Local News at 11: A Second-Half Rebound?

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

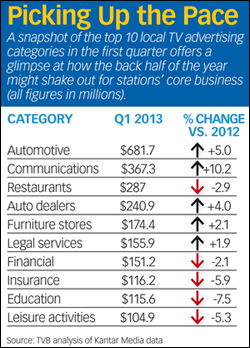

Everyone said 2013, lacking the Olympics and a political spending windfall, would be a downer of a year for local TV—the Advilresistant hangover to 2012’s ebullient record revenue. The first half, for the most part, confirmed those glum predictions. But the back half—catalyzed by a stabilizing economy and whatlooks like the emergence of a new and increasingly signi!cant ad category, appears more favorable. While some industry observers (among many others) retain deep suspicion about the direction of the U.S. economy, most local broadcast leaders are forecasting positive numbers for their core business in the second half of the year.

The year 2013 has a “different feel” than other odd-numbered years, said Leo MacCourtney, copresident of Katz Television Group, and in a good way. Advertising related to the continued rollout of the White House’s landmark Affordable Care law will help local TV to an 8%-9% growth in revenue in the second half, he believes. “I think health care will explode in terms of needing to educate the public, state by state, about what their choices are as Obamacare kicks in,” MacCourtney said. “We think it’s a huge spot play, as every state is different.”

Local broadcasters in general said the first quarter was soft, the second quarter a little healthier, and the next two appear to continue the modest momentum. If there was a story line for the first half, it was the M&A bacchanalia that saw Sinclair Broadcast Group continue its acquisitive ways, Media General and Young Broadcasting plan a major merger, and Gannett agree to gobble up Belo in a $2.2 billion deal—only to be outdone by last week’s Tribune’s $2.7 billion grab of Local TV. The acquisitions activity is likely to continue in the second half, with Allbritton— and a number of smaller groups doing it on the down low—on the block. “I think there’s definitely more to come,” said Robin Flynn, senior analyst at SNL Kagan. “The energy is not out of this trend yet.”

The vibrant stock prices of publicly traded TV station groups reflect this energy, with Wall Street placing bets on which group will move next. Most telling, say industry watchers, isn’t that private equity firms are cashing out on local broadcast, but that traditional broadcasters are plotting, or executing, their exit strategies. “The first rash were private equity deals, which we know are not long-term players,” Vincent Sadusky, president and CEO of LIN Media, said prior to the Local TV sale. “But Allbritton and Belo are quality broadcasters. To see them say, ‘Get big or get out’—I think we’re going to see this trend continue.”

A Strong Economy—Hopefully

The economy is harder to read than Ulysses. A survey of local broadcast leaders reveals a degree of optimism, albeit of the guarded variety, on the state of the U.S.’ financial situation. “The housing market is better, the job market is better, unemployment is supposed to drop,” said Steve Lanzano, president and CEO of the trade association TVB. “These are all good, positive things.”

Yet Lanzano acknowledged the still sensitive nature of the economy, and how Fed chief Ben Bernanke’s talk of “tapering” the Fed’s asset purchases crushed the stock market and could be a blow to consumer confidence.

Some cite the adage about the continued disconnect between Wall Street and Main Street. Paul McTear, president and CEO of Raycom, said generally robust national economic indicators, including the stock market and interest rates, have not yet trickled down to Joe Six-Pack. “The guy who lives across the street from you, the guy who rides the train to work with you, lacks [consumer] confidence,” said McTear. “That’s what is hurting retail spending and advertising.”

Local broadcasters are up against challenges on all fronts, including increasingly ambitious digital disruptors such as Netflix and Amazon, and slates of highly competitive original programming on the cable side. The broadcast upfronts shed some light on how the business will fare later in the year. Upfront sales appear to be down from last year, with most networks getting smaller price increases—a reflection that ratings have eroded to where advertisers choose to shift marketing dollars to cable rather than pay the broadcasters’ price increases.

Fox, for example, closed the bulk of its advance sales with about 10% lower dollar volume than last year, selling about 80% of its inventory at price increases of 5% to 7%—a point or so lower than a year ago. Ever-bullish CBS got price increases of 7.5% to 8.5%, while volume was estimated at $2.65 billion, about the same as last year.

While it is difficult to quantify, MacCourtney said he saw more “saleable” shows in the networks’ upfront presentations in May—and more emphasis on 12-month scheduling instead of just the traditional broadcast television season. “That helps stations with strong news in all four quarters, not just sweeps,” MacCourtney said.

On the local front, TV has its challenges, with news viewership declining. Some 48% of those surveyed in a 2013 Pew Research study called “Local TV: Audience Declines As Revenue Bounces Back,” said they watch local news regularly—down 2% from 2010 and 6% from 2006. News viewers under 30 dropped from 42% in 2006 to 28% in 2012.

