Model Behavior

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

About four years ago, Altice USA was being mocked by seasoned cable watchers who doubted the company’s plans to shave about $900 million in costs out of an already lean business, employing what its former French parent Altice N.V. (now Altice Europe N.V.) called a European-style cost discipline to the business.

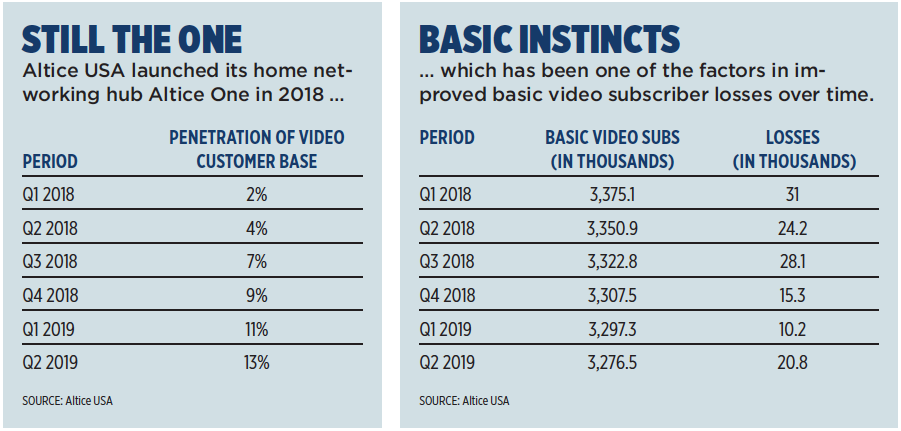

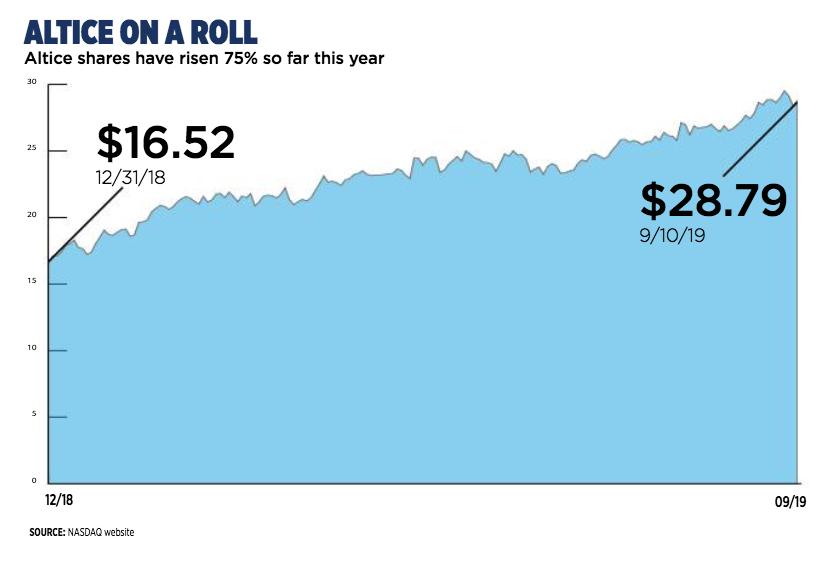

Since buying Suddenlink Communications for $9.1 billion in late 2015 — and Cablevision Systems for $17.7 billion less than a year later — Altice USA has managed not only to meet those cost-cutting targets, but exceed them. Along the way its stock, which had languished well below its $30-per-share June 2017 initial public offering price as investors continued to be skeptical, soared by more than 75% so far this year, which could put the operator back in the hunt for more cable properties. In the meantime, Altice USA, the Multichannel News 2019 Distributor of the Year, has reduced year-over-year video customer losses for six straight quarters and boosted broadband subscribers.

This month, it launched its own wireless offering, Altice Mobile, at a price that is less than half that of its cable peers and nearly one-third less than its competition.

Defying the Skeptics

Analysts, many of whom highly doubted Altice’s ability to survive in the cutthroat U.S. cable business, are now singing the company’s praises.

“I have to admit that I was among the skeptics and I’ve been proven wrong,” said MoffettNathanson principal and senior analyst Craig Moffett. “They’ve done everything they said they were going to do and there’s no evidence that their service delivery has been compromised in any way. Most of their quality scores are trending in the right direction. They are to be commended. They’ve done an exceptional job managing those assets.”

RELATED STORY: Altice One Burns the Churn

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

The numbers back up that assessment. In the second quarter, Altice USA reported revenue and cash-flow growth of 3.7% and 7.3%, respectively. Video subscribers fell by 21,000, better than the 24,000 it lost in the same period last year and the sixth straight quarter of year-over-year improvement. Four years into the company’s grand experiment, it appears Altice’s European approach is working in the USA.

