Home Shopping’s Second Act

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

In the race to pick the pandemic’s winners and losers, some executives argue that the deadly crisis could make home shopping and e-commerce a more important part of the TV industry.

In sharp contrast to the difficulties faced by traditional media businesses, which have been roiled by slumping ad revenue, layoffs and production shutdowns, government-mandated stay-at-home orders have boosted TV viewing, producing a marked rise in home shopping for products that consumers normally buy in shuttered brick-and-mortar retail outlets.

RELATED: Pandemic Changes the Home Shopping Mix

“The stay-at-home orders are producing a seismic shift in the way consumers shop,” said Brian Meehan, co-founder and chief operating officer of Knocking, a content creation and commerce company that works with media partners like Univision Communications, Cox Media Group and Sinclair Broadcast Group on their e-commerce efforts. “Every day is now Cyber Monday, and every day is bigger than the last.”

Meehan and others contend the crisis could prompt a wider shift towards e-commerce in the media sector. Knocking founder and CEO Markus Reinmund said a long-term decline in traditional linear TV advertising, accelerated by the pandemic, will push media companies to find better ways to monetize their content.

“In a short, two-month time frame, stay-at-home orders have really accelerated the long-term trend in consumer markets towards home shopping,” Reinmund said. “Consumers have more time to engage with media and TV viewing is up. But media companies are not profiting from this because they are seeing a dramatic decline in ad revenue. So, finding ways to be less dependent on ads and actually earn a share of the consumer spending is becoming a very attractive idea.”

Interest in that idea can be seen in efforts by Qurate Retail, NBCUniversal, Univision, ABC, Amazon Studios and Discovery, as well as major TV-station groups like Sinclair and Cox Media.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

“The overall market for home shopping and selling direct to consumers is obviously something that will only continue to grow,” NBCUniversal executive VP, head of marketing and advertising creative Josh Feldman said.

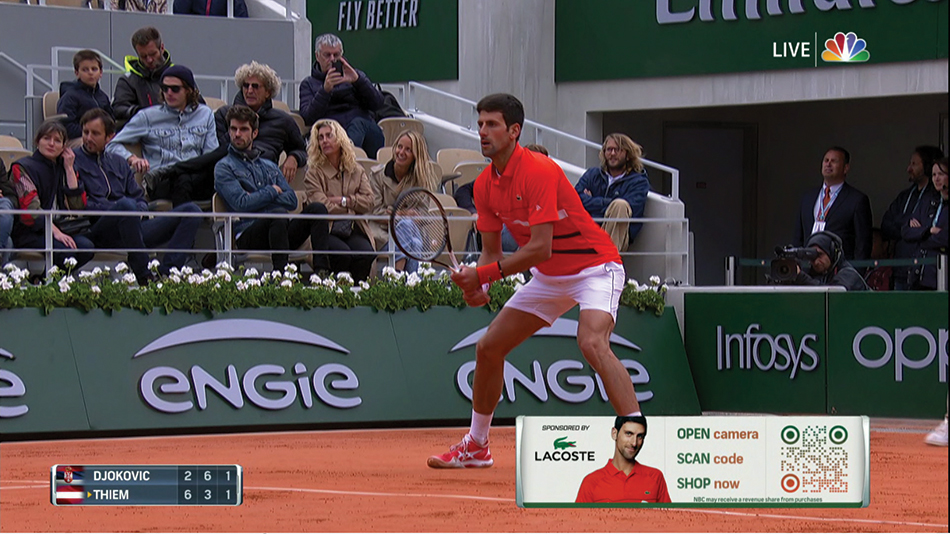

Last year, Comcast-owned NBCU launched ShoppableTV, which encouraged consumers to use their smartphones to buy products while watching such programming as French Open tennis, the Tour de France cycling race, Songland and Very Cavallari simply by taking a photo of a code on the screen.

This June, NBCU will dive even deeper into e-commerce with the launch of the NBCUniversal Checkout commerce system, which will simplify the process of buying goods via ShoppableTV content and branded videos and web articles.

Clicking with Commerce

In the pandemic’s early days, though, much of the e-commerce growth has been gobbled up by the already dominant giant online retailers. Amazon, for example, reported $75.5 billion in net sales of goods and services in the first quarter of 2020, up 26% from a year earlier, with net sales from its online stores hitting $36.7 billion in Q1, up 24% from Q1 2019. The tech giant has forecasted an 18% to 28% jump in total net sales for Q2 of 2020.

How much of this growing market can be captured by TV companies is open to question, given that most of the industry has little experience with retail. It’s also unclear if the growth in e-commerce makes up for lost ad revenue from brick-and-mortar retailers that are in increasingly precarious financial straits. Retailers accounted for 14.5% of the TV ad spend in 2019, MediaRadar estimated.

A recent survey by Elevate at the media research and consulting firm SmithGeiger found 46% of Americans were spending more time shopping online. Half of the people sampled also said they spent more time watching TV for entertainment, and 41% noted that they were watching more local news.

“The shift in shopping patterns is here to stay,” noted Andrew Finlayson, executive VP of digital strategies at SmithGeiger, which does work for Knocking. That, in his view, opens up e-commerce opportunities for TV companies. “Consumers that were resistant and not shopping at home now have the full experience of doing it and in many cases might be continuing this behavior in the future.”

Another trend driving increased interest is the growing use of streaming platforms. In the first quarter, Roku had 39.8 million active accounts and time spent streaming as up 49% year over year, VP of content distribution Tedd Cittadine said.

