Measuring the Bang for Branded Entertainment Bucks

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Branded entertainment has shifted from being a value-added proposition—thrown in when marketers buy commercials—to a key part of the TV advertising business.

Now a research company is promising to effectively calculate just how much value lies in branded entertainment programming by both measuring the size of its audience and determining its impact on consumers.

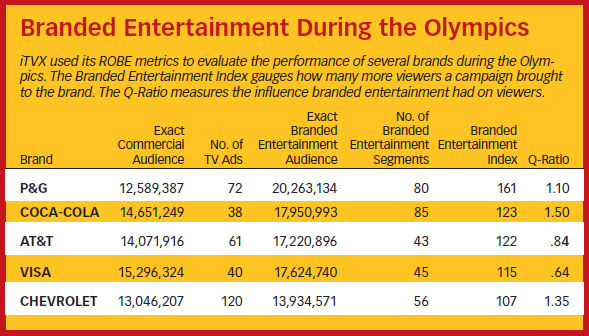

Branded entertainment specialist iTVX has added second-by-second viewership data from Rentrak to its own metrics to create a suite of measurement tools it is calling Return on Branded Entertainment, or ROBE.

The new data will give marketers a better idea of how much bang for a buck they’re getting from the packages of TV commercials, billboards, vignettes, integrations and product placements they’re buying from broadcast and cable networks, according to Frank Zazza, CEO of iTVX. And at a time when advertisers are clamoring for exposure beyond traditional 30-second spots, the ROBE data should give networks a new tool for selling branded entertainment packages.

“As branded integration deals are increasingly intertwined with traditional ad buys, advertisers need clarity from broadcasters in terms of their total media spend, and brands need to know what the exact audience reach is with their TV ads compared to the exact audience reach with their branded content,” Zazza says.

Rentrak, which draws data from TV set-top boxes in 9 million homes, has been making inroads in the media measurement business with its TV Essentials census-based TV ratings measurement service.

“What iTVX is bringing to the party is a real deep understanding of branded entertainment,” says Bruce Goerlich, chief research officer at Rentrak. “What we’re able to give them is the understanding of who’s really seeing it because, for the first time, we can lay second-by-second information against those exposures for the various forms of branded entertainment.

“You really can’t do that with a small sample,” Goerlich adds. Because vignettes and other forms of branded entertainment are handled in different ways within the show, you need to look at them second-by-second. And Rentrak covers 230 networks, from the biggest to the smallest.”

The new metric could become a basis for buying and selling branded entertainment as well as evaluating it. “We definitely think that this can become a currency that’s used in the marketplace,” Goerlich says. “Our goal is to allow for the television marketplace to use multiple currencies.” Auto companies, for example, can use Rentrak data to target car buyers rather than the entire demo of adults 18 to 49.

iTVX’s new ROBE suite comprises three components that can be used to evaluate branded entertainment campaigns in both the general market and the Hispanic market: ROBE Analytics delivers audience data and indexes that can be used for planning and buying; ROBE Insights— which leverages iTVX’s Q-Ratio to measure a program’s influence on the viewer in terms of recall, brand shift or purchase intent—guides the placement of integrations and commercials in programming and provides analysis of how to improve branded entertainment campaigns; and ROBE Research delivers forensic insights concerning the effectiveness and engagement of a branded entertainment campaign.

Zazza says branded engagement is the next level beyond branded entertainment, showing how it “affected the minds, hearts and behavior of the viewer….The advertiser today doesn’t just want to know what did I get for my exposure. They want to see how it moved the needle. And that’s branded engagement.”

Rentrak’s TV Essentials second-by-second audience data is allowing iTVX to dissect branded entertainment in ways it couldn’t before and attain insights that had not been available. iTVX is working with several major agencies to standardize measurement of branded entertainment. The company is also looking to create metrics to measure the effectiveness of entire campaigns.

“We’re just at the tip of the iceberg on this,” Zazza says.

E-mail comments to jlafayette@nbmedia.com and follow him on Twitter: @jlafayette

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.