Altice USA CEO Dexter Goei said what was considered to be a radical way to run a cable company four years ago was merely Altice’s normal way of doing business.

Altice N.V., a Netherlands-based cable, telecom and wireless service provider (its top markets are in France, Israel and Portugal) burst on the domestic cable scene in surprising fashion. It purchased Suddenlink Communications in late 2015 after emerging as a potential competing bidder to Charter Communications for Time Warner Cable. After Charter won that contest, Altice turned its attention to Cablevision Systems.

Altice N.V. split from Altice USA in June 2018, creating Altice Europe, housing the European telecom, cable and wireless assets, and Altice USA, the domestic cable business. Both companies, although separate, are controlled by Altice founder Patrick Drahi, who also serves as chairman of both Altice Europe and Altice USA.

Goei said that in studying the U.S. market, he was surprised to see how low operating margins were for cable operators compared to their European counterparts. One of the things that intrigued the company was that EBITDA minus capex numbers — considered a strong measure of a company’s profitability — were consistently in the 15% to 20% range, with 30% EBITDA margins and 15% to 20% capex margins, while in Europe Altice was operating similar businesses in the 30% range (50% EBITDA, 20% capex). The excuse given for the low range for cable operators had always been higher programming costs, but even when those expenditures were removed, nonprogramming operating expenses (a phrase Altice says it coined) were five to seven times higher than what Altice was experiencing in some of its European markets.

“That is purely an efficiency issue and a technology choice decision in terms of the pace you’re investing and the products you’re investing in,” Goei said.

Margin Walkers

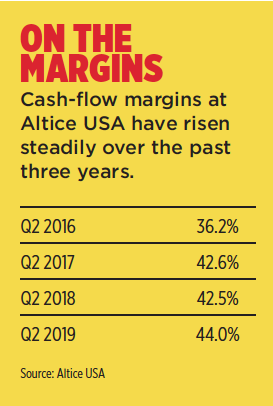

Today, Altice USA’s operating margins are among the highest in the industry and, in the second quarter, they reached 44%, up from 36.2% in second-quarter 2016.

To put that in perspective, cash flow margins at the much bigger Comcast and Charter Communications were 40.5% and 36.9%, respectively, in Q2.

“They still have plenty of runway left for higher margins as the mix shifts more and more toward broadband,” a profitable product, Moffett said. In a research report after Altice’s Q2 results, Moffett said margins could approach 50% in the next few years.

On a conference call with analysts to discuss Q2 results in July, Altice USA co-president and chief financial officer Charles Stewart said that, except for mobile losses of about $5 million in the quarter, margin growth at 44.2% was about 800 basis points better than when Altice closed the Cablevision purchase three years ago, and 170 basis points better than last year alone.

“That substantial margin improvement as we often discussed is supporting higher investments in all of our growth initiatives and as always, we’ll continue to look for ways to optimize our cost structure,” Stewart said on the call. “Further, the mindset in our efficiency practices are really ingrained in the company’s culture at this point.”

Altice USA has focused on broadband growth, like its peers, adding about 13,000 high-speed internet customers in Q2 to reach about 4.2 million broadband customers across its footprint. Unlike some other cable companies, it also still has a keen eye on video.

Moffett said Altice seems more committed to video than its peers do. That seems to fly in the face of the current business model, which favors broadband over lower-margin video. Cable One, which has the highest cash-flow margins in the industry at 47%, has lost nearly 25% of its video customers over the past four years and has not suffered financially. As more and more consumers stream video, other operators are starting to follow suit.

“I never would have thought we’d see the day when Altice seems more committed to video than Comcast does, whether that’s a function of the unique demographics in their footprint, or simply a different perspective on the role video pays in the bundle,” Moffett said. “You certainly can’t pretend that they don’t fully understand the argument. They just apparently don’t agree. They still think video is extremely important and worth defending with real energy.”

Goei has a fairly simple explanation: Altice still likes the video business.

“It all kind of peels together because our mindset is, this still is a profitable business,” Goei said. “Let’s make it more profitable than it is with the tools that we have.” He said he isn’t sure that Altice USA will continue to show year-over-year improvement on the video customer side, but he believes it will do better than its peers.

Scale is the Answer

Margin help could come by getting bigger through acquisitions, something that was a hallmark of its former European parent, now called Altice Europe N.V., in the earlier part of the decade. Altice N.V. spent about $30 billion on acquisitions in 2014 alone, but that has been put on the back burner as the company focused on shoring up its U.S. cable business. Now, with a healthy stock price — shares were priced at $28.89 on Sept. 11, up 75% for the year — Altice USA has a currency with which to seek out deals.

