Less Original Content Isn’t Slowing Streaming Penetration: Report

Analyst Michael Nathanson sees usage rising and raises estimates for Netflix

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Streaming penetration increased in the second quarter despite services pulling back on original content, according to a new report from MoffettNathanson media analyst Michael Nathanson.

In his All Things Streaming update, Nathanson said Netflix’s efforts to crack down on password-sharing appear to be paying off, and that he is raising his forecast for how many subscribers the platrform added for the quarter by 500,000 to 5.5 million, ahead of the streamer reporting its earnings on Thursday. The increase includes gains in North America.

The analyst also raised his estimate for Netflix’s second-quarter earnings to $22.35 a share from $22.25 a share and his target price for Netflix stock by $35 to $565 a share.

Using data from polling firm HarrisX, Nathanson said that during the quarter, streaming penetration edged up to 85% and usage increased as well for all of the key streaming services.

The biggest gainer in penetration was Comcast NBCUniversal’s Peacock, which rose to 21%. The smallest gainers were Apple TV Plus and Disney’s Hulu.

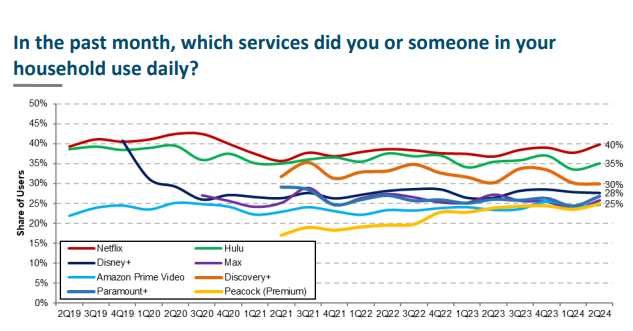

Daily usage of streaming services was also up for all of the services except Disney Plus and Warner Bros. Discovery's Discovery Plus.

The average number of streaming services per household rose to 4 from 3.8 and the average number of streaming services watched increased to 4.2 from 4.1.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“On the one hand, we expect in time this number to start ticking down as the streaming space rationalizes and consolidates, the increasing prevalence of bundles may keep users subscribed to a multitude of services well into the future,” Nathanson said.

Nathanson said that Netflix widened its lead over the other streamers during the quarter with 40% of its subscribers using the service daily. Paramount Global's Paramount Plus and WBD's Max also showed substantial gains in daily usage.

The streaming gains came as they released less content.

Netflix released 92 original seasons, down from 97 a year ago, according to the report.

“Two years ago, Netflix released a flurry of originals each quarter to find the select few shows that would break out,“ Nathanson said. “Now the market has shifted to allow the company to drive an increasingly large share of its viewership with its competitors’ content.

“This is reflected in acquired titles (and especially nonexclusive acquired titles) rapidly increasing share of the list of top streamed titles,“ he added. “Only two of 2Q24’s top 20 most streamed titles this quarter were an original.”

Most of the other big streamers followed suit by releasing less content in the second quarter. Peacock was the exception, releasing the same number of new original seasons in Q2 as it did a year ago.

Looking at the increase in nonexclusive titles streaming on multiple services, Nathanson noted this is something Netflix has grown increasingly comfortable with.

“It has seen time and again that a top acquired title, even if available elsewhere, can still be a top performer,” he said.

“Whether success on Netflix trickles back to the licensee is to be seen; popularity on Netflix seems to elevate what were previously second-tier titles such as Suits and Warrior but likely has a more muted impact on already popular titles such as Young Sheldon,” he said. “Still, this arrangement will likely only continue to increase in popularity as companies seek out increased licensing revenues.”

In the HarrisX survey, the number of people citing cost as the reason for cutting the cord declined, while the share mentioning content as a motivation increased, particular for Hulu, which streamed Shōgun and The Bear in the quarter.

As the number of people who have streaming services increased in the quarter, so did the percentage of people with both pay TV and streaming, which rose to 35% from 32% in Q1.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.