Is Bob Iger Really Feeling the 'Squeeze' From John Malone? Well, So Far, Charter's Down More Than Disney on Wall Street

The media conglomerate did get one notable price-target cut Tuesday, but the narrative that it's the one taking it on the chin seems premature

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

In the TMT business, stalled negotiations between companies are often distilled and hyperbolically dramatized by the business press into epic, personal showdowns between celebrity moguls.

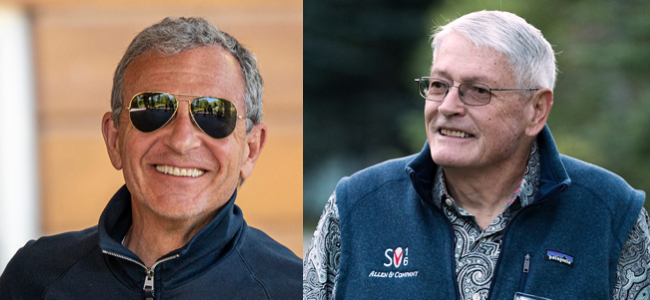

Take Tuesday's headline from The Information, which paints Charter Communications as getting the drop on Disney amid their epic distribution showdown: "John Malone’s Charter Squeezes Disney at Vulnerable Moment."

Certainly, there's plenty of evidence to suggest that the carriage dispute further complicates the path forward for Disney CEO Bob Iger, who was already trying to transition flagship channel ESPN to direct-to-consumer distribution amid declining linear revenue ... at a time when his company's investors are sensitive about high DTC losses.

Not having several billion dollars in affiliate fee money from Charter would make that gambit exceedingly harder.

As for Malone's cable empire, which was like everyone else in cable already beginning to cool to low-margin bundled video, The Information asked, "What does Charter really have to lose?"

We can imagine that before he escalated his ill-conceived culture war with Disney, Florida Governor Ron DeSantis asked himself largely the same question!

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

Disney and Iger are indeed formidable opponents in any standoff that is heavily based on PR. And in an era in which its high-speed internet customer growth has slowed to a trickle, Charter certainly could lose something by alienating a bunch of subscribers in the middle of football season and forsaking what is still a proven ISP churn-buster, video.

As for Wall Street's early take, it doesn't appear that Disney is getting the worst of things in the five days since its channels were removed from 14.7 million Charter Spectrum pay TV homes.

Wells Fargo analyst Steven Cahall did cut his price target for Disney by more than $30 Tuesday, but he stuck to his "overweight" rating for the company and predicted that investors would eventually overlook the short-term challenges of "an IP powerhouse" that is simply "down on its luck" at the moment.

Disney stock is only down 2.3% since Thursday when the Charter blackout began.

As for Charter, Tuesday presented no major equity analyst downgrades are price-target shifts. But for a cable company in the middle of a pricy network upgrade and high capex cycle, growth doesn't come easy, either.

Charter's shares are down nearly 6% since Thursday.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!