Linear TV Viewing Hits Low Point in Q2: Samba TV

95% of ad impressions seen by 50% of TV households

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Linear television viewing hit its lowest point in a year during the second quarter, according to Samba TV, with only about 56 million U.S. households — or about half the population — tuning in.

The average daily reach of linear TV was down 0.1% in the second quarter compared to the second quarter a year ago. Similarly, linear minutes watched was also down 1% in the quarter from a year ago.

In its State of Viewership report, Samba TV said the dwindling supply of linear TV viewing was leaving advertisers in a bind, with 95% of their impressions now reaching only half of U.S. TV viewers.

“We have reached a tipping point for television and advertising more broadly. This is a wake-up call moment for our industry,” said Samba TV CEO and co-founder Ashwin Navin.

“It has become a business imperative for the advertising market to evolve away from legacy practices that are leading to significant waste and missed opportunities to embrace new solutions that do not oversaturate the same potential customers with the same costly ads while leaving tens of millions of households largely ignored,” Navin said.

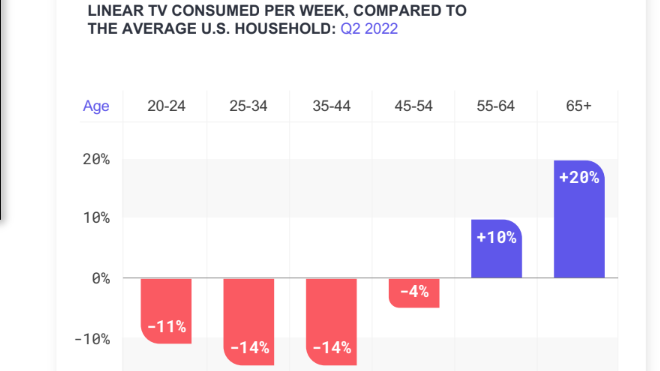

The drop in linear viewing is being led by younger adults, those in the Gen Z and millennial generations. Millennials under age 35 watch 25% less linear TV per week than households over 35.

Sports remains a bright spot for linear TV. Samba said that 70% of the linear programs with the most reach were related to sports. Only four programs had 10 million households tuning in and all were big sporting events. Women’s sports were also begin in the quarter, with the women’s college basketball championship up 81% from a year ago.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Things were not all cheery for the streamers.

According to Samba TV’s analysis, streaming platform have only 30 days to capture audiences with their most popular shows before viewers turn there attention to the next buzzworthy item.

The is a big problem because of how easy it is to cancel a streaming subscription. Samba said what it called “subscription cycling” was on the rise. That phenomenon has consumers signing up for s streaming service to watch a favorite show, then canceling when their done watching it.

About half the subscribers to SVOD services watch just one of the service’s top programs during the quarter.

For example, 62% of HBO Max subscribers watched Sesame Street, but none of the other shows HBO Max had in the top 50. At Apple TV 68% watched Central Park, but not of its other most popular shows. The percentages were smaller at Disney Plus and Netflix. Encanto was the only top Disney Plus show viewers by 35% of its subscribers and Stranger Things was the only big Netflix program watched by 33% of its subscribers.

“With more than $40 billion being spent this year alone on new content, consumers are overwhelmed by choices,” Navin said. “Platforms need to ensure they are driving smart strategies ahead of content launches to draw in not just built in fans but broader viewers who may be interested. In today’s content streaming wars, just because you build it, doesn't mean viewers will come to it. We need to be much more strategic about how we drive engagement before, during and after launches.” ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.