“I think about it every day,” Goei said of increasing scale. “The premise was always very difficult for us in the last 18 months because our stock price wasn’t there. We’re up [75%] to date; Charter is up [50%]. We’re starting to narrow the gap in valuation with our peers. And so we’re going to continue to see if we can continue to narrow that gap, to make at least the discussion with anyone out there — whether it be a Charter, a Cox, a Mediacom, a Cable One or even some of the overbuilders — a proper valuation discussion based on proper numbers.”

With about 4.2 million broadband and 3.3 million video customers, Altice USA is still a distant third behind Comcast’s Xfinity (22.1 million video customers and 26.5 million high-speed internet subscribers) and Charter’s Spectrum (15.8 million video and 24.2 million broadband subscribers).

Altice USA is also two distinct companies in one. Suddenlink is in mostly secondary markets in the South, West and Midwest; Optimum (the former Cablevision footprint) is in the largest media market in the country, the New York metropolitan area. Suddenlink’s broadband penetration is in the 30% range while Optimum’s hovers around 70%.

Goei makes no predictions about how the cable landscape will shake out, but he said as the wireline and mobile businesses converge, so too may cable operators and wireless providers.

Outside of outright purchases, Goei sees a near future in which cable operators and wireless companies band together to build out networks in competitors’ territories — for example Charter and Verizon pairing up to build out residential footprint in Comcast territory.

“That’s where it’s going to end up, because the bigger you are with both infrastructures, it’s going to allow you to spend a lot more money to go after more customers and deliver a better experience,” Goei said. “We’d love to be part of that equation. We’re too small today. We don’t know how it will pan out, but I can’t believe we’re going to be in the same situation in five years.”

How Altice USA will fit into that future has yet to be determined. In the meantime, the company will continue to roll out products and services geared to increasing its reach, including on the video side, where Goei said a large portion of its customer base — especially in the New York tri-state area for its Optimum branded product — continue to be heavy users of video. The company realized early on that a focus on customer service and the customer experience would help preserve the base, he added.

That led to heavy investments in the Altice One platform, the fiber-to-the-home build, and its investment in programming like business-news streaming service Cheddar, he said.

Altice purchased Cheddar in April for about $200 million, folding that operation into Altice News, which includes its News 12 hyperlocal news channels and international news network i24 News. Altice News is headed by Cheddar founder Jon Steinberg, who reports to Stewart. Stewart also heads up Altice’s advertising unit, a4.

While news programming may keep customers glued to their sets for awhile, Altice also made a bold customer service move last month with its “Price for Life” campaign, offering new customers 200 channels of video and a 200 Megabits per second internet service for $64.99 per month (not including taxes and charges) for as long as they remain a subscriber. For customers who want more video and internet, “Price for Life” has three other tiers: Select, with 340 channels and 200 Mbps internet for $74.99; Core TV with 220 video channels and 400 Mbps for $84.99; and Premier TV with 420 channels (including premium channels HBO and Showtime) and 200 Mbps for $94.99.

The idea is that a Price for Life offer will strengthen customer loyalty. The upside is that, after a certain amount of time, customers will most likely upgrade to higher-priced broadband speeds.

“When you give someone the peace of mind that he will have that price and that package for as long as he lives, he will never churn,” Goei said. “He will never even call, probably. He’s just happy.”

All About the Network

But a video service, and a broadband offering for that matter, is only as good as the network it runs on. In 2017 Altice embarked on a five-year plan to bring fiber-to-the-home to its customers, called Generation Gigaspeed. To date, Altice has about 1 million homes in its footprint passed by fiber and expects to add another 1 million homes next year.

“The network is the foundation of everything we do,” Altice USA chief operating officer Hakim Boubazine said.

Perhaps the highest profile product to come out of the rebuild has been Altice’s in-home communications hub, Altice One (see Platforms). It launched in 2017 and has gone through three different versions. Altice One 3.0 was released in May and is a version the COO is especially proud of.

“We nailed it,” Boubazine said. “We have a great device that’s simple to install, simple to use, has a great UI which is very engaging and now we’re aggregating services.”

One of the more popular aspects of that version was a Sports Hub, a feature that allows customers to get an overview of games taking place within 48 hours of their original airing and the ability to select a customized view for their favorite teams. Even though the product was launched when baseball season was already underway and football had not yet started, “tens of thousands” of customers signed up their teams.

