Hulu Buys AT&T Stake in JV for $1.43B

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

AT&T said it has sold its 9.5% interest in streaming video service Hulu back to the joint venture for $1.43 billion.

Hulu was formed in 2007 by a partnership between The Walt Disney Co., 21st Century Fox, Comcast and Time Warner Inc. Disney, which had already owned 30% of the joint venture, acquired Fox’s 30% interest in the service when it closed its $71.3 billion purchase of several Fox assets last month. AT&T assumed the Time Warner interest when it acquired that company last year. Since that time, AT&T had said it determined the Hulu interest was not a core asset. Comcast, which owned a 30% interest in Hulu, is expected to keep that stake.

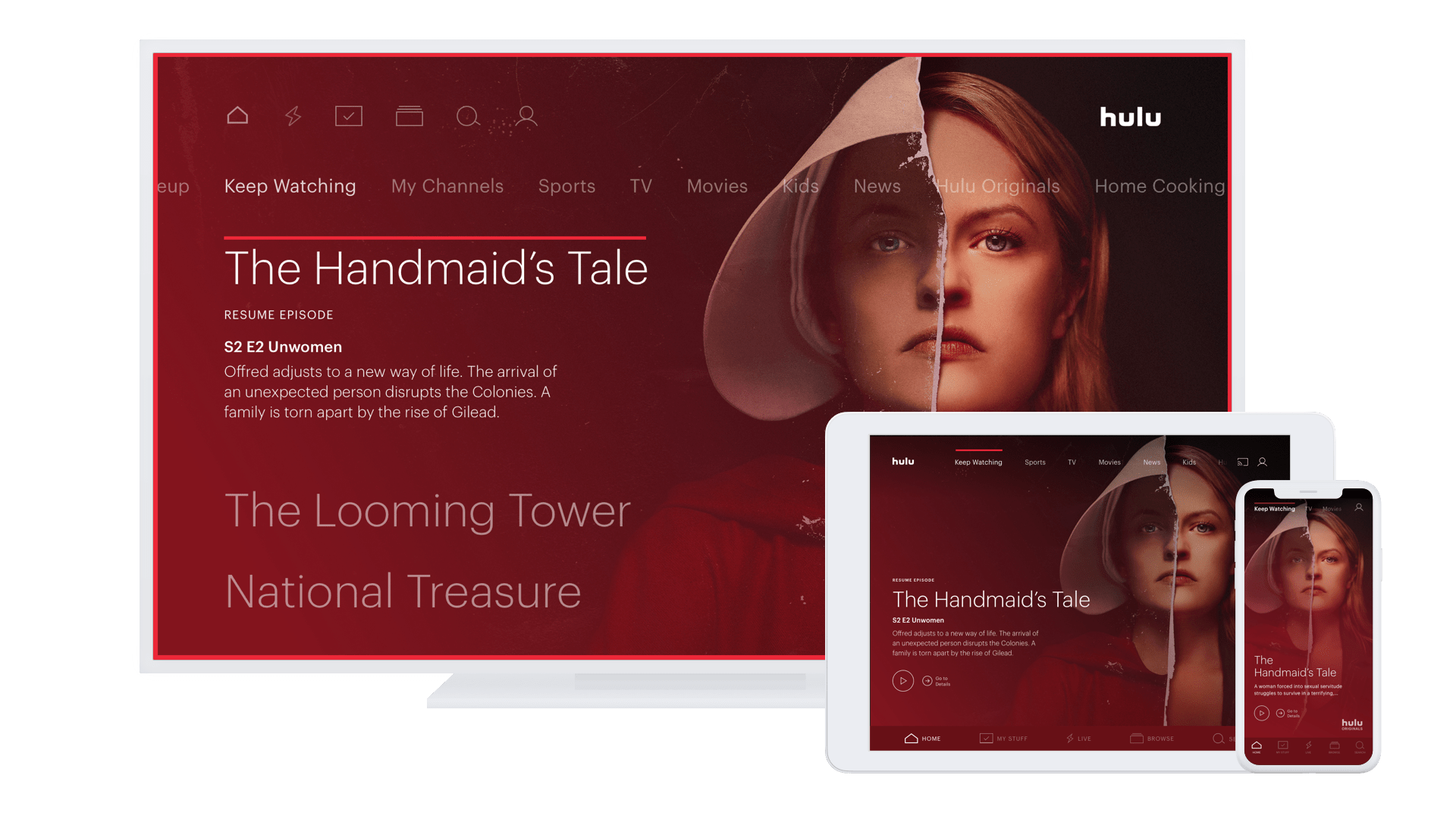

Hulu has about 25 million customers across its three services — an ad-supported streaming offering, an ad-free offering and Hulu With Live TV, an OTT service that includes live programming from several networks. Disney, which has a 60% controlling stake in the service, has said it plans to boost subscribers to between 40 million and 60 million by 2024.

The deal values Hulu at about $15 billion. The two remaining owners of the service — Disney and Comcast — will have to work out how AT&T’s 9.5% interest will be allocated over the coming weeks. AT&T said the transaction did not require any governmental or other third-party approvals and was simultaneously signed and closed.

“We thank AT&T for their support and investment over the past two years and look forward to collaboration in the future,” Hulu CEO Randy Freer said in a press release. “WarnerMedia will remain a valued partner to Hulu for years to come as we offer customers the best of TV, live and on demand, all in one place.”

AT&T said it will use proceeds from sale, along with additional planned sales of non-core assets, to reduce its debt.

The smarter way to stay on top of the multichannel video marketplace. Sign up below.