Is It Time for Streaming Video to Play Moneyball?

How will streaming services consistently identify, acquire and develop projects that resonate? That’s going to require ever better ways to measure and predict success

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

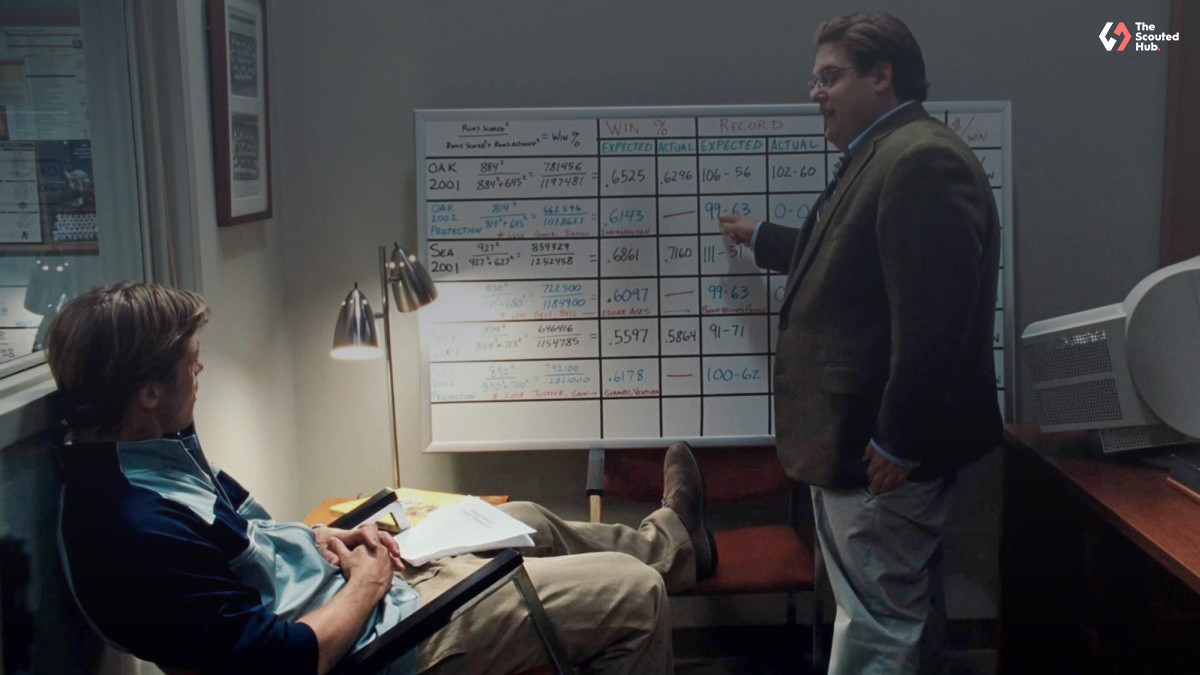

Nearly 20 years ago, author Michael Lewis captured a tectonic shift in America’s Extremely Fusty Pastime as Major League Baseball sloooowwwllllly began moving to a more data-driven approach to evaluating talent. His best-selling book, Moneyball, also became one of those always-gotta-watch-when-it’s-on movies, a wonky and unlikely hit in 2011 for Sony, starring Brad Pitt as Billy Beane, general manager of the perpetually cash-strapped Oakland A’s.

The book tracked baseball’s painful shift in understanding a new, numbers-first path to success (though pioneer “SABRmetricians” such as Bill James already had been writing about it since the early 1970s). Moneyball relied on new statistics that are more closely tied to a team’s real success. Thus, stolen bases became less valuable (unless you succeed at least 70% of the time), while lots of walks (both those given up by pitchers, and those earned by batters) became far more important.

Beane used those stats to find and sign undervalued players at a time when other teams relied on batting average, ERA and RBIs to figure out who was “good.” Using a Moneyball-informaed approach, the A’s had outsized success, especially given its micro-sized payroll, for a number of years before the rest of MLB caught on. Subsequently, we’ve seen an explosion of new measures across many sports, as executives facing gigantic labor costs and high expectations rethink how to value which players contribute in meaningful ways.

Two decades after Lewis’ book, Hollywood is finally stumbling into the Moneyball era of streaming video. It’s time, especially now that Netflix has corrected course, and Wall Street is finally looking beyond dumb old stat lines like subscriber additions.

Hollywood’s equivalent of the Oakland A’s is, improbably, Warner Bros. Discovery, though no one’s confusing CEO David Zaslav for Brad Pitt.

Laboring under WBD’s $53 billion debt load, and promises to whack $3 billion from the company, Zaslav cast a skeptical eye at HBO Max’s very expensive lineup and said: ‘Hmmm, we gotta bunch of shows that each cost tens of thousands of dollars to carry but get no hits (er, views). Time to waive them.”

And thus, American Pickle, old episodes of Sesame Street, and Batgirl were sent to the showers, possibly never to be seen on a Major League roster again. The uproar across Hollywood was loud and predictable, many creators upset by Zaslav’s green-eyeshade approach, his reduction of the creative efforts by hundreds of people to a few brutal (and still secret) numbers.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

Unfortunately for creators, Moneyball is definitely the future for streaming services, as CEOs, investors and others start looking at those new stats to see how well money is being spent in the Streaming Wars.

