers they want out. Three years ago, they couldn’t sell because the economy was so bad and there were no buyers.”

Even with all of the deals getting done and the FCC’s spectrum auction on the horizon (see “Spectrum Speculation,”), many broadcasters still just want to run strong local businesses that serve their communities.

“What I think is important is that while TV stations face a lot more competition for viewers and for advertisers, they are still an important part of the local media mix,” says Mark Fratrik, VP and chief economist at BIA/ Kelsey. “When the car dealer in Wausau, Wis., wants to advertise that they have a 72-hour sale, they’ll still use local TV stations as part of their local media mix. Local advertisers who want to reach their local audiences generally need to use local television.”

E-mail comments to palbiniak@gmail.com and follow her on Twitter: @PaigeA

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Contributing editor Paige Albiniak has been covering the business of television for more than 25 years. She is a longtime contributor to Next TV, Broadcasting + Cable and Multichannel News. She concurrently serves as editorial director for The Global Entertainment Marketing Academy of Arts & Sciences (G.E.M.A.). She has written for such publications as TVNewsCheck, The New York Post, Variety, CBS Watch and more. Albiniak was B+C’s Los Angeles bureau chief from September 2002 to 2004, and an associate editor covering Congress and lobbying for the magazine in Washington, D.C., from January 1997 - September 2002.