“They saw the app and went straight to booking their favorites to get ready for the season,” Boubazine said. “That’s great, because having that cloud-based platform that we can modify at will remotely helps us deliver what is the most important factor whenever you come up with an innovation — to create a ‘wow’ effect right out of the gate.”

As the fiber build progresses, Boubazine said the plan is to leverage the network even more and eventually move to a “headless architecture,” which he said essentially eliminates the need for internal wiring. Eventually, he sees a day where pay TV distributors serve more as content aggregators, where they make apps for specific programmers available in a package for a fee.

“When we architected the Altice One platform, we had that in mind, because we knew at some point those guys would come,” Boubazine said. “What happens whenever a market passes the threshold of fragmentation? It consolidates somehow. We are there.”

Boubazine doesn’t believe that consolidation will happen through M&A, but through platforms. The company with the most powerful platforms and relationships wins.

But perhaps the biggest impact of the network will be on Altice Mobile, the wireless service that was launched at the beginning of the month.

According to Boubazine, the convergence of cable wireline broadband and wireless network technology is at the very core of the operator’s agenda.

Huge investments in fiber-to-the home, improving the home WiFi experience through the Altice One platform and expanding the reach of public Wi-Fi hotspots have all been “in preparation of our mobile adventure,” Boubazine said.

“Our vision has always been convergence,” he said, explaining the cable company’s quest to deliver seamless connectivity to its subscribers when they step out of the home.

As Boubazine explained, average revenue for cable services is around $150 a month right now. Wireless is business that generates almost as much — $140 a month, Boubazine noted. And as cable looks to exploit the opportunity, Altice USA has an advantage that Comcast and Charter do not.

To launch its new wireless service, which has the lowest price point in the industry starting at $20 a line, Altice USA is leveraging what it calls an “infrastructure-based” MVNO deal with Sprint. This means it essentially owns the core network, the Home Location Register database (HLR) and Subscriber Identity Module (SIM) components.

One of the roadblocks to controlling core/HLR/SIM management has been the device and SIM providers. “But Altice already had the scale and relationships with device/SIM providers in Europe and the Dominican Republic to leverage for the U.S.,” said Gregory Williams, analyst for equity research company Cowen.

“Our ambition is not to only feed the home, but to deliver the best broadband outside the home, as well,” Boubazine said.

Altice USA was late to cable’s latest wireless wave, with Comcast rolling out Xfinity Mobile in April 2017 and Charter launching Spectrum Mobile last year. That delay might have worked to Altice’s advantage. Several analysts have pointed to Altice’s superior MVNO economics. Its deal with Sprint (and eventually T-Mobile, when that merger is complete) gives the cable company the ability to transfer wireless traffic to its own WiFi network and to substantially reduce costs. That is more than reflected in the price point for the wireless service: $20 per month for life for Optimum and Suddenlink customers, $30 per month for everyone else. That’s about half the $45 per month Comcast and Charter charge for wireless, and about one third the $70 monthly average for wireless customers of Verizon and AT&T.

“The fact that they have come out with a wireless offering at $20 a month for life, that they swear 16 ways to Sunday they can make money on, is nothing short of extraordinary,” Moffett said. “That suggests that they have a cost structure in their MVNO agreement that is radically better than anyone imagined.”

A $20 or $30 price point should also help attract subscribers. In a research note, Barclays media analyst Kannan Venkateshwar estimated that Altice USA has about 5 million subscriber homes and 8.5 million homes passed within its footprint, implying a potential base of 13 million to 22 million wireless customers. Given that Altice said it will also be able to sell wireless outside of its footprint — particularly in Manhattan, where it does not have a cable presence — that base could be even higher.

Venkateshwar estimated that Altice could capture more than 10% of that potential wireless base in the first two years of operation, which would add another 200 basis points of revenue growth annually.

“Given the price point, our present wireless revenue estimate and therefore full-year revenue growth estimate could prove conservative,” Venkateshwar wrote in a report.

Goei has said he expects the wireless product to be profitable in about 12 months, adding that the pricing for the product isn’t predatory.

“We are not pricing this at a negative gross profit per customer,” Goei said on a conference call announcing the product. “We intend to make this very profitable going forward.”

There might be doubters concerning the company’s ability to make wireless profitable: Comcast and Charter have already lost hundreds of millions of dollars on their respective wireless offerings, which have been touted primarily as retention tools.

Goei, though, has stared down skepticism before.

“You can’t offer a $20 product in a market where the prevailing ARPU is close to $50 and not make noise,” Moffett said. “People will have to take notice and they will have an impact on the market.”

Daniel Frankel contributed to this report.