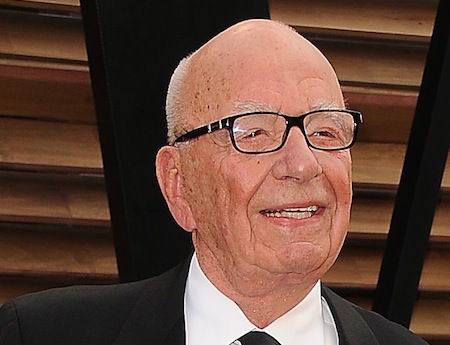

Murdoch Pulls Offer for Time Warner

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

21st Century Fox on Tuesday said it withdrew its $80 billion offer to buy Time Warner.

Time Warner had rejected the offer and had begun installing anti-takeover measures to protect itself from Rupert Murdoch’s advances.

Instead of buying Time Warner, whose HBO premium cable network and sports rights appeared to be attractive, 21st Century Fox will buy back $6 billion of its own stock, a move that appealed to Wall Street, which had been nervously finding ways to be optimistic that a Fox-Time Warner combination was a good idea.

Initially it appeared that Murdoch was getting set to make a larger bid, with the sale of European satellite assets putting nearly $8 billion more in his war chest. At this point, it seems that bid might not be coming.

In a statement put out after Fox’s withdrawal, Time Warner released a statement that said its board and management are committed to enhancing long-term value. “We look forward to continuing to deliver substantial and sustainable returns for all stockholders. Time Warner is well positioned for success with our iconic assets, including the world’s leading premium television brand, the world’s strongest ad-supported cable network group, and the world’s largest film and television studio. We thank our stockholders for their continued support,” the statement said.

Both companies will be announcing earnings on Wednesday and analysts had expected both companies to discuss why an acquisition would or wouldn’t be good for shareholders. The potential combination of Fox and Time Warner would have been a poster child for a TV industry in which programmers felt they needed to get bigger to gain leverage as distributors consolidated, with Comcast buying Time Warner Cable and AT&T acquiring DirecTV.

Fox stock finished the Tuesday trading down 1.08% at $31.03. But in after hours trading following the announcement, shares jumped 6.51% to $33.05. Time Warner was down 0.4% to 85.19 at the close, then dropped more than 10% in after-hours trading.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

In a statement on Tuesday, Murdoch said that: “We viewed a combination with Time Warner as a unique opportunity to bring together two great companies, each with celebrated content and brands. Our proposal had significant strategic merit and compelling financial rationale and our approach had always been friendly. However, Time Warner management and its board refused to engage with us to explore an offer which was highly compelling.”

The Murdoch bid included both cash and stock, and Time Warner questioned the value of the stock, whose price dropped when the bid was confirmed.

“The reaction in our share price since our proposal was made undervalues our stock and makes the transaction unattractive to Fox shareholders. These factors, coupled with our commitment to be both disciplined in our approach to the combination and focused on delivering value for the Fox shareholders, has led us to withdraw our offer,” Murdoch said in his statement. “21st Century Fox’s future has never been brighter. The strength of our leading franchises, combined with the power of our emerging growth businesses and the leadership positions of our international enterprises put us on a path for even greater success.”

21st Century Fox said the $6 billion share repurchase program was expected to be completed in the next six months. "This significant return of capital underscores the company’s ongoing commitment to disciplined capital allocation and returning value to shareholders in a meaningful way,” Murdoch said.

In a research note, analyst Marci Ryvicker of Wells Fargo, said “while we grew to like the Fox-Time Warner combination, we have to admit some level of relief with Fox’s press release, which confirms to us that the company remains disciplined, is dedicated to creating shareholder value and is not ‘empire building.’”

Ryvicker noted that the $6 billion buyback was bigger than the $5 billion buyback she’d been anticipating for 2015. The additional $1 billion in purchases will add 3 cents a share to earnings per share in 2015, she estimated.

“We remind you that both Time Warner and Fox report [earnings]tomorrow — with Time Warner before the open and Fox after the close,” Ryvicker said. “We expect to hear from both management teams regarding all of the recent developments. Fun times!”

The withdrawal of Fox’s bid for Time Warner was seen as good news for public interest groups concerned about concentration of media.

The prospect of Rupert Murdoch buying Time Warner presented real harms to the U.S. and global media landscape,” said Angelo Carusone, executive VP of Media Matters for America. “It would given him control of 40% of the cable market and 30% of the movie market. No one should hold that much influence but Murdoch, in particular, has demonstrated that he is far too irresponsible for that amount of power. Today's decision was a victory for the thousands of people who signed our petition urging shareholders to oppose the sale as well as media consumers across the country.”

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.