Average revenue per user is starting to matter, but so too is a useful questioning of one of the internet’s long-held beliefs, in the Long Tail. Everything has an audience, somewhere, the Long Tail suggests. Making everything you have available and find-able can build big audiences out of lots of little niche ones. Zaslav begs to differ, and perhaps others will start to do so, too.

It was one thing to carry some deadwood projects when your team had a rich, absentee owner, as Warner Media did when it was part of AT&T.

Back then, Warner Media was something like the Los Angeles Angels, whose rich owner devoted mammoth sums to a handful of truly great players (Mike Trout, Albert Pujols, Shohei Otani) but forgot to fill out the rest of the roster adequately.

The Angels have made the playoffs only once 2009, and Arte Moreno is now trying to make like AT&T, and sell the team.

Netflix, by contrast, has acted much like the Los Angeles Dodgers, spending heavily, but deeply informed by its copious data. After April’s brutal course correction, even Netflix has begun to spend a little more carefully, Co-CEOs Reed Hastings and Ted Sarandos have promised.

Everybody else faces even more complications, working from smaller “payrolls,” and needing to be more cost-efficient in their programming choices. Simply put, how will streaming services consistently identify, acquire, and develop projects that resonate? That’s going to require ever better ways to measure and predict success.

Some metrics companies have been pushing new statistics for years, much like Bill James in his Kansas City basement. In some ways, those statistics are a reflection of a reflection, Plato’s shadows on the cave wall further reflected onto another wall.

Take Parrot Analytics, which concatenates behavioral data from 2 billion consumers regarding more than 1 million titles, 2,000 distribution platforms, and 100 million metadata tags. Quibble with the methodology (as my beloved if grumpily skeptical editor has in the past), but there’s almost certainly something worth looking at in that pile o’ numbers.

Parrot investigates how people talk about a given show, across outlets such as social video, blogs, fan and critic ratings, search results and much else. Parrot’s new quarterly report card suggested Netflix should refocus its team on the basics if it wants to get back on top.

“But in order to get back to the cultural heights Netflix has reached over the past decade, it must return to the fundamentals of the streaming business — consistently releasing highly in-demand original content to grow and retain its subscriber base,” Parrot’s report says.

Disney, Parrot suggests, should roll more of Hulu adult-focused programming into Disney Plus. HBO Max must figure out how to keep HBO/HBO Max fans happy by giving them more zeitgeist-defining shows even as Discovery Plus reality shows get grafted onto the team.

“…the biggest question about HBO Max isn’t so much subscriber growth but subscriber satisfaction — what is the value of the platform that moves from curation to scale as a core philosophy?” Parrot’s report says.

Taboola’s cave-wall metrics track what stories from 9,000 publishers are getting read across its network. The company follows not just big outlets such as CNBC, AP, E!, and Business Insider, but plenty of smaller ones for its stats.

No surprise, perhaps, that the debut last weekend of Game of Thrones’ prequel House of the Dragon not only attracted an HBO/HBO Max record of nearly 10 million viewers, but also was the most read-about show on Taboola the day of its debut, attracting 250,390 page views, the company said.

“What people read about online tends to be a true reflection of what they’re really interested in,” a company spokesperson said by email. “Compared to other measures, like social media mentions where people may want to bash a show, reading a news article about a show indicates authentic interest, and therefore can be a gauge of a show’s success. Our data shows that House of the Dragon generated the most readership on premiere day, which is a good proof point for HBO’s decision from today to renew the series for a second season.”

Re-signing the stars behind a gigantic hit is hardly a novel strategy. Baseball’s Seattle Mariners just gave rookie phenom Julio Rodriguez a whopping 14-year contract. When you know, you know, I guess. Though the third-party data sure has to be a comfort when you’re committing another quarter-billion dollars of your scarce cash, like Warner Bros. Discovery just did.

Somewhat more surprising, perhaps, is the hype that erupted around a different fantasy franchise, Neil Gaiman’s The Sandman, in the 45 days leading up to its Netflix series adaptation, jumping almost 156,000%. Gaiman was also the most-read creator of the quarter’s big franchises, less of a surprise given not only his many frequently adapted graphic novels and novels, but also because of his prominent social-media presence.

So what’s going to be the bigger hit, or at least, one of the good-enough hits to keep on the service for months or years to come?

The metrics, like the media, tend to be focused on the Hall of Fame franchises. But as Moneyball starts to transform Hollywood, don’t be Arte Moreno, whose teams started well but have faded badly. Remember, you have to build an entire team of programming to keep the fans coming back season after season.

David Bloom of Words & Deeds Media is a Santa Monica, Calif.-based writer, podcaster, and consultant focused on the transformative collision of technology, media and entertainment. Bloom is a senior contributor to numerous publications, and producer/host of the Bloom in Tech podcast. He has taught digital media at USC School of Cinematic Arts, and guest lectures regularly at numerous other universities. Bloom formerly worked for Variety, Deadline, Red Herring, and the Los Angeles Daily News, among other publications; was VP of corporate communications at MGM; and was associate dean and chief communications officer at the USC Marshall School of Business. Bloom graduated with honors from the University of Missouri School of Journalism.