Local weekday news output declined by six minutes in 2012 on the heels of four years of new records, according to an annual survey from RTDNA/Hofstra University, which also noted that weekend news grew.

Obama-Rama

A range of factors can push revenue one way or the other in the second half, including gun-control spending from highly motivated, and moneyed, New York City mayor Michael Bloomberg and various elections around the nation, including those in top 10 markets Boston and New York. Some sales chiefs said NFL spots are pacing ahead of last year. “They’re buying as we speak,” said one major-market general manager. “The NFL is hot and heavy. It’s live events—people want to buy sports.”

But several sources said it will be health care-related spending that drives second-half revenue. Wrapping one’s head around the 974-page Affordable Care Act is challenging, even for policy wonks. Consumers and business leaders alike will hope to get up to speed on it as the legislation’s rollout continues. That means advertising money from state and federal outfits, explaining the nuances of the individual mandate, among other aspects of the law, along with the health care providers vying to get consumers into their plans.

Scott Roskowski, senior VP of marketing at TVB, said insurance companies will likely generate about $100 billion in new revenue due to the health care overhaul. If they allocate 1% of that to advertising, he !gures about 70% would go to TV stations—a $700 million windfall that he thinks may be conservative.

Lanzano said to look for the spending to start in August. “It’s a new category, and we think it could be significant,” he said.

Kevin Cuddihy, Univision Television Group president, said stations will bene!t, and Spanishlanguage outlets in particular. “A disproportionate number of Hispanics need health care,” he said. “That helps state-by-state spot television in general, but Univision even more so.”

Yet others said Obamacare isn’t necessarily all good news for local broadcasters. Numerous local business owners are dissecting the legislation and crunching their own numbers, and they may be pulling back on their marketing budgets until they see how the law impacts their bottom lines. “In several markets, the answer that comes up as to why there’s slower ad spending is that business owners are taking a wait-and-see attitude as they work through [the new health care law],” Sadusky said.

Regardless, Obamacare-related spending may just be the category that saves 2013’s bacon, as political did last year and retransmission consent fees did before that. “There’s always one category that gets hot and helps us through the year,” said the big-market station chief. “It’s all about new business—you can’t really rely on core.”

Ad buys are coming in late as marketers shop for better deals later in the game, making it hard to predict revenue. And comparing second-half numbers to last year’s second half is tricky. Stations started getting outrageous political spending last summer, bumping countless core advertisers as the elections heated up, and the total neared $3 billion on local TV. “There was a fair amount of displaced ads in the back half, so on the core side, the hurdle is not especially high,” said a veteran station analyst, who forecasted low-to-midsingle- digit growth in the half.

Among the key categories, MacCourtney notes telco and retail are up, while packaged goods and !nancial services are down. The automotive advertising that drives station revenue looks to be up around 6% this year and next, noted Lanzano.

“There’s huge pent-up demand for cars,” said Bob Prather, who was Gray Television president and COO until he resigned June 21. “And people feel more comfortable about their jobs than they did a couple years ago.”

Put a Number on It

Lanzano sees second-half core business “muddling along” with 1.5%-2% growth. Prather forecasts the low single digits, while Cuddihy expects high single digits for the second half. Averaging the predictions of several broadcast chiefs interviewed by B&C results in 4-5% revenue growth for the second half—perhaps a little higher in smaller markets, lower in larger ones. “We’re not seeing the significant growth numbers we saw before,” said Lanzano. “It’s kind of the way of the world, and people have learned to live with it.”

It could be worse—especially with a much rosier year ahead on the heels of 2013. The Winter Olympics—a boon for NBC stations— are set for Russia in February, and the midterm election madness will start earlier than anyone expects, as usual, and will involve more spending than anyone has a right to expect, as usual.

“With the shenanigans in Washington, there should be a veritable cornucopia of advertising,” said Barry Lucas, senior VP of research at Gabelli & Co. “I expect the political pot to simmer pretty good in 2014, and good news stations in competitive markets can pretty much back up the armored car to the station.”

E-mail comments to mmalone@nbmedia.com and follow him on Twitter: @BCMikeMalone

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Michael Malone is content director at B+C and Multichannel News. He joined B+C in 2005 and has covered network programming, including entertainment, news and sports on broadcast, cable and streaming; and local broadcast television, including writing the "Local News Close-Up" market profiles. He also hosted the podcasts "Busted Pilot" and "Series Business." His journalism has also appeared in The New York Times, The L.A. Times, The Boston Globe and New York magazine.