Moody’s: NBA Deal Locks Up Rights, But at High Cost

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Credit rating agency Moody’s Investors Service believes the recent $24 billion, nine-year National Basketball Association rights deal reached by ESPN and Turner Broadcasting System will secure sports programming for the content companies for the long term, but includes digital rights that could lead to subscriber losses for some multichannel video programming distributors.

The Turner-ESPN deal came at a high price – more than double the cost of its current agreement, according to Moody’s estimates. But it removes any uncertainty regarding the ability to carry the lucrative sports programming well into the next decade and other aspects of the deal – including digital rights for NBA programming on the Internet – gives ESPN and Turner more leverage in negotiations with distributors. The deal will likely cause affiliate fees to rise over the next few years as distribution deals come up for renewal, given the must-have nature of the content, Moody's wrote. Turner, which is currently in the middle of its renewal cycle – as evidenced by its current spat with Dish Network – could be the first to reap the affiliate fee benefit of the deal.

Traditional television remains the preferred way to watch video programming of all kinds, Moody’s says.

For the full story go to Multichannel.com.

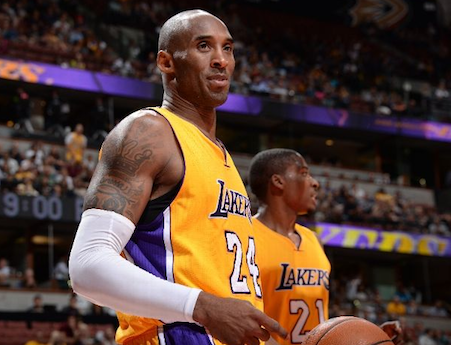

(Photo Credit: Andrew D. Bernstein/NBAE via Getty Images)

The smarter way to stay on top of broadcasting and cable industry. Sign up below