“This is having a positive impact lifting the viewership for many of our channel partners, including the home-shopping channels that have seen, on average, double-digit increases in viewership time during the first three months of 2020,” he said.

Viewership gains are welcome news for traditional home-shopping channels, which have struggled in recent years because of larger industry-wide declines in pay TV subscriptions and linear TV viewing.

In 2019, Qurate Retail, which owns QVC and HSN, reported a 4% drop in sales to $13.46 billion.

iMediaBrands, the owner of ShopHQ and the Bulldog Shopping Network, saw even bigger declines, with net sales of $501.8 million for the fiscal year ending Feb. 1, 2020, down from $596.6 million in fiscal 2018.

Qurate Retail responded to the decline with a major expansion in digital operations. In August 2019, it launched a live streaming app with on-demand video and six channels on Roku and Amazon’s Fire TV. The Roku app now has more than 3 million installs, making it one of the platform’s top 25 free apps, said Todd Sprinkle, QVC’s senior VP of brand creative and production.

Qurate brands also have bolstered their presence on social-media platforms such as Facebook, Instagram and YouTube, with over 350 hours of content each week on Facebook Live; added linear streams on smart TV platforms like Samsung TV Plus and LG Channel Plus; and an expanded presence on local broadcast stations.

“Over the years, the model has evolved from linear TV into a multiplatform shopping experience that spans web, broadcast, mobile and social platforms,” QVC’s Sprinkle said. “We can reach a greater proportion of households today than we could 10 years ago,” even with multichannel cord-cutting.

Since the start of the pandemic, Sprinkle said, “we are seeing increased interest online in items that are helpful in the home,” with page views for a number of items increasing in March. Categories upwardly affected include food (up 66% from a year earlier on QVC and 48% on HSN.com), home-office gear (77% on QVC.com and 234% on HSN.com), wellness (up 143% on HSN.com) and health and fitness (up 126% on HSN.com).

Check It Out

These trends are occurring as a number of major programmers are rethinking their business models with new ad products and e-commerce applications.

Early efforts in that direction seem promising, with companies like Knocking, Univision and NBCU reporting successful e-commerce efforts.

“We’ve had an incredible response with the conversion rate of ShoppableTV being around 30% higher than the average e-commerce conversion rate,” NBCUniversal’s Feldman said.

Next month’s launch of NBCUniversal Checkout will further strengthen those efforts] by simplifying the creation of e-commerce offers and streamlining the consumer experience, Feldman said.

RELATED: Working for Pandemic Relief

Checkout is part of NBCU’s On Platform ad offering and its larger push into advanced advertising systems.

“Checkout can turn any branded video or web article into a native shoppable experience,” he said. “You can go to a video of a holiday gift buying guide and buy multiple brands in one checkout in the most frictionless way without the viewer ever leaving the environment they came for.”

A shift in viewing and consumer focus towards digital media and streaming should make such efforts even easier.

Univision, for example, currently has e-commerce offerings for national linear TV, local TV stations, online, social media and radio. “Being on multiple platforms was a key part of our strategy from the start,” Univision Local Media senior VP of growth initiatives John Buergler told Multichannel News.

In June of 2019, Univision partnered with Knocking to launch Gangas & Deals, a digital shopping market for Hispanics, with six- to eight-minute segments featuring upcoming brands on the morning show Despierta America. As part of the multiplatform efforts, Univision posts clickable materials on Instagram, where consumers can easily buy products.

Adding e-commerce options to the video on streaming platforms would be a logical next step that would greatly simplify the purchasing process, though Univision and most other media companies have not yet made that move.

Discovery’s Food Network Kitchen subscription video-on-demand service launched last October on Amazon’s Alexa, Fire TV and other platforms with features that would allow users in select markets to buy ingredients for some of its cooking show lessons.

And Amazon Prime Video’s original series Making the Cut with Heidi Klum and Tim Gunn, which premiered in March, allows viewers to purchase fashions featured in the competition show.

Data-Driven Dollars

Cittadine said Roku’s connected-TV platform already has a number of attractive features for e-commerce. The Roku Pay setup, used to buy app subscriptions on the platform, can streamline the checkout process, and Roku’s extensive data collection and analytics efforts could help companies promote their products, create targeted ads and develop more compelling e-commerce strategies.

“We’re still in the early days of shopping on streaming services,” Cittadine said. “But you can imagine the opportunities this creates when you can target the right consumer who is looking for a product with embedded purchasing power and interactivity.”

That makes improved data and measurement of audience engagement one of the key opportunities surrounding e-commerce efforts.

Last fall, Knocking began testing short, one-to-three-minute “Local Steals & Deals” segments that could be placed in local newscasts. In March, it fully launched the product, which now airs on stations owned by TV groups including Cox Media and Sinclair.

The exact format is up to the stations. Typically, a local anchor or personality will introduce the segment, which is produced by Knocking and hosted by former QVC personality Lisa Robertson. Local Steals & Deals features upcoming brands selected by Knocking and is typically part of the newscast or show, rather than an ad.

The segments are crafted as editorial content, with brands that have compelling stories about the entrepreneur behind the companies or the causes they support, rather than straight product pitches, Knocking executives said. As editorial content, they also don’t have to take away from ad time and have the long-term benefit of providing valuable data about the consumers.

“It is a fundamental shift in the business model for media,” Knocking’s Reinmund said. “Instead of just exposing them to an ad, I can go way beyond that. I’ll have actionable deep-engagement data and I can build a relationship with a consumer that will be much deeper and more valuable.”